The global need to reduce our dependence on the most polluting fossil fuels is becoming increasingly evident. The dual priorities of net zero and energy security dictate an ever greater requirement to shift away from coal and oil. Whilst much emphasis has rightly been placed on the role of renewables to address this as part of a greener economy, gas is increasingly seen as a vital transition fuel for many countries to help them meet their climate goals.

This is particularly relevant in coal-dependent regions of the world, such as Southeast Asia (SEA) where 80% of the world’s new coal generating capacity is expected. For many countries in this region, it is not feasible to roll out renewables at the pace required to meet demand and reduce carbon emissions quickly, whilst maintaining grid stability. As a less carbon intensive source of energy to coal, gas can therefore play a significant role.

We recently announced the launch of Bridgin Power, a power generation platform that will pursue gas-fired assets and focus on delivering the energy transition across SEA. Nimbus, its first transaction was the acquisition of a 220MW operational gas-fired power project in Barishal, southern Bangladesh, which uses reserves from a local gas field just 7km from the site. An expansion plan for another co-located 220MW is also planned.

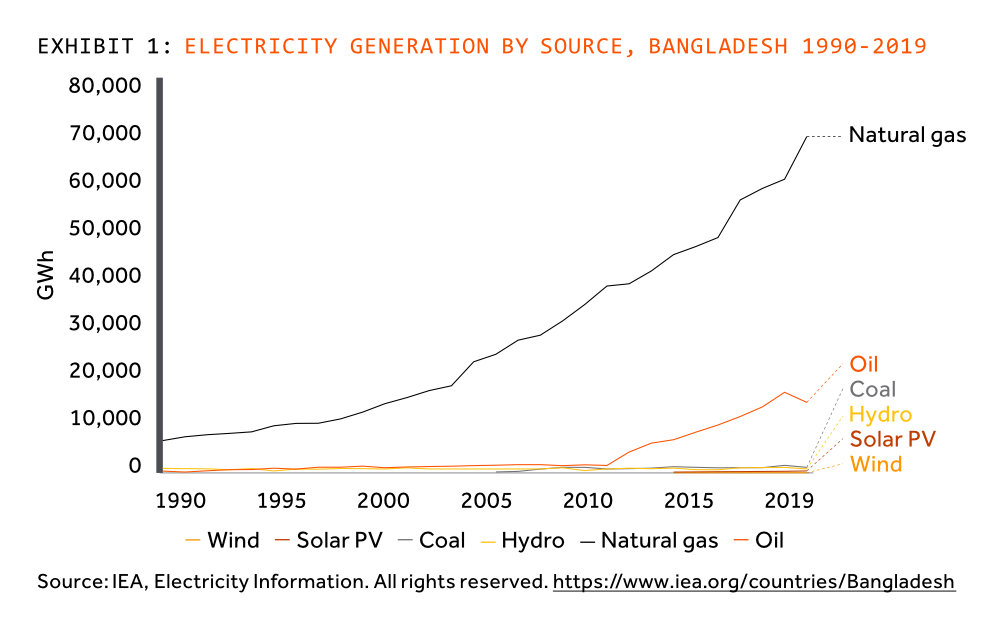

The acquisition highlights the important role that gas can play in the transition. While Southeast Asia is expected to shift to renewables in the long term, and huge investment flows are anticipated to help the region increase its generation from renewable sources, the immediate baseload demand can only be fulfilled by thermal energy (Exhibit 1). As a far cleaner alternative to coal – which often has to be imported – harnessing a country’s indigenous gas reserves therefore provides an obvious short and medium-term solution to supporting its energy strategy, while contributing to climate goals. Natural gas is 50% cleaner than coal on a CO2 basis, but more than 1,000 times cleaner on an air quality and pollution basis, so there are also considerable environmental and health benefits. Domestic production also provides immediate relief from global energy insecurity which many countries are likely to continue facing over the coming years.

As in other markets where energy poverty is high and access and affordability are low, investing in enabling power technologies such as gas plants therefore supports the transition away from fossil fuels as well as delivers socioeconomic benefits. The recent inclusion of gas in the European Union’s green taxonomy supports this position of gas having a pivotal role as a sustainable fuel source in the energy transition.

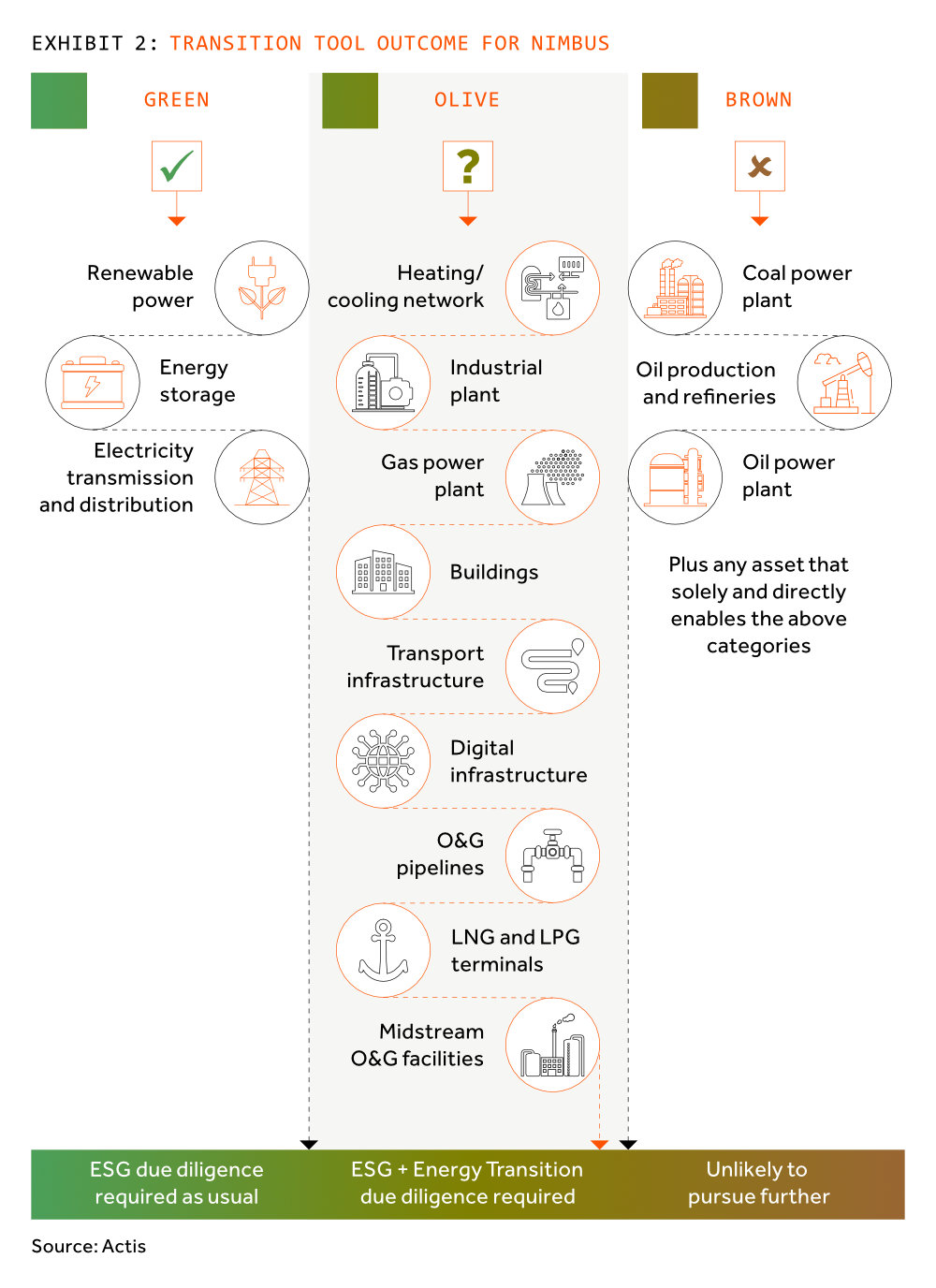

How do we ensure such investments have positive outcomes? We have developed an in-house Transition Tool with consultants SYSTEMIQ, that is run as part of our due diligence process (Exhibit 2). It assesses climate transition risk by analysing the role of an individual asset in the local market in relation to national climate transition and decarbonisation plans. It identifies assets as “green” (Paris/net zero aligned), “misaligned” (where Actis will not invest) or somewhere in between which we call “Olive”.

“The Actis Transition Tool assesses climate transition risk by analysing the role of an individual asset in the local market in relation to national climate transition and decarbonisation plans.”

Bridgin Power uses the Transition Tool to inform future investments into such ‘Olive’ assets where the asset plays a clear role in a transition and decarbonisation pathway, and where there is no viable alternative. The tool also helps Actis identify what can be done during the hold period to future proof and decarbonise such Olive assets to become “Smart Olive” – that is measures to protect us from stranded asset risk, and make operations more efficient and resilient.

Analysing the Nimbus asset through the prism of our Transition Tool enabled us to demonstrate that Bangladesh’s renewable options are limited and that no lower carbon solutions could be implemented. Wind resources are relatively low, there is insufficient suitable land for solar development, and much of the country is susceptible to flooding or other natural disasters.

In this instance, investing in gas is delivering immediate economic benefits in terms of energy production, helping the country meet its baseload need. Bangladesh has set a target of generating 4.1 GW of electricity from renewable energy sources by 2030. The investment therefore supports the switch away from coal, as a more carbon intensive fuel source, and the plant has the flexibility to operate at mid-merit or peaking power ahead of greater renewables generation in the future.

Investments such as Nimbus highlight the important role that responsible investment into gas can play in supporting countries in their transition to a lower carbon economy.

Marina Johnson is a member of Actis’ sustainability team