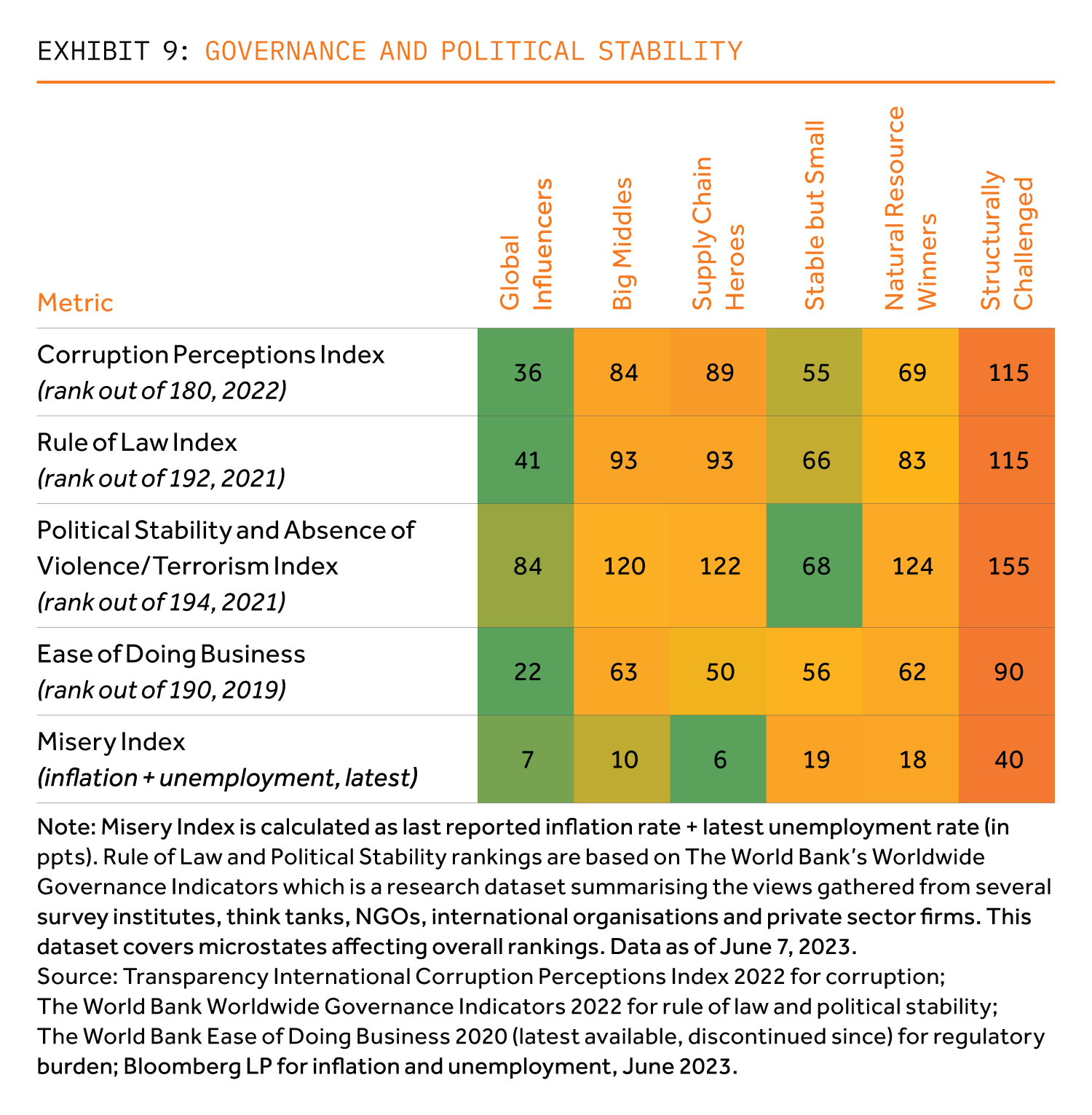

Political risk appears in varying guises including corruption, rule of law, ease of doing business or political instability.

For long horizon investors, rule of law is critical. A predictable and reliable legal system fosters and protects investments. Think property rights or contract enforceability. A reliable and transparent legal system and equal application of law tend to reduce corruption.

There is a plethora of indices measuring these variables (see Exhibit 9). These cover rule of law, corruption, political stability, ease of doing business and misery. The last, devised by economist Arthur Okun, combines inflation and unemployment and can posit social unrest risk levels.

In general, ‘Global Influencers’ score positively in these areas; ‘Stable but Small’ show well, reflecting their European heritage. ‘Structurally Challenged’ score worst of all.

The Misery index seems most indicative. It is currently the highest amongst the ‘Structurally Challenged’ countries, followed by ‘Stable but Small’ and ‘Natural Resource Winners’. This is also perhaps why street protests – so far mostly peaceful – have been the most prominent in EM Europe (‘Stable but Small’), Latin America (‘Natural Resource Winners’) and Africa (‘Structurally Challenged’).

‘Supply Chain Heroes’, ‘Global Influencers’ and ‘Big Middles’ stand out as having relatively low levels of “Misery”. In fact, ‘Big Middles’ and ‘Supply Chain Heroes’ have seen material improvements in this metric since post GFC.