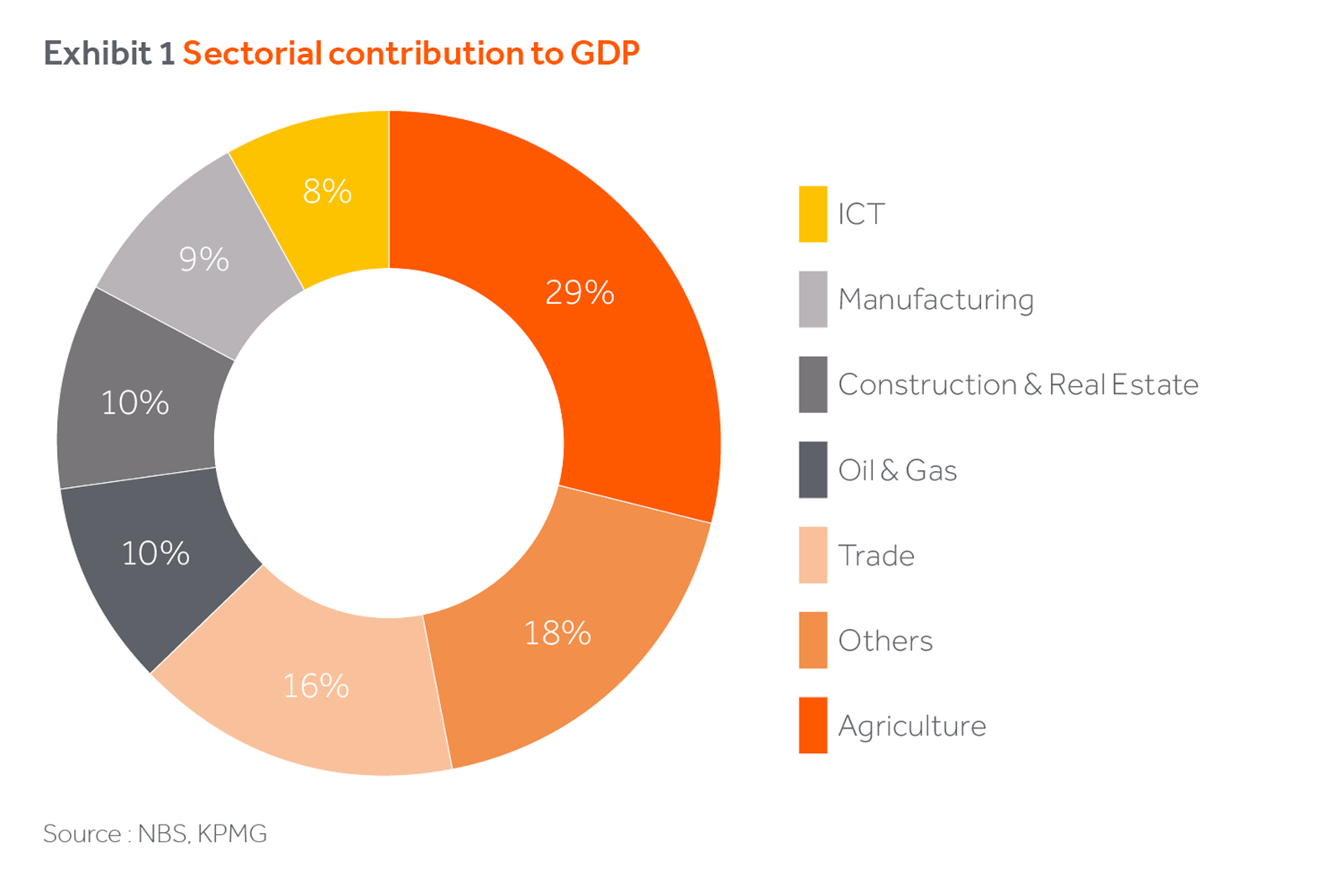

The Minister of Finance, Kemi Adeosun was recently quoted saying that “Nigeria is not an oil economy”. This is a bold assertion given the economy has only just emerged from five quarters of contraction, its longest recession in over two decades. And by most commentators’ reckoning, this was a recession that resulted from the global slump in oil prices compounded by a fall in its production levels due to disruptions by restive militants in the Niger Delta. So her assertion does not do much to dilute the reality that the economy remains vulnerable to oil, as even though only 10% of GDP, oil accounts for 70% of Government revenues and 90% of forex earnings. Rather, her statement should be seen as an acknowledgement of the futility of the continued reliance on oil for sustainable growth.

The Economic Recovery and Growth Plan (ERGP) launched in Feb 2017 to reset the economy on a growth path demonstrates the fact that policy makers are now paying more than lip service to the need to diversify. This includes explicit recognition of the need to close the infrastructure gap and that this will require private sector investments enabled through improving the country’s ability to attract FDI. As these initiatives will only be realised in the medium to long term, Nigeria, the largest and most populous economy in Africa will remain vulnerable to shock in oil price or production levels. But the key question we ask is whether, in the event of a short to medium term recovery in oil prices and output, the country will repeat its historical pattern and risk this becoming another “wasted recession”.

Improving Business Environment from FX stability and Oil Rebound

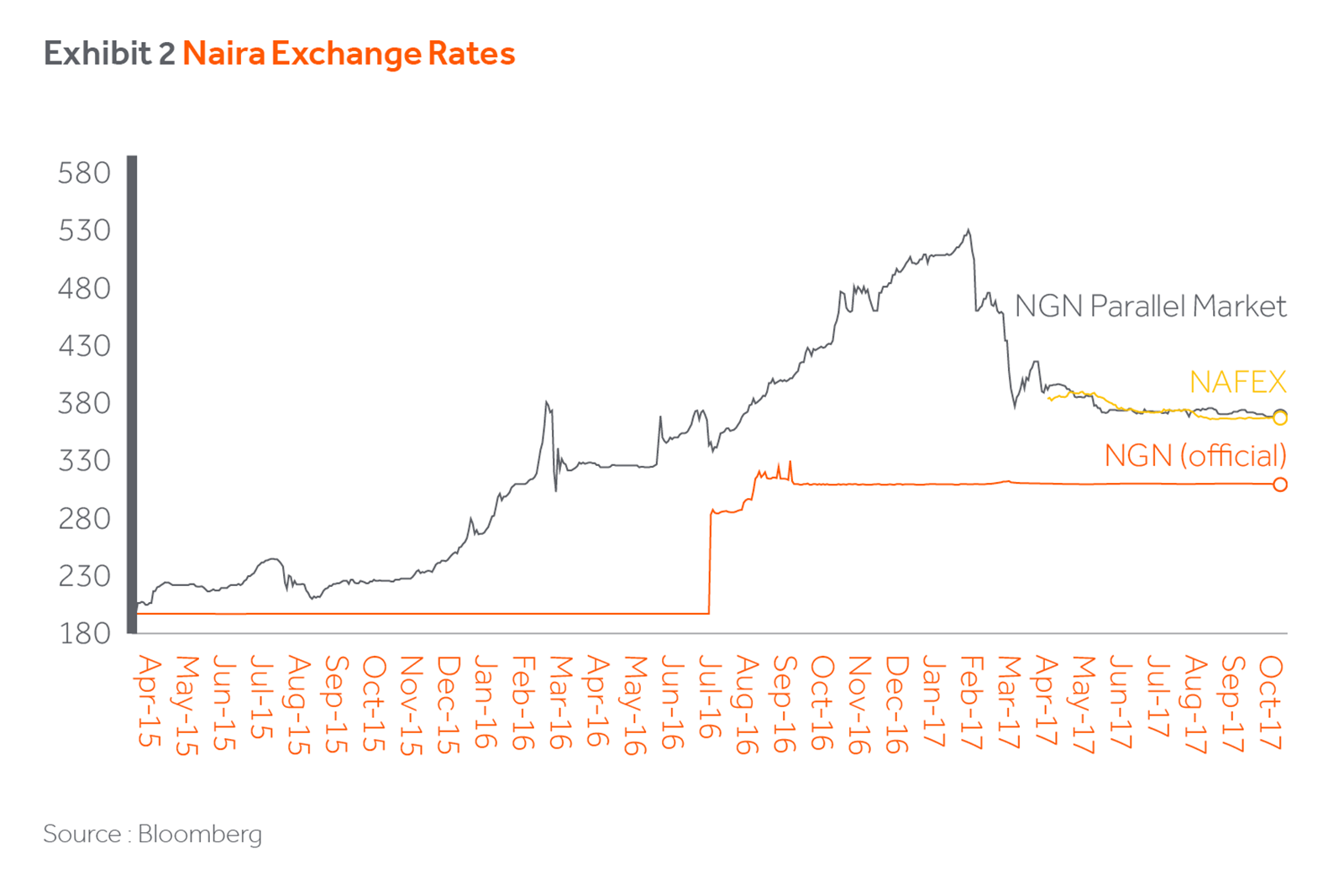

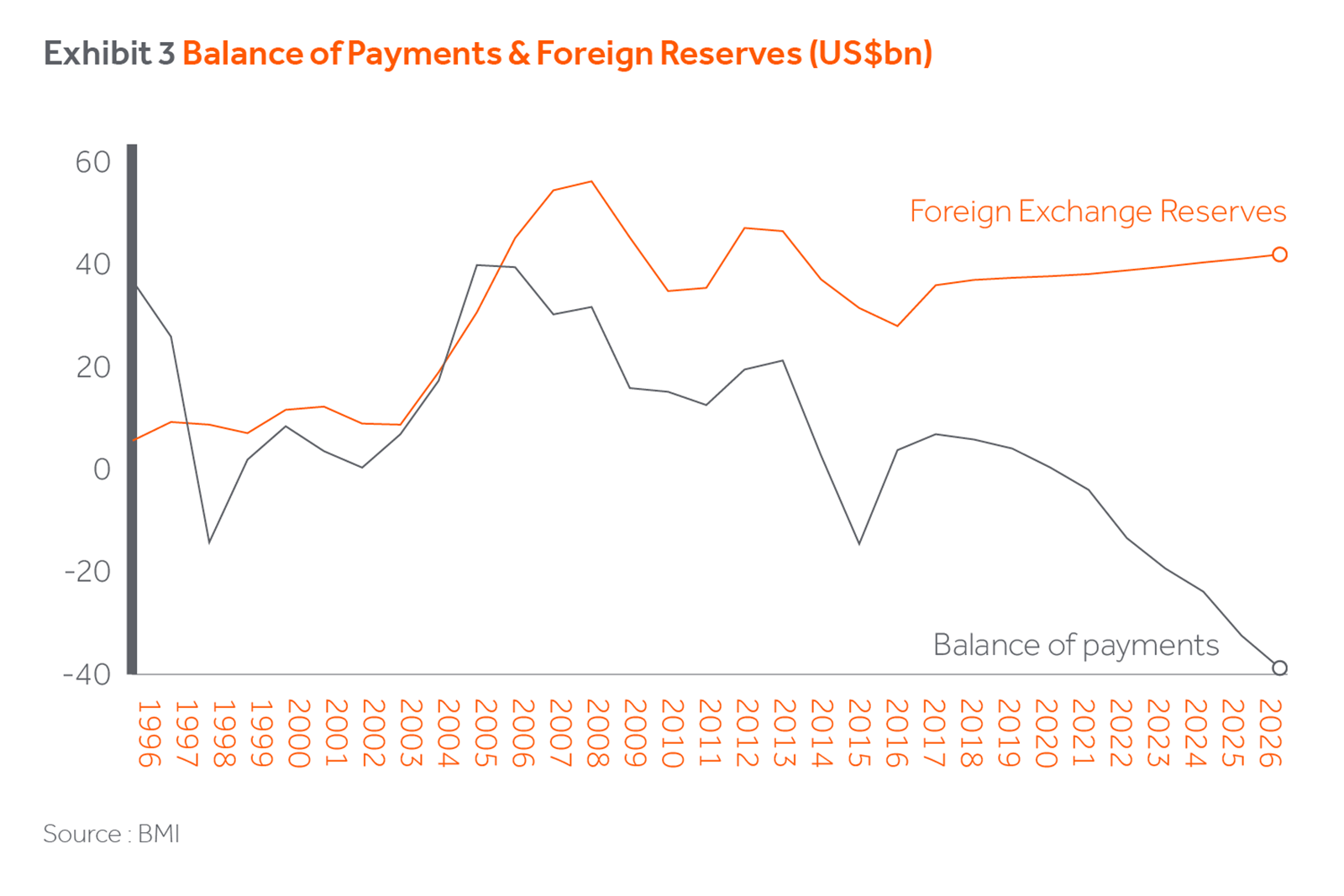

Eight months into the ERGP implementation, notable progress has been made on improving the enabling environment in two areas. One, Nigeria moved up 24 places on the Ease of Doing Business index, from 169 to 145 giving momentum to the government’s target to move to top 100 on the index by 2019. India recently moved into top 100 on the index and had its ratings upgraded in spite of slowing growth. Secondly, following wide spread criticisms on the implementation on a plethora of policies, including FX restrictions and an unusual multiple exchange rate regime, the Central Bank of Nigeria finally relented and introduced, in April 2017, the Investors and Exporters FX window. This was an inflection point for easing FX shortages in the economy with the index of the window, Nigerian Autonomous Foreign Exchange Fixing (NAFEX), now the de facto pricing benchmark for the Naira as its rates have now converged with both the parallel and interbank markets. The Naira has appreciated from N520/USD in Q1 to N360/USD. The restored investor confidence is also evident by the over $10bn traded in the window since inception, and rising FX reserves levels now at three-year high, even though the CBN continues to maintain the official exchange rate at N305/USD.

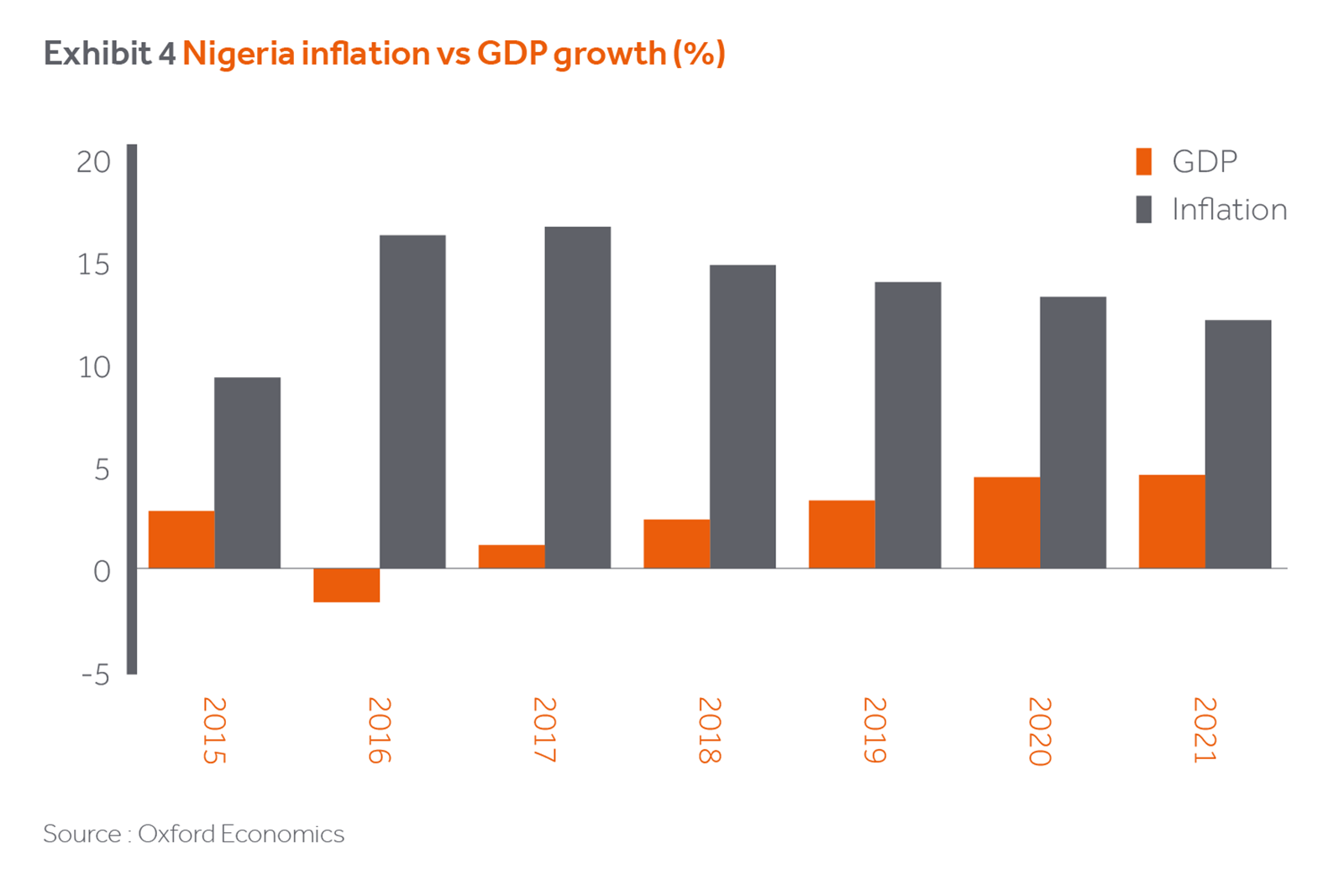

The markets also have responded favourably with the stock index up 38% YTD, USD bond yields trading at 6%, 100bps lower than at beginning of the year and inflation trending lower from over 18% to 15.91%. Furthermore, the improved FX liquidity is boosting economic activities which remain largely import dependent. For instance, we have seen a pick up in the retail segment to which we have an exposure via our investment in Jabi Lake Mall in Abuja. Retailers previously restricted from the FX markets are now able to restock and are starting to expand their footprints. We also observe a similar uptick in enquiries and lease take up for office space by both new entrants and existing businesses expanding, reflecting increased business confidence and as such vacancy levels are trending downward as experienced at Heritage Place, our Grade A office development in Ikoyi, Lagos. This is in spite of the growth numbers which continue to reflect poor performance in Q3 2017 in sectors outside oil and agriculture.

Closing the Infrastructure Gap will Require Significant Private Sector Investments

The government has articulated the need to close infrastructure gaps and also recognises that the government cannot fund the over US$100 bn annual investment required to close the gap; the US$7 billion capital budget allocation for 2017 is small change in comparison. Creditably, the government is prioritising capital spend that catalyses significant counterpart funding either by bilateral or concession arrangements. Some examples include the standard rail gauge and 3,000MW hydro power projects with the Chinese both costing c.US$5bn each and the 30-year concession of the narrow gauge rail system to GE, that has announced a US$2.7bn investment program. In addition, plans to concession airports and roads via public private partnerships were recently announced.

In the power sector, to catalyse investments, the government has set up a Payment Assurance Guarantee Support Scheme to guarantee power purchase contracts to the tune of US$2bn. This strengthening of the power value chain is a welcome development for both new investors like Black Rhino that announced a 540MW IPP project recently and existing investors such as our Actis Energy 4’s investment in the Azura Power 450MW IPP project set for completion in 2018.

The challenge of financing the country’s infrastructural needs including the social infrastructure of health and education underpins the need to diversify government revenues.

Diversification strategy to cover both Fiscal Revenues and FX sources and uses

With a tax to GDP ratio of 6%, the government targets to increase this ratio to 15% in the medium term in line with peers; Egypt 18.1%, Kenya 18.8% Ghana 20.1%, and South Africa 25.8% in 2016. The plan is to widen the tax net rather than increasing tax rates as less than 10mn of the 70mn economically active population pay any taxes. To this end, there is ongoing effort to strengthen the tax administration and enforcement leveraging technology and improved communication. A tax amnesty program has been launched to encourage voluntary tax compliance with enforcement to start in Q2 2018.

On the diversification of FX sources, the two pronged approach is to lower the import bill and boost non-oil exports. The ERGP has refined the wholesale approach of the CBN to restrict imports by focusing on the five items (refined petroleum products, rice, wheat, sugar, and tomatoes) that account for 60 – 70% of the import bill. A mix of incentives and tariff protections are in place to encourage local production and has catalysed major investments and is set to lower the import bill. Most notable is the US$9bn oil refinery being developed in Lagos by Dangote Industries which will reduce the import bill for refined products on completion in 2019. Progress has also been made in the large scale cultivation of rice by major corporations such as Olam Group, thus reducing the reliance on imports, particularly in the rural areas. In addition to the import substitution which is now rightly and largely focused on areas where Nigeria has comparative advantage, the Nigerian Export Promotion Council is promoting non-oil exports with a combination of incentives including export expansion grants of 5-15% of export values and capacity building to support SMEs to access international markets.

2019 election cycle may distract from reform implementation

Nigeria has been known to develop detailed well-articulated economic plans, the challenge has always been with implementation. 2.5 years into the Buhari administration, the sense of urgency in implementing key policies such as the single market determined exchange rates, removal of petroleum subsidies, cost reflective electricity tariffs is still lacking. Also, monetary policies remain focused on Naira stability with high interest rates, tight liquidity management stifling growth and crowding out private sector credit. There are also risks to the government’s ability to finance the budget due to revenue shortfalls. While the debt to GDP ratio at 11% is considered low compared to peers, debt service at 30% of fiscal revenues does limit the capacity to borrow, particularly as the Buhari administration continues to ignore low cost debt options with multilateral institutions.

With upcoming elections in 2019, political risk is increased as it is not clear if President Buhari will run for re-election. Unfortunately, this is now distracting from a focus on economic reforms as well as potentially impacting on decisions such as removal of subsidies and Naira float which are considered non-populist and thus unlikely to be implemented ahead of the elections in 2019.

Window of opportunity for sustained growth path is open

The last year has seen recovery from the depths of fiscal, economic and fx recession, sustained recovery depends on continuing the reform momentum as well as the still compelling secular growth drivers – demography and urbanization and entrepreneurial drive. Nigeria has been a country of false dawns, and the hope is the current opportunity presented by a period of stable and moderate oil prices is fully utilized.