The climate emergency

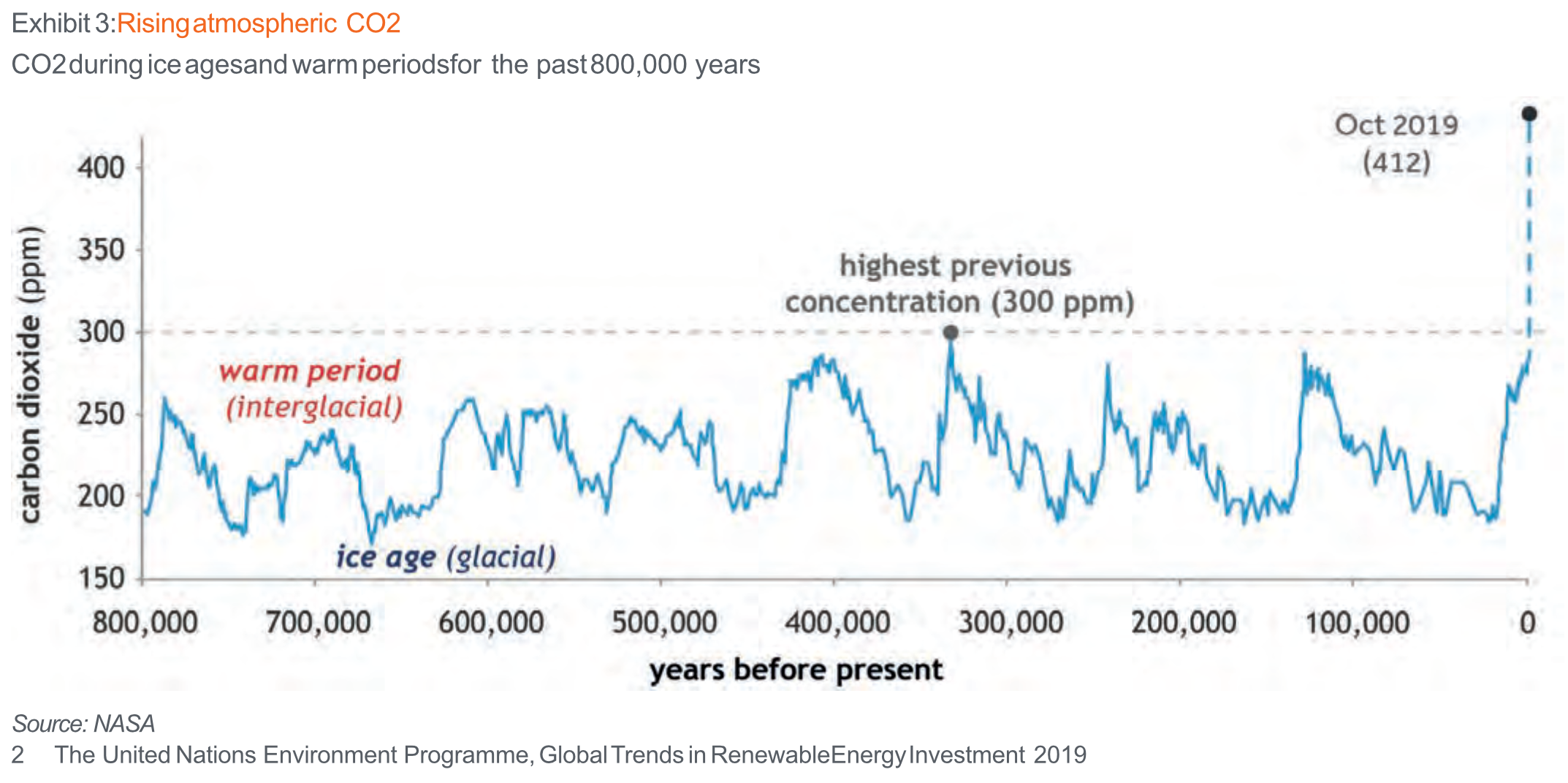

Climate change is front and centre for everyone. Global temperatures are at 3 million year highs. We face a significant threat to our current way of life if we do not adapt, quickly and dramatically, to the climate emergency. Rapid decarbonisation and a full scale energy transition are essential to halt our current direction of travel.

Predictions of the impacts of climate change can seem biblical in their nature – droughts and floods, famine and extreme 1 The Intergovernmental Panel on Climate Change, Summary for Policymakers of IPCC Special Report on Global Warming of 1.5°C approved by governments storms, ecosystem collapse and disruption of oceanic and atmospheric circulation. Some of these physical impacts involve thresholds in the climate system beyond which major impacts accelerate or become irreversible and unstoppable. We could face severe food and water insecurity in some regions, the advent of climate refugees and mass migration, displacement and conflict – triggering the erosion of our political and democratic systems, themselves critical to finding solutions. The lives and livelihoods of hundreds of millions, if not billions, of people worldwide will be affected.

How long do we have?

The Paris Agreement commits to limiting global temperature rise to 2 degrees Celsius (above pre-industrial levels), and to pursue 1.5 degrees Celsius, which would cause significantly less harm. The landmark UN Intergovernmental Panel on Climate Change (IPCC) report released October 2018, uses the starkest language yet to underline the urgency and the impacts of a changing climate, claiming that we have 11 years left to limit the climate catastrophe.1

To limit warming to 1.5 degrees Celsius, we have to reduce our net carbon emissions to zero by 2050. This means huge changes to how we live, organise our cities, travel, what we eat and how we generate electricity. The good news is that it is eminently doable – we know what needs to be done and we have the tools to do it.

The role of the renewables revolution

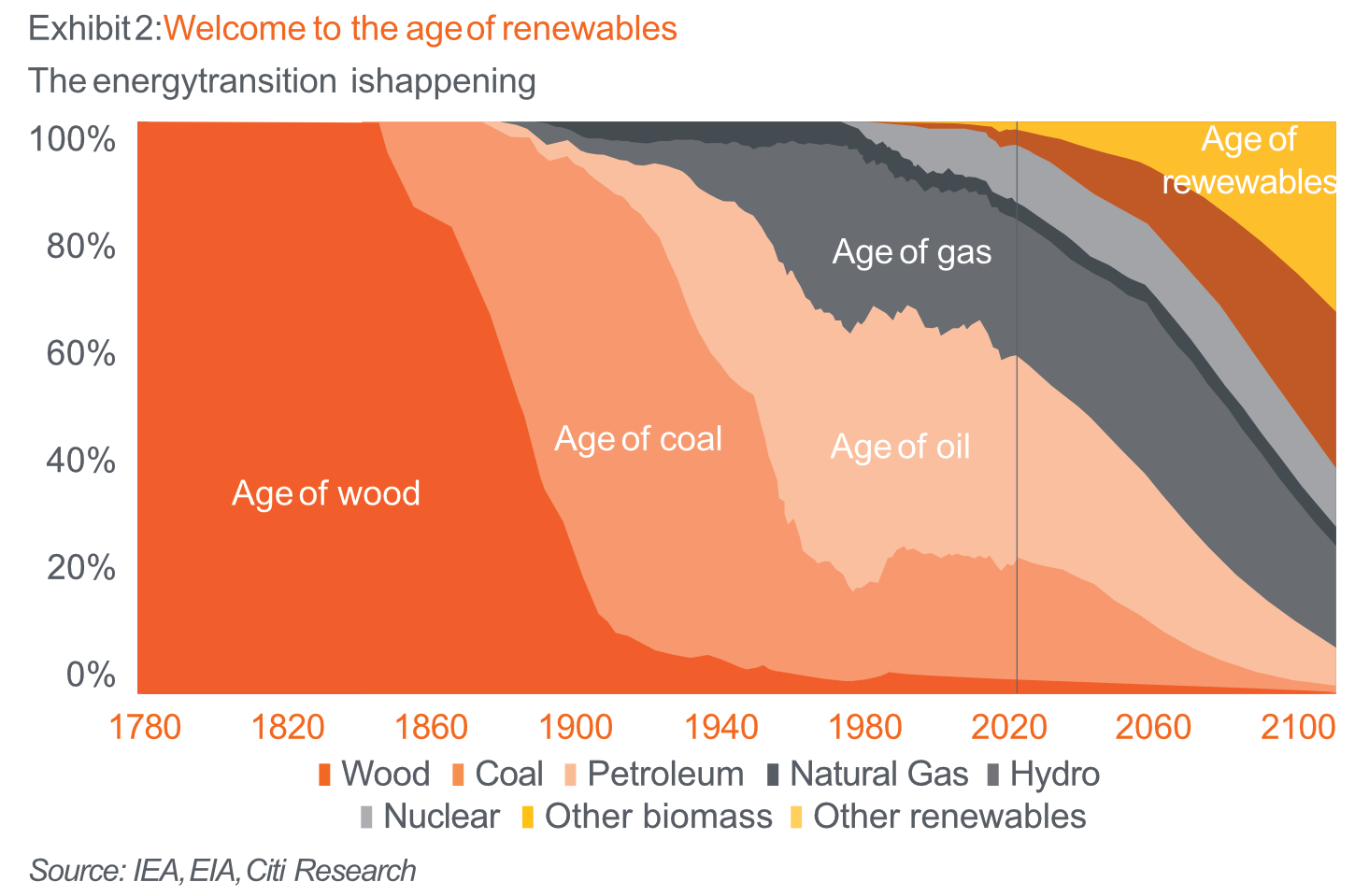

The last decade has seen investment into new renewable generation capacity exceed $2.5 trillion, and capacity quadrupled to 1650 GW2 . In 2016, for the first time annual new installation of renewables exceeded that of fossil fuels. Despite such huge strides, wind and solar generation today remains at just 7% of the total and there is a clear need to accelerate the pace of the switch to renewables.

So, how to finance the switch? And what are the opportunities for investors?

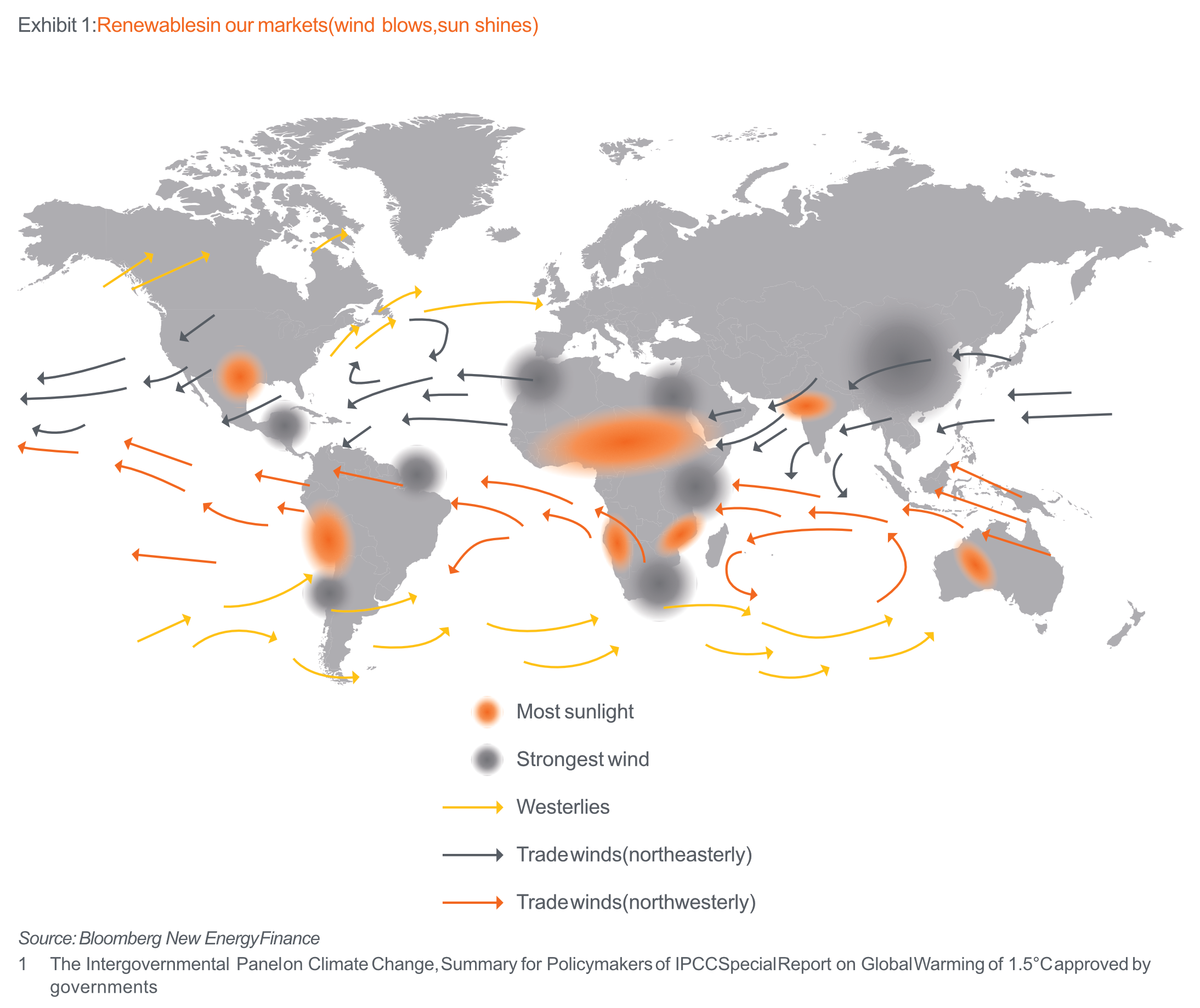

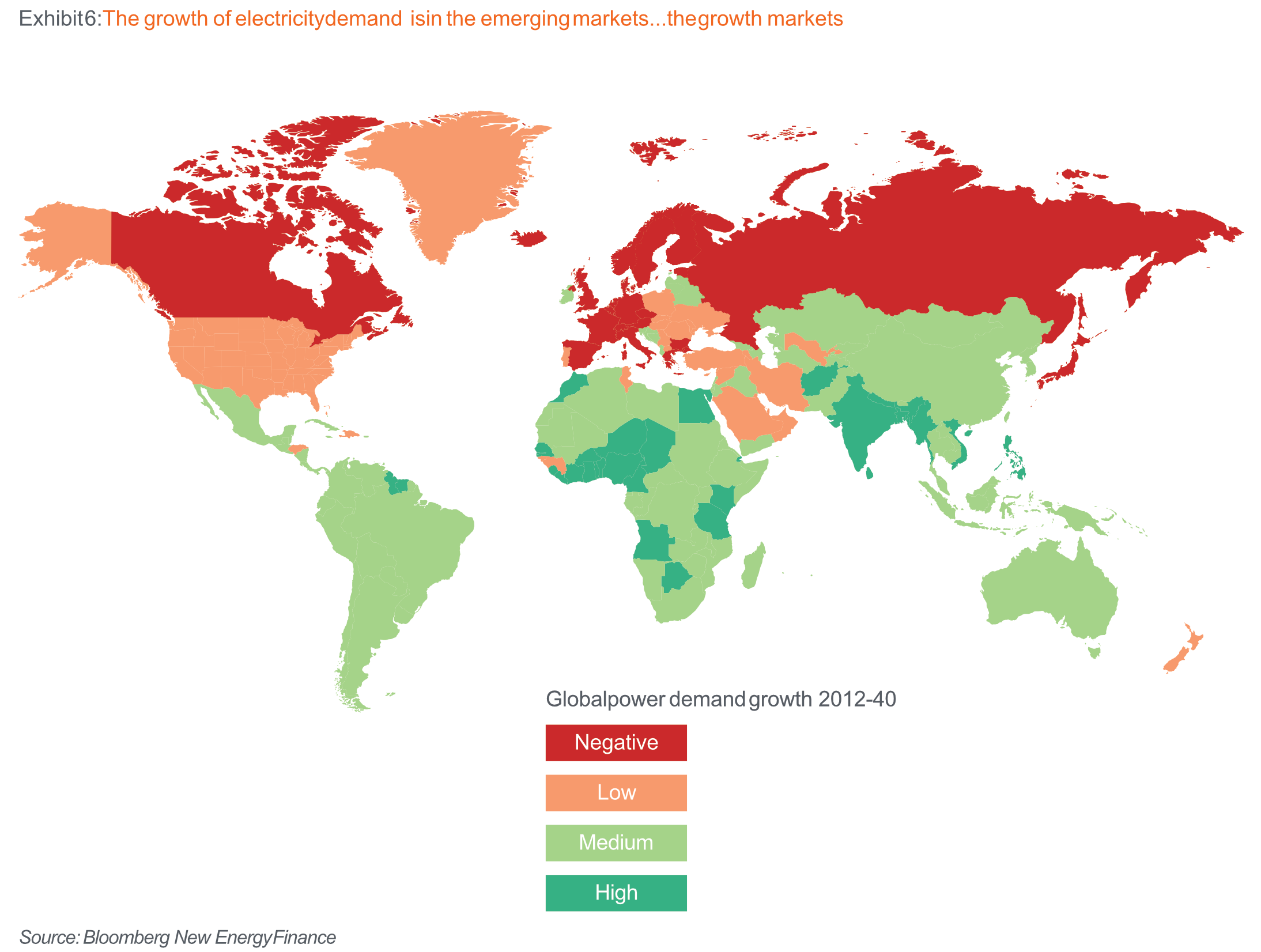

The largest opportunity is in emerging markets. The sun is hot, the winds are swift and demand growth rapid.

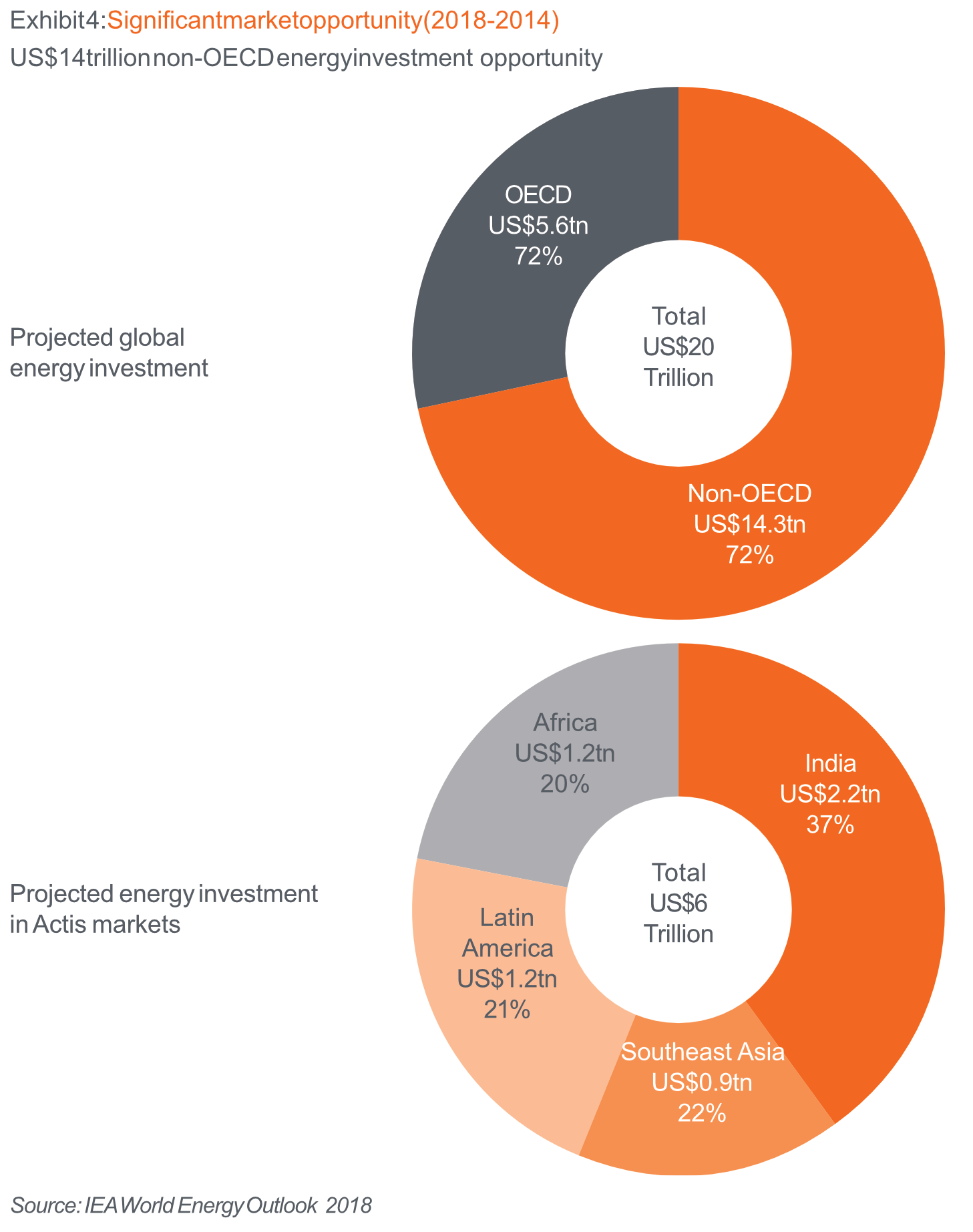

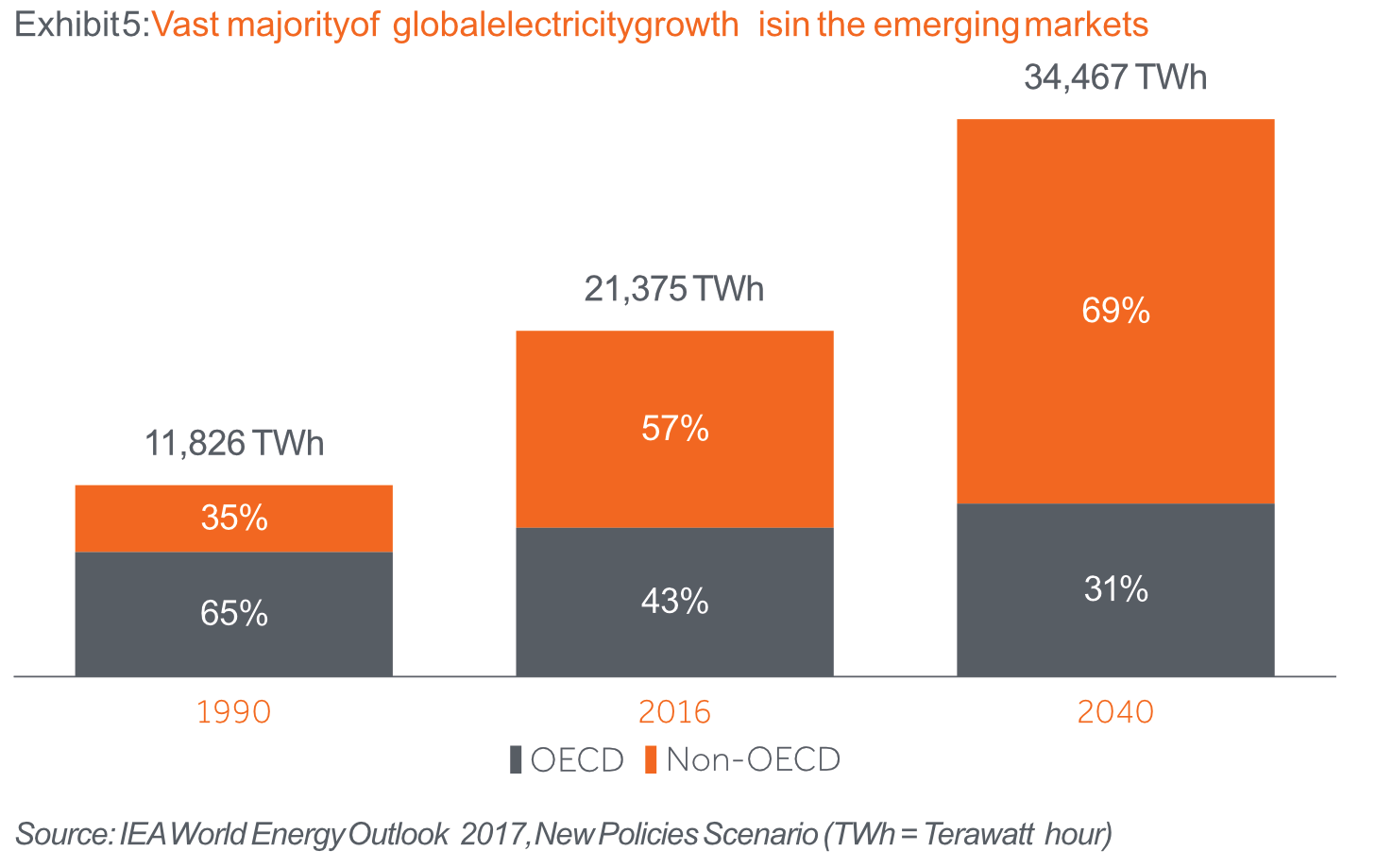

We estimate that 10,000 GW of new capacity is needed by 2050 and the majority of that – 7000 GW – will be in non-OECD markets. Approximately 80% of new generation capacity to 2050 will be renewables.

Wind and solar would go from 7% of generation today to 50% by 2050 (“50 by 50”). Costs continue to decline for wind and solar – which are now the cheapest technology across more than two-thirds of the world (PV cell prices have fallen 90% in the last 15 years). By 2030 wind and solar should undercut commissioned coal and gas almost everywhere. Coal’s role in the energy mix will fall from 37% today to 12% by 2050. Oil will be negligible and gas, hydro and nuclear will remain about the same3.

Electricity demand is set to increase by 62% to 2050 – meaning there is a need for almost $14trillion in new investment4.

This represents a huge opportunity for investors, particularly those investing in emerging markets. Diverse strategies can be deployed: invest in growth and buildouts of new capacity (greenfield), or invest into operating assets, offering annuity type returns, over a longer time-frame. Venture capital investors can focus on investing in battery technology.

carbon capture storage, hydrogen and other new technologies.Beyond investing thematically into ‘solutions’ to the energy transition (eg renewables), prudent investors must act on the fact that companies across all sectors need to focus on two areas: decarbonisation (adaptation) and resilience (mitigation).

Decarbonisation – beyond generation

Our private equity business spans a diverse range of sectors. In each area, we strive to mitigate the risks posed by climate change and identify the value creation opportunities that it presents. We are investors in supermarket chains, where the potential for resource savings is significant. For example, Companhia Sulamericana de Distribuição in Brazil and Food Lovers Market in South Africa have both committed to resource efficiency, waste reduction and recycling programs. These programs have already delivered tangible benefits, such as a 60% reduction in energy consumption. This has also helped to secure debt at below market rates from development finance institutions. In addition, both companies now focus on sourcing goods locally, reducing the carbon footprint of produce while also reducing prices by 20% without compromising on margins.

3 Bloomberg New Energy Finance, New Energy Outlook 2019

4 Bloomberg New Energy Finance, Solar, Wind, Batteries To Attract $10 Trillion to 2050, But Curbing Emissions Long-Term Will Require Other Technologies Too

In the Real Estate Sector, developments and buildings combined account for nearly 40% of global CO2 emissions. The IEA points out that there is potential for global building energy demand to decline between now and 2040, despite total building floor area growing by a further 60%. On average, buildings in 2040 could be nearly 40% more energy efficient than today5.

In our markets, we have seen first-hand how improved resource efficiency deliver significant cost savings and lower emissions. Rapidly declining costs of solar PV combined with sub-Saharan Africa benefitting from globally high irradiance levels means that installing rooftop solar panels often makes commercial sense. Actis’ Jabi Lake Mall is set to become Nigeria’s first solar-powered mall – a 600KW rooftop solar plant is being installed and will sell power to Jabi Lake Mall through an innovative 15-year Power Purchase Agreement. This will offer a cheaper and more stable energy alternative and will reduce the shopping centre’s CO2 emissions by over 13,000 tonnes.

In addition to the opportunities presented by solar, we have implemented a “green by design” approach to real estate investments that meets both our commercial and environmental goals. Actis has built the first internationally certified green commercial buildings in Nigeria, Ghana, Kenya and Cameroon. Douala Grand Mall in Cameroon has achieved a green rating, and it is calculated that it will be 29% more energy efficient than other non-green buildings in Douala6. This has been achieved through reduced window to wall ratio, reflective paint/tiles for the roof, insulated roof and external walls, energy-saving lighting, occupancy sensors in the bathrooms and skylights to provide daylight to 50% of the top floor area.

Renewables are here to stay. More than that they are here to grow. Not only do they contribute to the vital and herculean task of tackling rapid carbonisation they meet portfolio investors needs to incorporate responsible investments in their portfolios. The growing background of stakeholder pressures on asset owners to play a role in delivering climate change and increasing adaptation of renewables cannot come too soon.

Gas must be part of the mix

Energy demand is rising and it is forecast to reach 40TWh by 2040, with almost 70% of demand occurring in emerging markets7. A secure supply of energy is required to meet increasing demand and, due to supply intermittency, cannot be footed by renewable energy sources alone. Maintaining a reliable energy grid is a fundamental requirement of an energy system.

Gas will play a critical role in the energy transition acting as a bridging fuel to a low carbon future.

Key benefits include:

– Providing flexible energy supply to counter intermittency of renewables. We are not yet at the point where economies can forgo centralised thermal generation completely

– CO2 emissions (per unit of energy produced) from gas are around 70% lower than coal and around 30% lower than oil8

– Gas is more efficient and more readily available than coal or oil in many key Actis markets (some African nations have significant indigenous reserves). Harnessing indigenous gas reserves and displacing reliance on more expensive, imported fuel sources enables funds to be diverted to other critical services and infrastructure

– Songas, a gas platform in our first energy fund, is an example of this. It is estimated that the platform’s use of indigenous natural gas saved the Tanzanian economy US$5 billion as it reduced use of expensive liquids fuels. It now supplies 21% of Tanzania’s electricity9

– Aside from the CO2 advantages of gas versus other fossil fuel sources (coal, HFO, diesel, burning charcoal), gas is also preferable in terms of impact on local air pollutions/ human health e.g. SOx and particulates, waste management issues and environmental pollution (leaks, spills)

– Inclusion of gas in a system versus 100% wind and solar, reduces overall power prices. This will change however as batteries and other forms of storage become cheap enough. Affordability itself drives economic wealth which enables economies and civil society to better mitigate for and adapt to climate change.

Actis’ approach to gas

– Actis’ overarching strategy across Energy and Infrastructure is to identify opportunities for operational efficiencies to maximise energy production. This ensures as much energy as possible is generated from the same quantum of fuel type and that losses are minimised

– We see significant financial and environmental benefits in converting open-cycle gas turbine plants to combined-cycle gas turbines (CCGT). By converting the Azito power plant in Abidjan, Actis increased the generating capacity by 140 MW without any increase in gas consumption increasing the value of the asset while significantly reducing the carbon intensity. CCGTs emit fewer gases (sulfur dioxides, carbon dioxide and nitrogen oxides) into the atmosphere than OCGTs and are more efficient as reuse waste heat to generate more power

– We focus on harnessing indigenous gas reserves to support national economies to meet rising energy demand in a self-sufficient manner, and to reduce reliance on imports.

7 https://www.iea.org/geco/

8 https://www.iea.org/geco/emissions/

9 https://songas.com/overview/