The world is undergoing an energy transition. Electricity demand alone will double in the next three decades¹. Transmission and distribution will advance materially, impacted by the shift in energy mix towards renewables and evolving load patterns from electric vehicle and heating demand.

This rapidly evolving energy transition gives developing countries opportunity to create a cleaner and greener energy ecosystem with accessibility for all and self-supported by indigenous renewable resources. Deployment of new technologies, proven concepts and best practices from mature electricity markets will allow developing countries to leapfrog in creating an efficient energy system whilst avoiding costly mistakes. As the energy transition drives the change for power systems, close co-operation between stakeholders, such as governments, utilities, grid operators and investors, is central to the much-needed grid modernisation which ensures energy access for all.

The doubling of electricity demand will be supplied by an almost tenfold increase in renewables’ installed capacity which also needs to be connected to a power grid. To achieve a combined vision of energy transition, electrification of energy and universal energy access, the transmission and distribution grid (‘T&D’) will need to overcome challenges including:

- Grid stability and the need to maintain stable frequency with variable supply;

- Grid extensions facilitating electrification, power system resilience and security of supply; and

- Grid digitalisation and smart monitoring to improve the level of service, the performance of existing and ageing assets, faster reaction time and avoiding brownouts and blackouts.

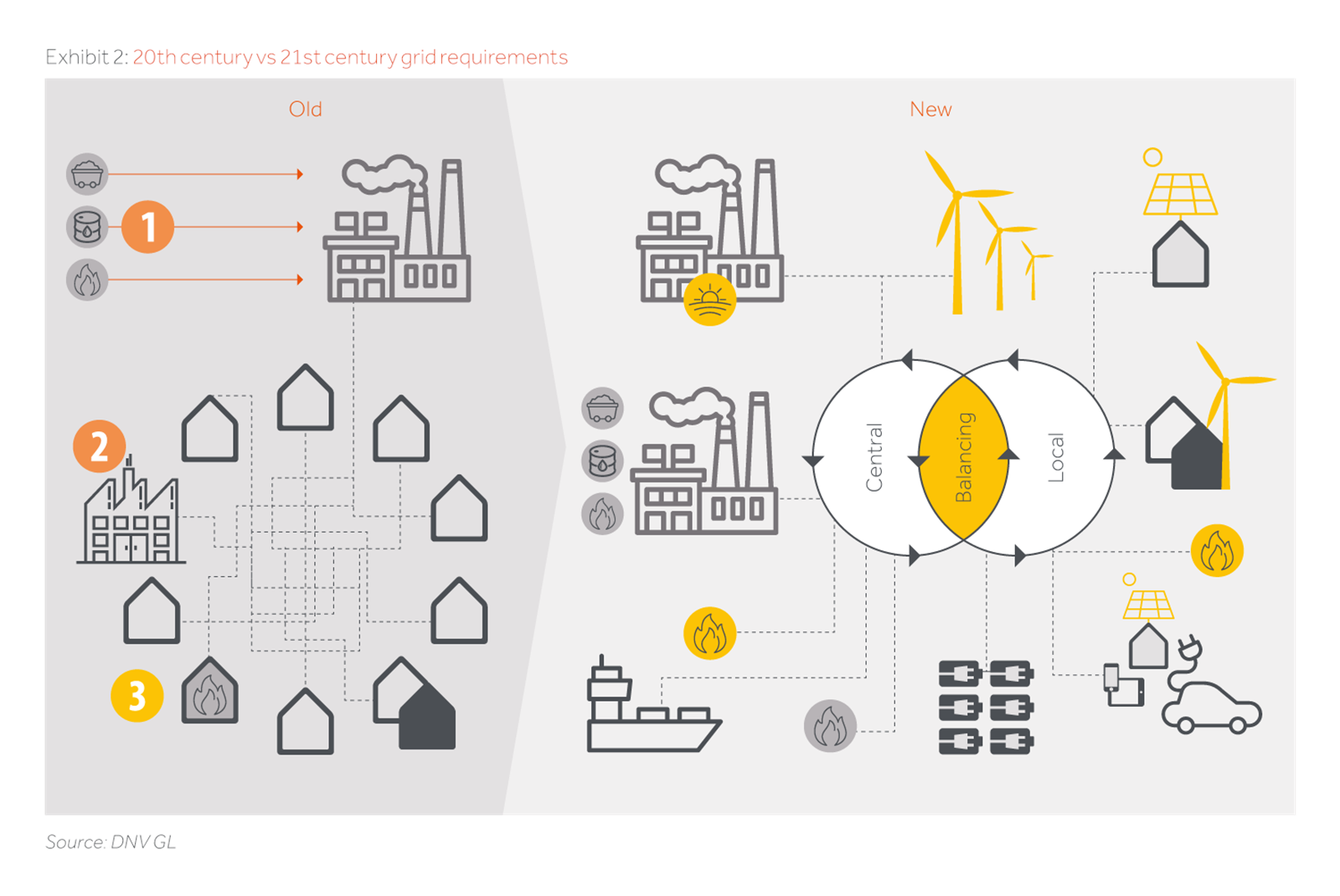

Increased renewables share in the energy balance has another complication, as renewable power generation comes both from large scale projects like wind or solar farms on transmission lines as well as numerous smaller ones such as residential PV solar connected on the distribution grids or micro grids that generate and distribute electricity at local level. The old scheme of one main single backbone grid in a ‘star’ configuration is moving towards a central main grid interacting with several local grids and generation units, making grid balancing and management a difficult task.

To manage such dynamic power networks, Actis is seeing an improved focus from grid operators and utilities in the emerging markets to invest in renewables integration, grid modernisation, improved resiliency and reliability, and digital transformation. As physical realisation of grid modernisation can take many years and often lags power generation, all key stakeholders will need to work together much more closely than on the generation side.

Transmission: a panel of technological solutions and best practices

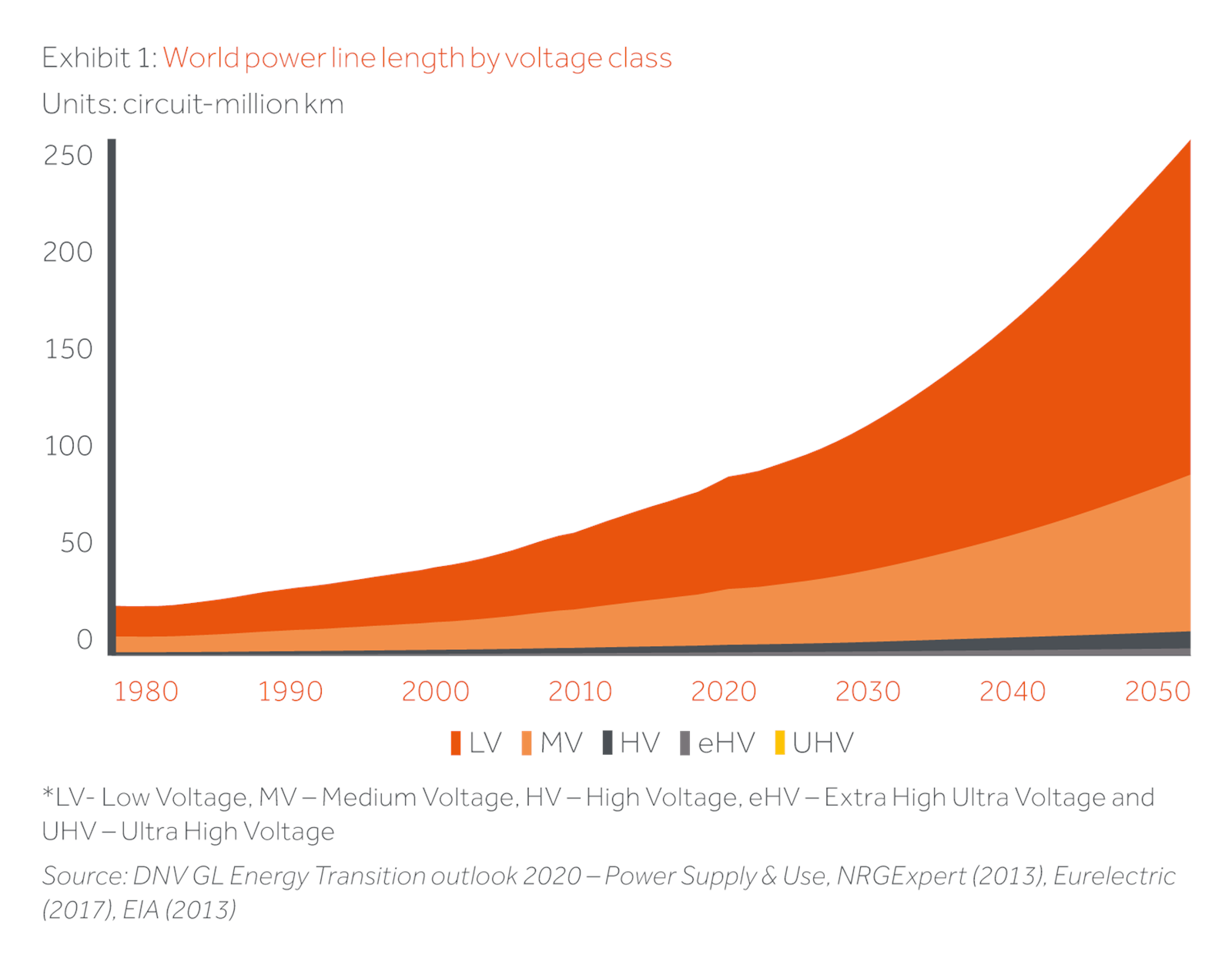

The world power line length and capacity is expected to grow by 2.5x², with a substantial amount of grid growth in the emerging markets to ensure energy accessibility to the last mile.

Exhibit 1 shows the growth of world’s power line capacity by voltage class.

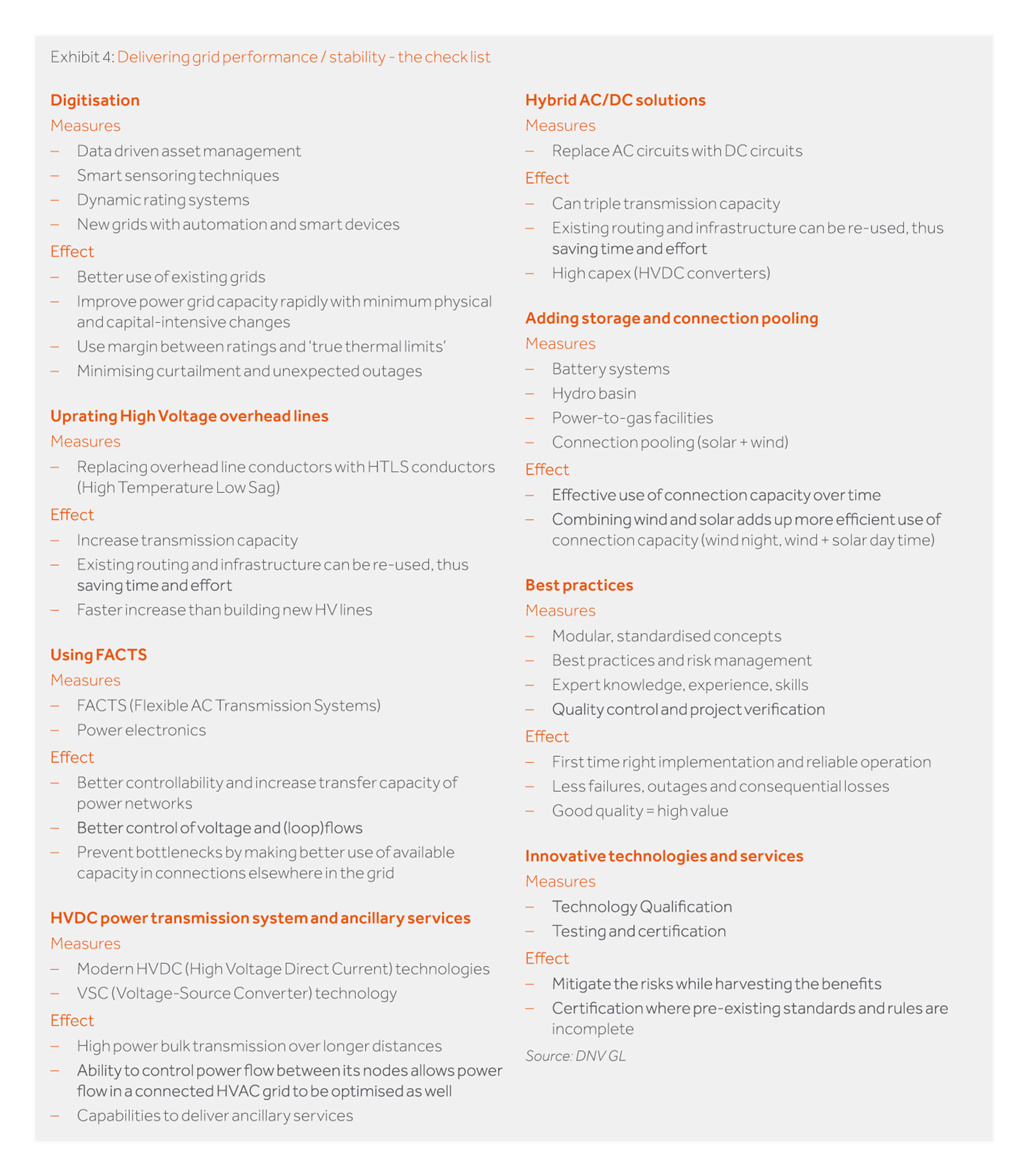

Although LV and MV lines dominate in terms of the length of lines to be invested in, a strong transmission backbone will also be required to satisfy electricity transport, system balancing needs and trading. As utilities/grid operators in the emerging markets consider transmission grid extension, they can evaluate options aside from straightforward grid extensions listed in Exhibit 4 to meet their key objectives.

Exhibit 4 provides a list of measures, based on available technologies or best practices, and potential effects, which can be utilised to improve grid performance and/or stability.

Each country’s grid is unique due to their geographical shape, load centres (industries or population) vs. generation centres, topography among several other factors – hence, the evaluation of the most cost-effective solutions (to meet the objective and challenges) will be key.

Increasing renewable grid penetration: matching intermittent generation and fluctuating demand

Variable renewable energy is expected to deliver over 60% of the global power mix in 2050, from wind and solar PV1 raising the question of grids having sufficient stability to meet demand reliably. Unlike fossil fuels that can be cheaply stored for prolonged periods, the supply of, and demand for, electricity over the grid must always be balanced.

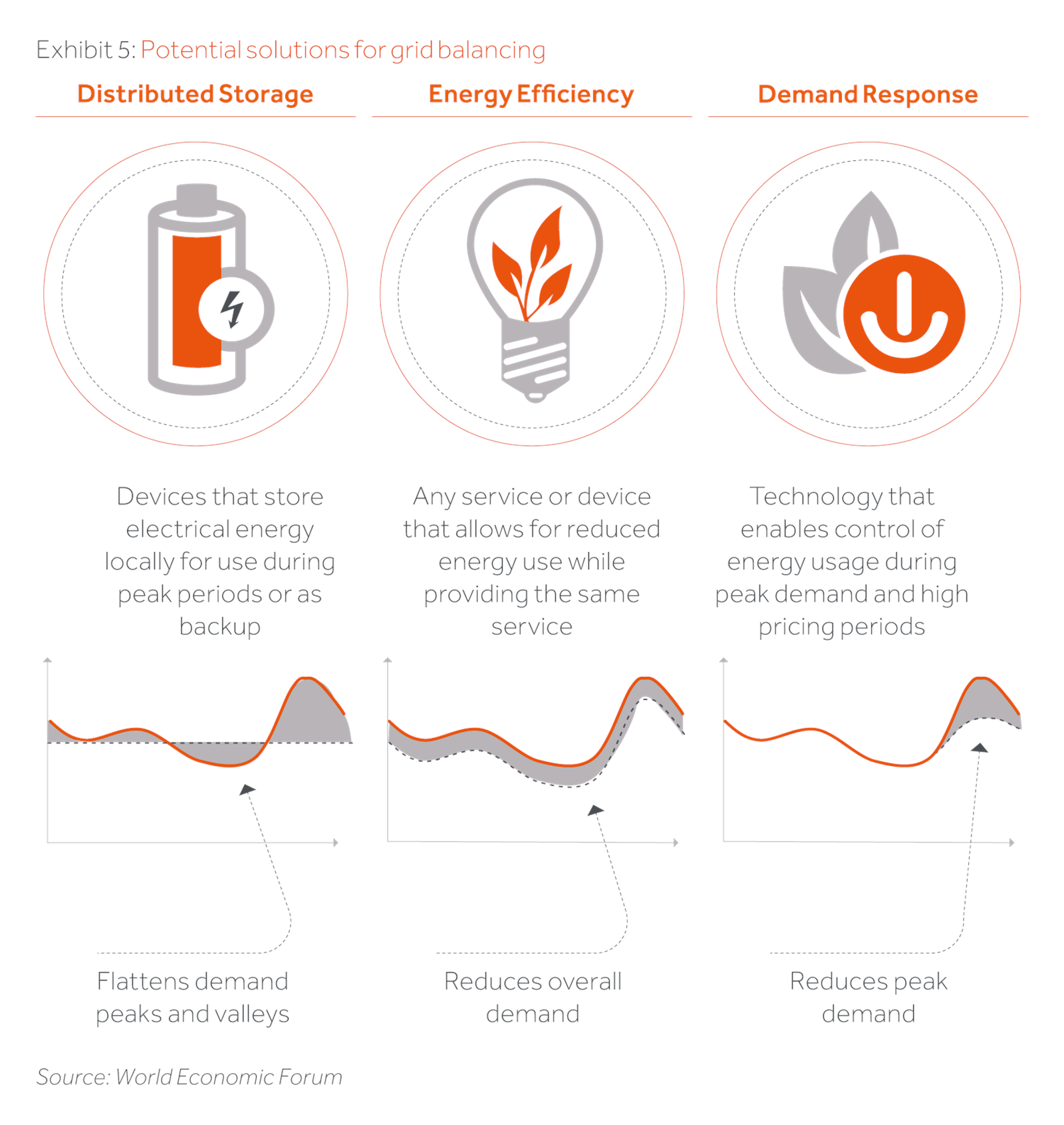

By accurately predicting supply and demand, utilities and grid operators will be more equipped to deal with the intermittent supply of renewable power and can therefore move to a more decentralised system. There are several solutions which could be applied to solve the grid balancing challenges as shown in Exhibit 5.

Distributed storage or utility scale storage: Battery and other storage including hydrogen and electrical vehicle (EV) to grid connection will increasingly be used to allow power generation to be decoupled from demand. Long term duration storage solutions are expected to become commercially available by 2030 with EV charging systems that can be fed into the grid being 10% of all EV storage capacity and able to provide 24/7 grid flexibility2.

Energy efficiency and demand response: Other options to improve grid flexibility include energy efficiency (green buildings and smart systems) and demand side response, enabled by interconnected digital solutions. On the demand response side too, several large industrial customers use price signals to shift their load requirements from periods of high price, tight supply (often leading to voltage reduction or other grid constraints) to periods of cheap, abundant electricity. New technologies (Li-ion batteries) will also assist in this response management. New technologies (such as Li-ion batteries) will also assist in this response management and are expected to undergo deployment due to lower cost and flexibility to install and operate for demand response.

Distribution: reliable energy access for all customers

As emerging markets utilities/grid operators prepare for decarbonisation and pave the way for roof-top solar, electric vehicle charging infrastructure, mini-grids and more distribution networks, the complexity and operational requirements increase in magnitude. To manage those challenges, a range of smart grid and digital technologies and solutions are available to build a resilient and future proof grid infrastructure:

The list in Exhibit 6 is not complete but indicates the range of digital opportunities to support an optimised transmission network.

Framework for a Smart Grid: Emerging markets can get it right first time

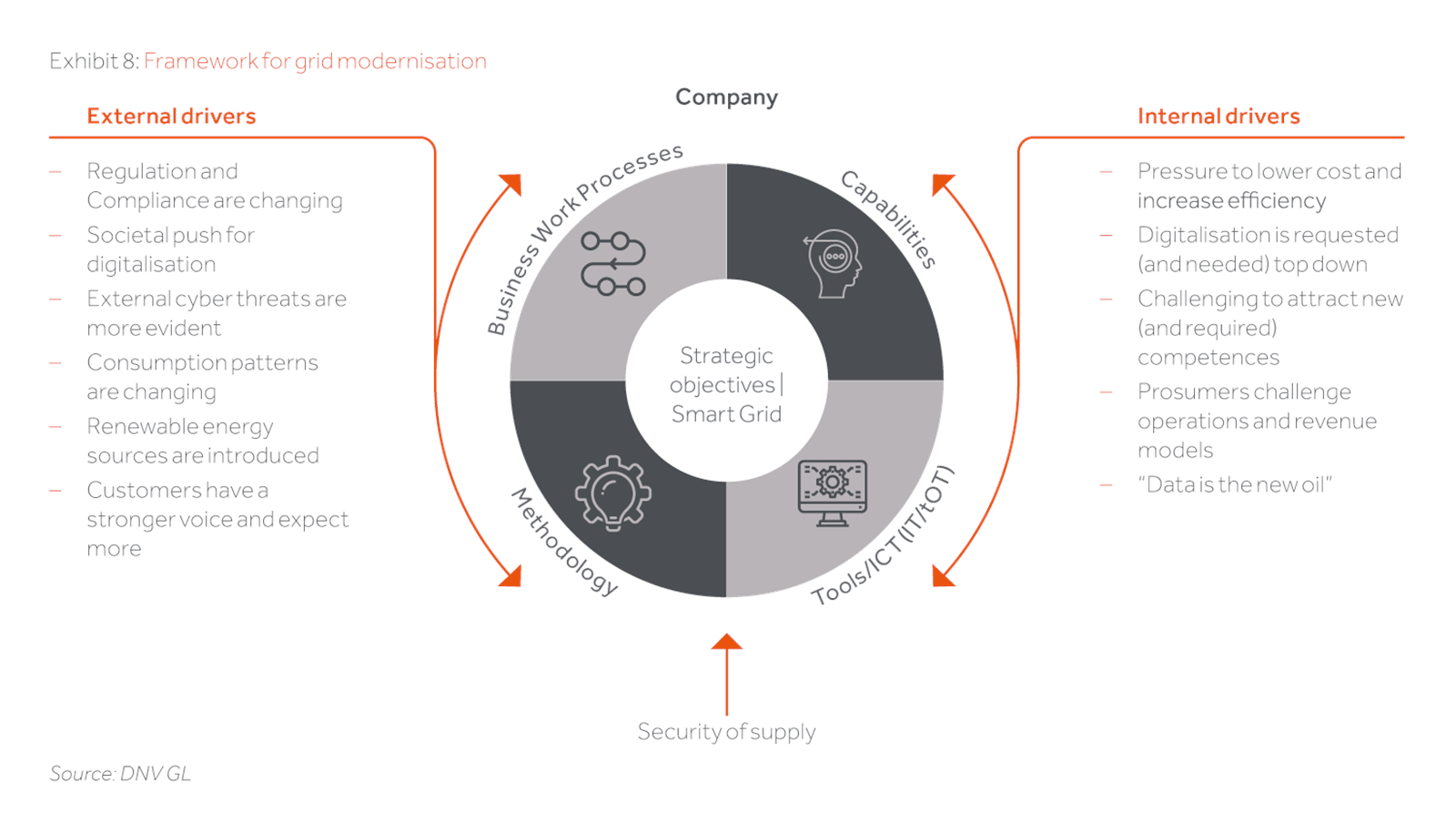

To secure a coherent development of a grid, utilities and grid operators must deploy a framework (see Exhibit 8) to include all the relevant parameters and elements needed to meet objectives, solve current and foreseen challenges, and to make the right technology investments in the grid at the right time. Emerging energy markets can learn from other markets when they embark the journey to implement.

Building a smart and digitised grid means also building a safe one in terms of cybersecurity. IT and IOT systems of the utility must be updated to protect against risk of intrusion and grid control while also protecting data from the consumers.

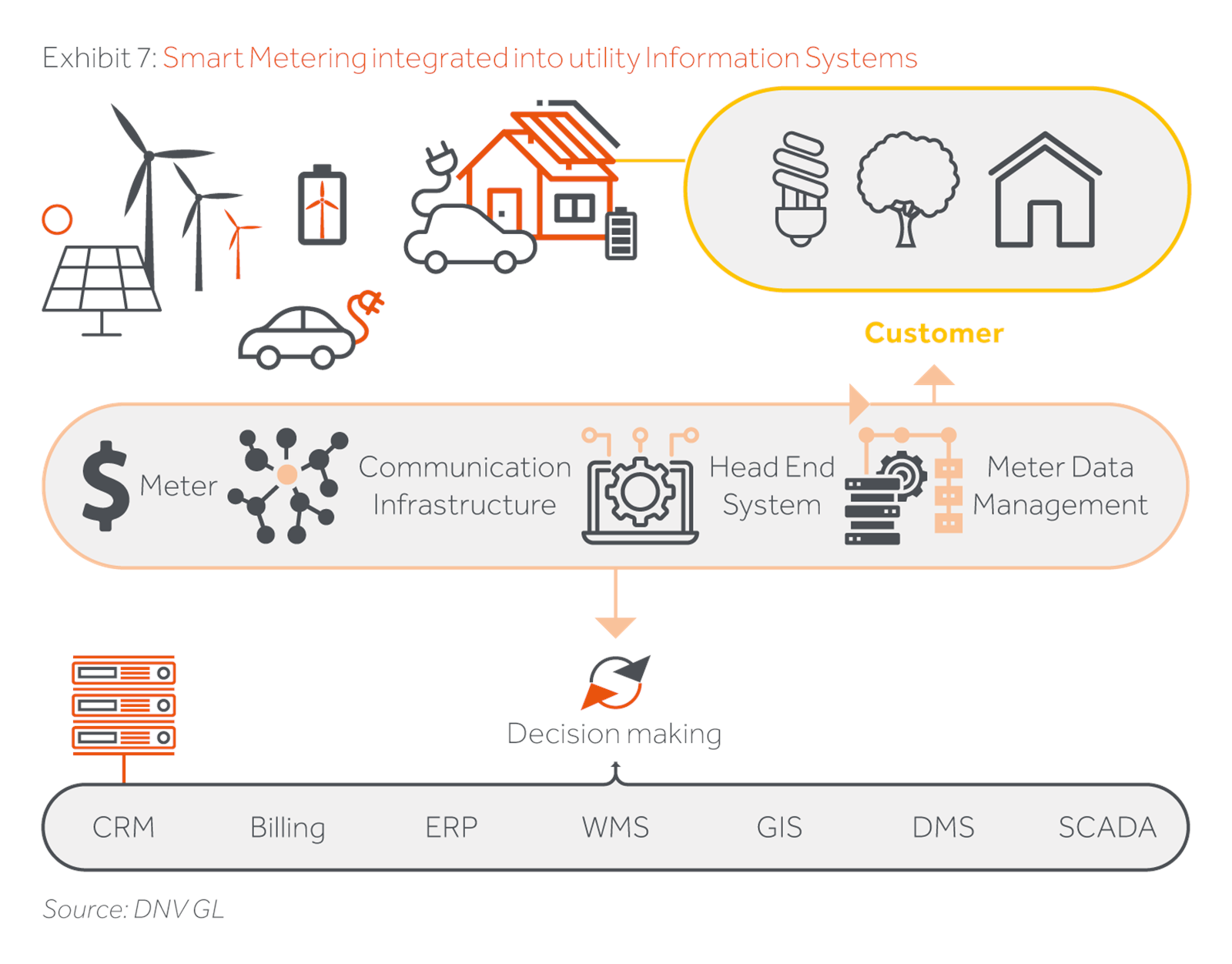

The future winners in the space of transmission and distribution grids will create value from data and digital platforms. Smart Metering, see Exhibit 7, is one example technology that provides data and insight on how to optimise tariffs and grid investments, and in addition reduce non-technical losses or energy thefts. It is also one of the first digital technology investments in emerging energy markets together with centralised SCADA.

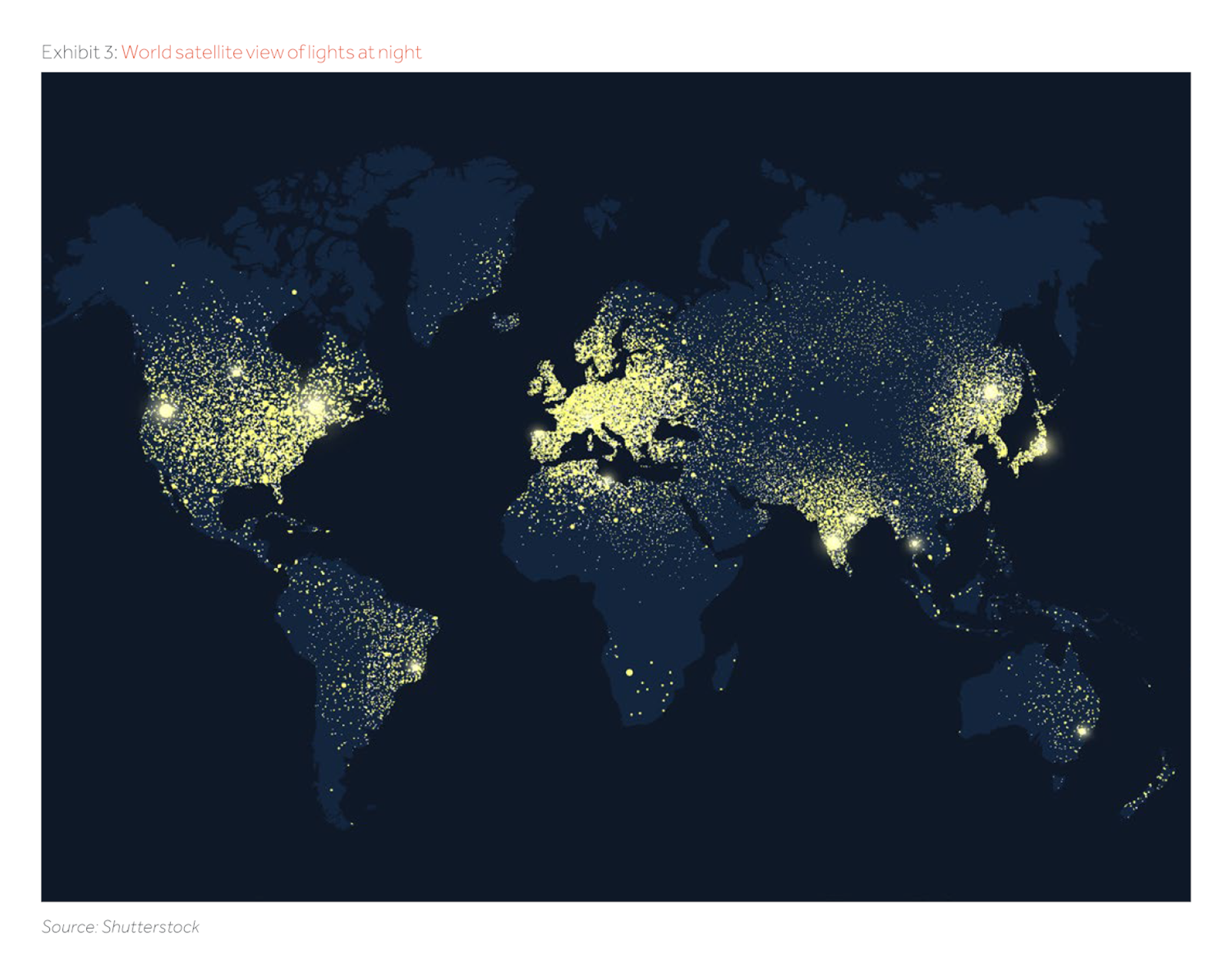

Smart cities and population concentration

As emerging markets urbanisation and electrification grow, individual energy consumption increases alongside rising wealth. As per the United Nations Population Division³, it is expected that roughly two-thirds of the world’s population would be living in cities by 2050. The increased concentration of load centres and consumption would put pressure on the energy grid and support the need for development of smarter cities with digital and smart grids, which would need substantial infrastructure investments.

Grids: a US$20 trillion investment opportunity

Grid investments are primarily driven by greater electricity demand, requirements for new connections for power stations distant from the grid, and the need to reinforce transmission and distribution systems due to expansion of intermittent power generation sources.

As per DNV’s estimate, US$20 trillion will need to be invested over the next 30 years to develop new grids with digital capabilities, from transnational, ultra-high voltage transmission systems to local distribution grids.

Governments and regulators in emerging markets are doing their part by pushing up standards and authorising capex for grid modernisation through the regulatory and policy framework. And the private sector and investors will need to continue playing a key role in proposing feasible and bankable solutions including technical innovations and new business models for realising a smart, reliable and digital grid system to serve future requirements over the next 50 to 100 years.

As an emerging market investor with a track record of investing in, managing and operating national utilities and grids, Actis is well positioned to support the modernisation of grids by identifying the latest technologies and best practices to develop smart grids. For instance, Actis through its investments in Umeme (Uganda), Energuate (Guatemala) and now currently in Eneo (Cameroon) has undertaken several grid modernising initiatives such as deploying smart meters, installing centralised SCADA (Supervisory Control and Data Acquisition), automating grid substations, and digitalising operations and maintenance processes. Actis’ focus on grid modernisation and digitisation will continue to be a key value driver in future grid investments.

1 DNV GL Energy Transition Outlook 2020

2 DNV GL, DNV GL Energy Transition Outlook 2020

3 United Nations, World Urbanization Prospects 2018