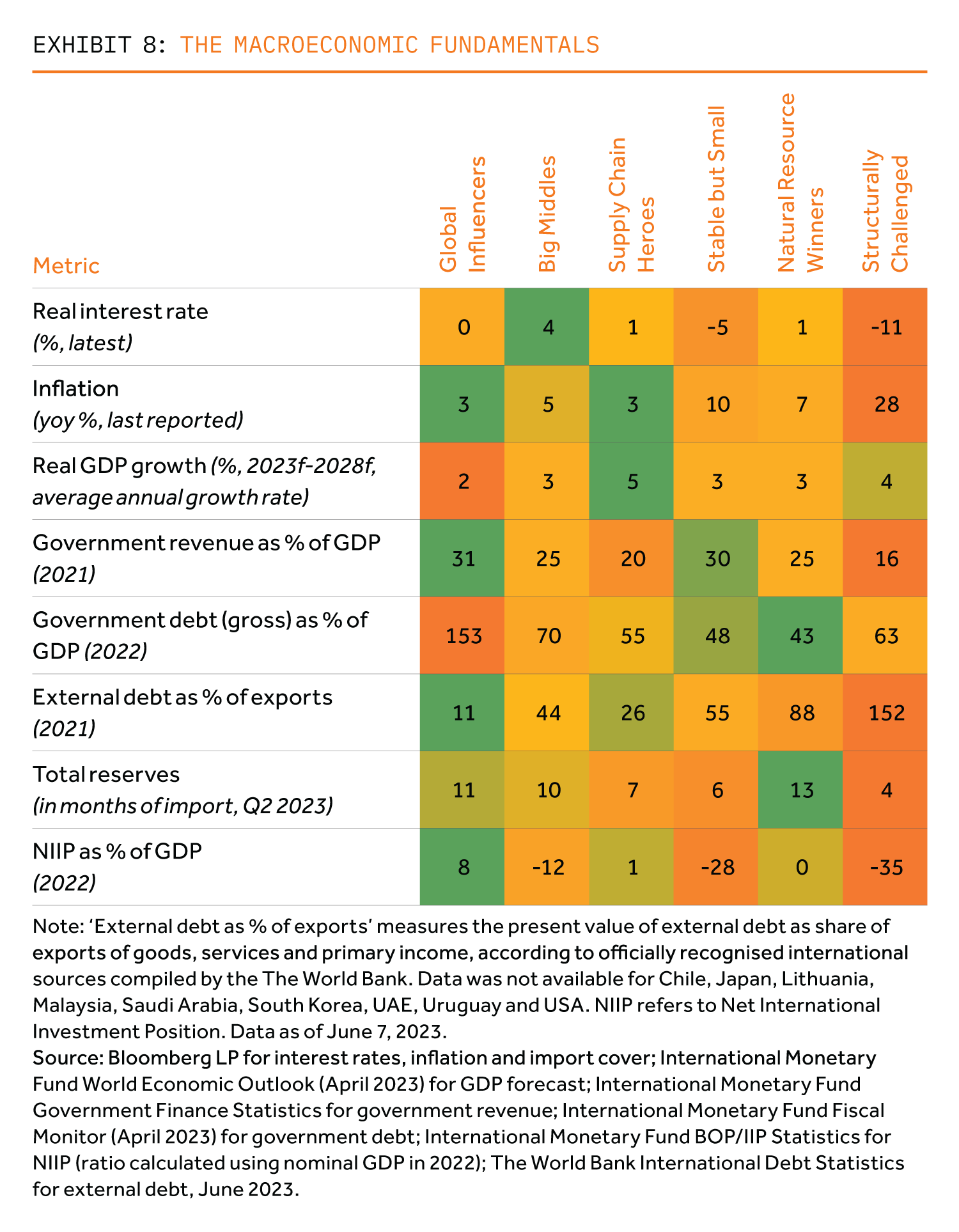

Traditional research focuses on macroeconomic variables including inflation, interest rates and fiscal trends. Whilst we acknowledge the importance of these variables, they seem often to us to be symptoms rather than causes of investment risk (see Exhibit 8).

An appropriate interest rate is important for balancing investment, consumption, and inflation in an economy. Negative real or low nominal rates can incentivize borrowing and discourage savings, as money is being lost on investments in real terms.

Traditional research focuses on macroeconomic variables including inflation, interest rates and fiscal trends. Whilst we acknowledge the importance of these variables, they seem often to us to be symptoms rather than causes of investment risk

Stubbornly high inflation and deeply negative real rates remain, above all, a challenge amongst ‘Structurally Challenged’ and ‘Stable but Small’ (largely EM Europe) countries. Even so, as we go to print, headline inflation appears to have peaked. The IMF forecasts inflation will decline amongst ‘Stable but Small’ economies over the next two years, but inflation will remain above target amongst most ‘Structurally Challenged’ economies. Across other buckets, CPI pressures have already been softening, albeit slowly.

Real rates, on average, are highest in the ‘Big Middles’. This implies room for stimulating activity should the need arise. It also suggests that these economic systems are robust enough to absorb orthodox policies and, in some cases, get ahead of the curve. This is a virtue not a vice.

In terms of the real GDP growth outlook across the next half decade, the most impressive country bucket is ‘Supply Chain Heroes’. The IMF GDP forecast is aligned with this bucket’s recent track-record – think Vietnam and other ASEAN countries’ remarkable past decade. Buckets other than ‘Supply Chain Heroes’ will grow at a relatively similar rate; ‘Global Influencers’ economic growth will be slower.

General government revenues to GDP – especially tax take to GDP – reveal why some countries are structurally more vulnerable to shocks than others. Here, the ‘Global Influencers’ and ‘Stable but Small’ countries stand out, whilst ‘Structurally Challenged’ have lowest government revenues – and tax intake – relative to GDP. Government debt to GDP ratio is problematic in the latter group (excl. Türkiye), implying limited fiscal scope and possible debt distress scenarios if either global or domestic conditions worsen.

A key solvency ratio is external debt to exports. It is useful as a trend measure indicating the repayment capacity of an economy. Data limitations apply but calculating bucket averages for the economies where data is available yields a very clear-cut result: ‘Structurally Challenged ‘economies are, on average, three times worse off than any other bucket. In fact, this indicator is flashing red in regard to solvency concerns across this group. These fears have proven warranted in the case of Ghana, which earlier this year effectively missed coupon payments on its Eurobond.

Another important macro stability benchmark is the import coverage ratio. It measures the number of months that a country’s foreign currency reserves could cover its total import bill. Too low import cover implies vulnerability to external shocks, such as a sudden rise in commodity prices or economic slowdown. This metric shows how ‘Natural Resource Winners’ are currently sitting on a fiscal bonanza; whilst at the opposite extreme are the ‘Structurally Challenged’ economies. ‘Global Influencers’ (including China) and the ‘Big Middles’ occupy the second and third most favourable spots.

In the case of the ‘Big Middles’, there has been a clear trend towards more sound policymaking, central bank independence and FX reserve building in the past decade.

The net international investment position (NIIP) is the difference between a country’s stock of foreign assets and a foreigner’s stock of that country’s assets; a material negative NIIP suggests more vulnerability to developments in the global financial markets.

On this metric, ‘Global Influencers’, ‘Supply Chain Heroes’ and ‘Natural Resource Winners’ are the best positioned. The former group is driven by Japan which runs the biggest total net creditor position in the world in US dollar terms (and one of the largest as a share of GDP). The latter is driven by the GCC economies, but South Africa also performs well. ‘Big Middles’ (including South Korea with a material positive NIIP) are in the middle of the spectrum. ‘Stable but Small’ and ‘Structurally Challenged’ are the worst positioned. All economies in the latter two groups are debtor nations vis-à-vis the rest of the world.