Demand in Korea for sophisticated and sizeable commercial data centres remains strong.

Supply lags demand due to the particular circumstances of development in Korea. While this supply demand dynamic opens up an attractive investment opportunity, capitalising on it poses significant challenges.

Growing Demand for Commercial Data Centres

In the early days, data centres were mostly used for those few enterprises with needs for management of a large quantity of data. As businesses grow and diversify and Information and Communication Technology (ICT) continues to advance, utilising ICT for almost every business has become important resulting in growing needs for specialised IT departments.

This transition, however, has been costly for many enterprises and organisations. Data consumption has kept on accelerating driven by fast evolving ICT needs.

Large corporates have been driving the search for efficient ways to manage their data focusing on cost reduction, ease of expansion, and easy and reliable access to data. Consequently, needs for cloud services meeting these objectives have risen and are expected to continue to grow.

Moving into the cloud requires a growing number of sophisticated and sizable commercial data centres to attract global cloud service providers (CSPs).

However, supplies are not following up

Demand for effective facilities is sprinting ahead of supply. This is the legacy of telecommunications having been a government-driven industry with national infrastructures dominated by a handful of large players with strong government influence over activities.

Carriers still depend on KT’s wired communication networks as KT was a state-owned carrier that established nationwide networks. As a telecommunication bureau, the state-owned company holds land in key locations in Seoul (mostly for telephone exchanges) giving a clear cost advantage in development and operation of data centres.

This has had inevitable consequences allowing major CSPs to have established their initial foothold in some of the most prime areas of Seoul with limited room for expansion.

However, the carrier-driven Korean data centre sector is changing. Development in virtually all of the prime areas owned by the carriers has been completed meaning their cost advantage relative to new entrants is reduced.

Legacy carriers who have exclusively carried out the development with their own sites have limited experience in some critical development areas including power procurement and securing permits and approvals.

In addition to land scarcity, carriers face growing capex to support their core businesses. Unlike some developed markets, the major local carriers build and own telecommunication infrastructures.

Establishment of 5G networks is still in an early stage and needs to be laid more densely than the existing 4G. Space for such expansions is only getting more constrained resulting in growing costs. Local carriers have been aggressively growing digital platform businesses including media streaming services that will continue to require a significant amount of investment capital.

While data centre development is certainly an attractive business, this capital intensive activity is increasingly falling behind in priority, particularly given that they no longer have prime land available for development.

Identifying this transition that is still in an early stage, we have taken a leading position by successfully closing transactions for two sizable data centres and one mid-sized urban data centre development that collectively require c.92MW total capacity load in prime areas of Seoul.

What it takes to develop a data centre

The successful transactions we closed required particular capabilities to overcome key challenges in data centre development and operation. As described earlier, the CSPs have established their foothold in some of the most prime areas in Seoul.

Such areas have extremely limited sizable land parcels and power grid. Whilst Korea generates plenty of electricity additional installations of power grid in such prime areas are challenging due to land scarcity, lengthy and complicated permit and approval processes, grid system monopolized by KEPCO and a risk of civil complaints that can delay the construction for years.

So you have a market where the key end-users prefer sizable data centres located within their existing clusters and this requires large land parcels in the prime areas with access to substantial power fed from the existing grid that is already under pressure with a highly limited expansion opportunity for the foreseeable future.

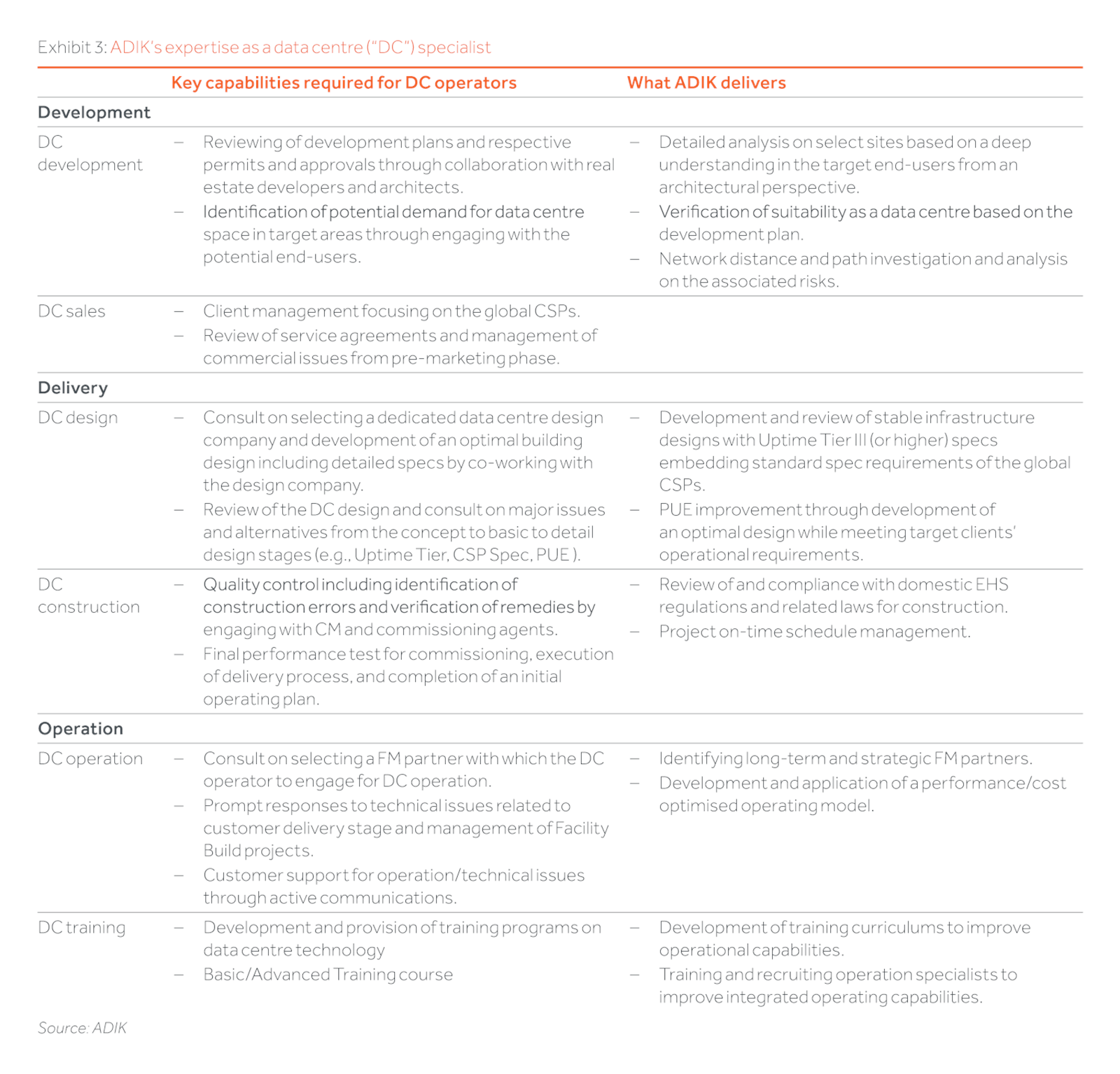

In addition, developers need to have a deep understanding in technicalities of data centre building deigns, knowledge that is scarce in the Korean real estate investment sector since this is a new asset class.

Data centre operation is dominated by the major local carriers serving the growing needs of the CSPs, and presence of the global operating platforms such as Equinix and Digital Realty is currently low. With the proven capabilities through many years of operations, the carriers have continued to remain as an attractive operator for the CSPs.

That said, these carriers have their limitation as their core revenue driver is network businesses meaning their key professionals are not exclusively dedicated to data centre operations.

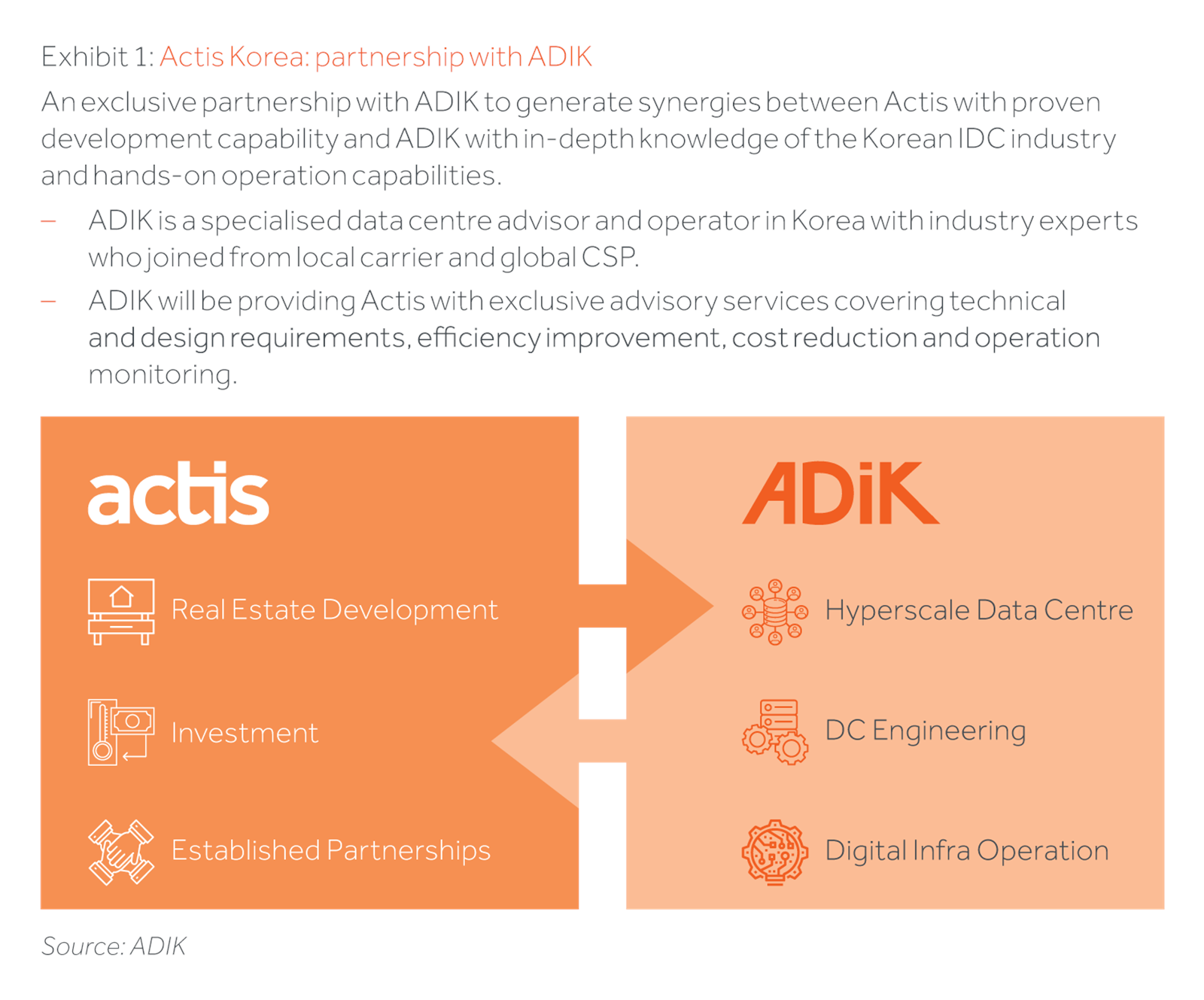

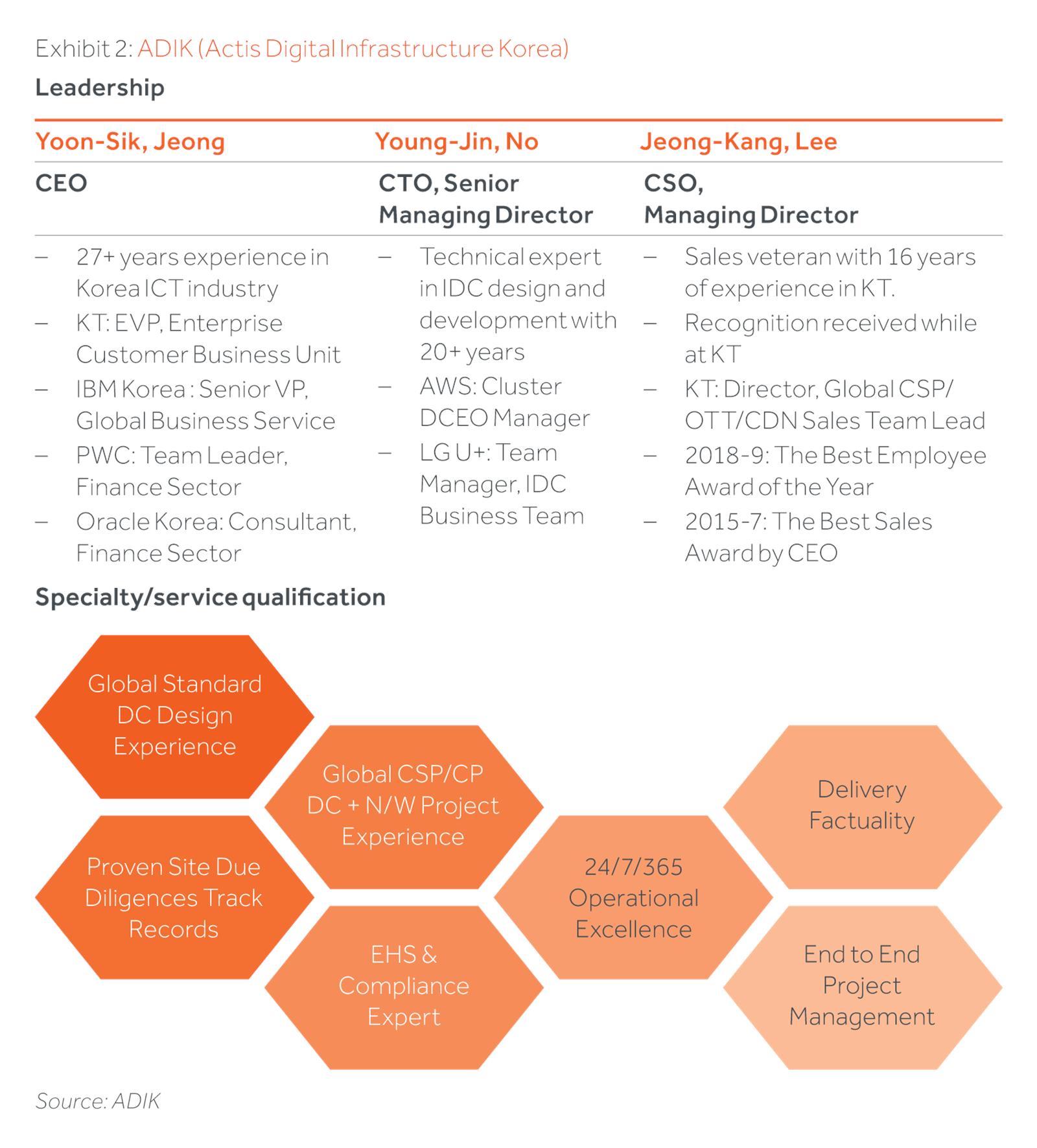

Understanding this, we have secured an exclusive contract with a local operating partner ADIK that has been established by top calibre professionals coming from both major local carriers and a global CSP.

ADIK has been engaging in our data centre development projects from the beginning providing critical expertise and feedback on building designs, lease marketing, and operation plans. Not something our competitors in the local market have.