Where We Stand Today

|

Malaysia

|

|

- March 2023 inflation 3.4%, down from 4.7% in August 2022

- Interest rate 3.0%, up 125bps since January 2022

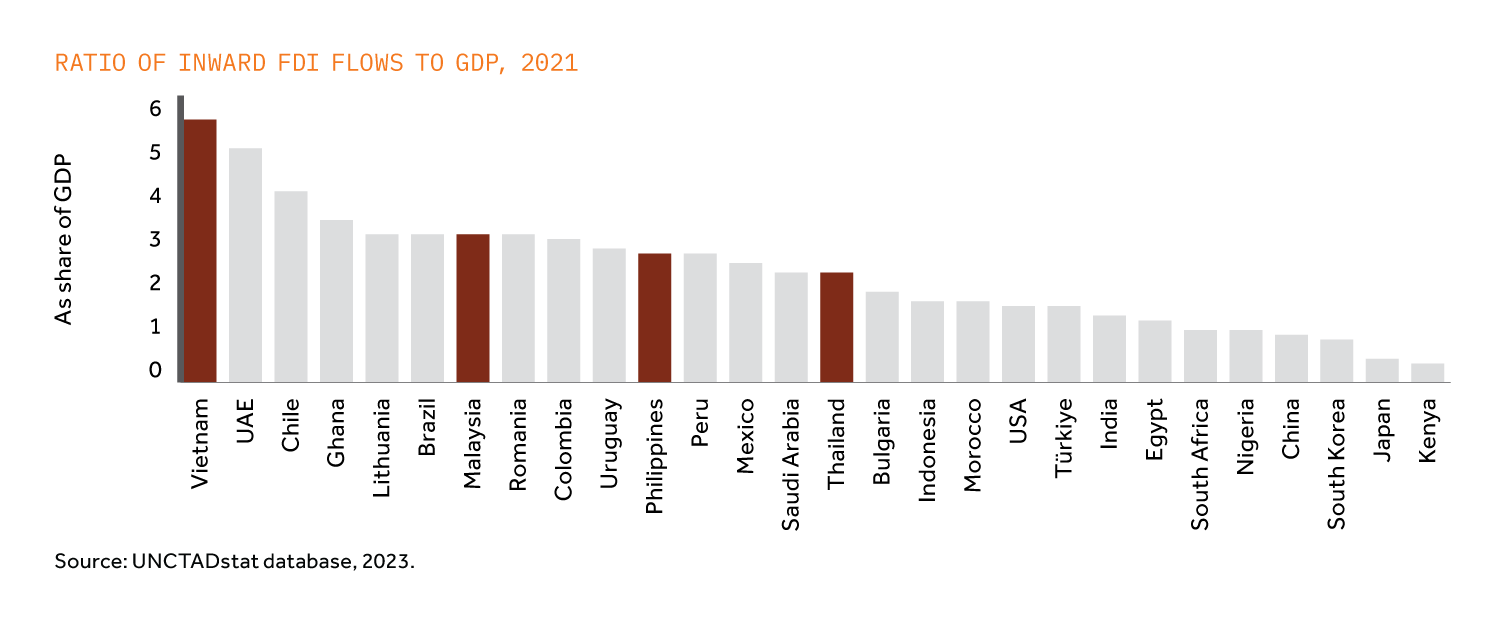

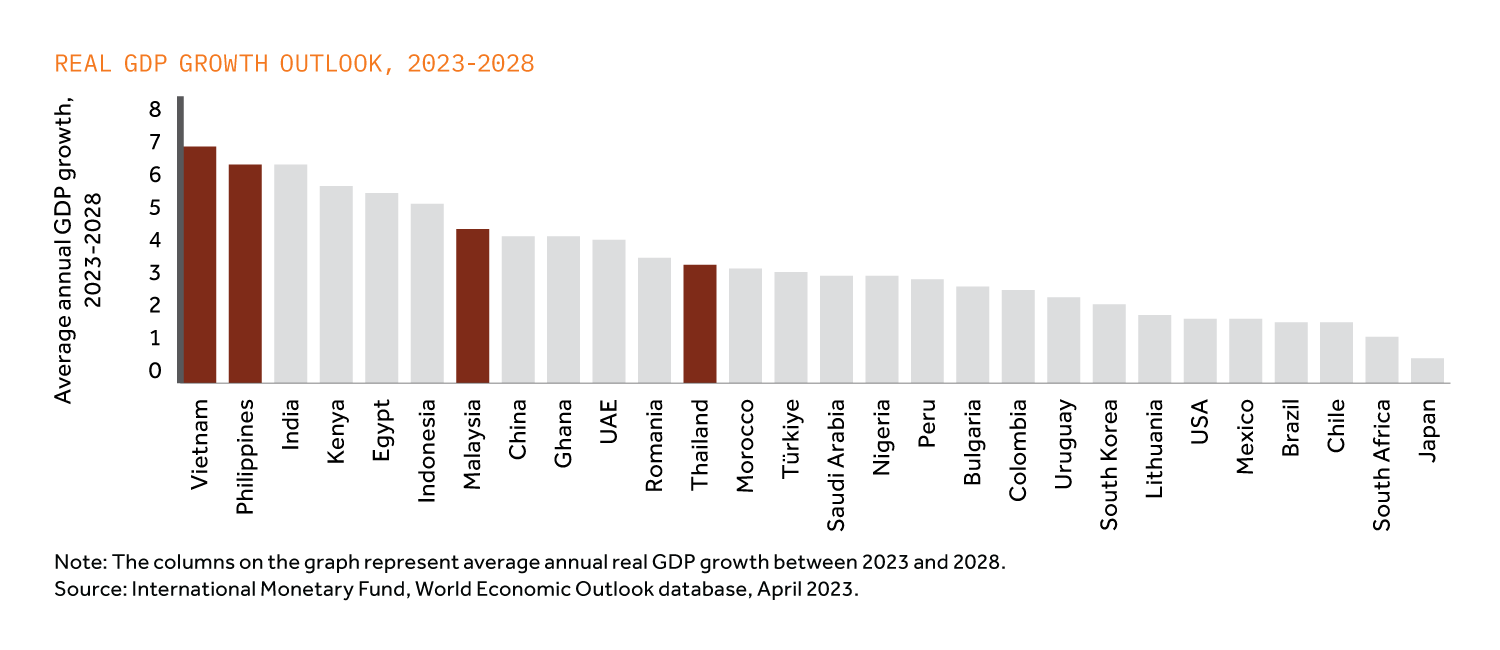

- GDP growth 8.7% in 2022, an outperformer

- Ringgit trading at 4.54 per USD, 3% weaker than a year ago

- A relative success over last decade with sound banking and financial institutions

|

Philippines

|

|

- April 2023 inflation 6.6%, down from 8.7% in January 2023

- Interest rate 6.25%, up 425bps since January 2022

- GDP growth 7.6% in 2022, an outperformer

- Philippine peso trading at 55.68 per USD, 6% weaker than a year ago

- Relatively stable macro picture despite some balance of payment constraints

|

Thailand

|

|

- April 2023 inflation 2.7%, down from 7.9% in August 2022

- Interest rate 2.0%, up 150bps since January 2022

- GDP growth 2.6% in 2022, and accelerating this year

- Baht trading at 33.7 per USD, 3% stronger than a year ago

- Well-positioned to benefit from China+1 with a long export manufacturing tradition; baht is a fairly stable currency, tipped to benefit from tourism recovery

|

Vietnam

|

|

- April 2023 inflation 2.8%, down from 4.9% in January 2023

- Interest rates 6%, up 200bps since January 2022

- GDP growth 8% in 2022, an outperformer

- Dong trading at 23,469 per USD, flat compared to a year ago

- Key winner of China+1 story with a low volatility, slowly depreciating currency. FDI inflows of $1.5-2.5bn every month

|

Source: Bloomberg LP for consumer prices, interest rates and exchange rates. International Monetary Fund World Economic Outlook database (April 2023) for real GDP growth figures in 2022 and 2023f. Exchange rates as of May 22, 2023 and interest rates as of June 7, 2023.