Of all markets, EM foreign exchange is one that can reward an investor with more arbitrage opportunities than most. At Actis, we do not speculate on FX rates, but our returns are heavily influenced by the relative performance of our local currencies to the US dollar, and in consequence, over time we have developed a long term view on FX which we use to inform our decisions around investment, exit timing and hedging alternatives.

In its simplest form, the exchange rate of a currency is determined by the supply and demand for that currency. Demand is from foreigners wanting to buy domestic goods/ services or assets, while supply is from residents wanting to buy foreign goods/ services or assets. The supply and demand for goods and services is accounted for in the ‘current account’ of the balance of payments and the supply and demand for assets in the ‘capital account’.

In the short run, the theory of Uncovered Interest Rate Parity (UIRP) holds that the difference in interest rates between countries should be reflective of the expected appreciation/depreciation of the currency. An investor should be indifferent to holding deposits in different currencies because the movement in the exchange rate would be fully compensated for by the interest rate differential. In the very short run there is some evidence that this holds but practically this is not the case. If this held, there would be no basis for investors to borrow in a low interest country to purchase instruments in a higher interest country, also known as the ‘carry trade’ (the emerging market carry trade is estimated to be worth at least US$2 trillion).

The theory of Covered Interest Rate Parity (CIRP) extends using the Forward Rate. This theory states that the difference in interest rates between two countries is equal to the expected depreciation/appreciation as measured by the forward curve. Under the assumptions of capital mobility and perfect substitutability of domestic and foreign assets, this is a no-arbitrage condition, representing an ‘equilibrium’ state. Economists have found evidence that this holds in most instances. So then is the forward curve a good predictor of exchange rate movements?

The existence of ‘covered interest arbitrage’ as a trading strategy shows CIRP does not hold all the time either. The global financial crisis laid bare how it can also breakdown completely. Counterparty risks, political risks, transaction costs and tax implications can all lead to divergence. These can be more acute in the emerging market context.

In the long run, economic theories of exchange rate determination move from the capital account to emphasize the ‘real economy’ and the current account mechanism instead. Economic theory suggests that with perfect markets and where there are no transportation costs or differential taxes, identical goods should sell for the same price in two separate markets. If they didn’t there would be an arbitrage opportunity by buying in the cheaper market and selling in the more expensive market, hence equalizing prices. This is known as the ‘Law of one Price’.

From this principal derives the ‘Theory of Absolute Purchasing Power Parity’ (APPP) which holds that the exchange rate should equal the difference in the price levels between the respective countries. The implication is that if a good costs less in one country than in another, when taking into account the exchange rate, then one would expect the currency where the good is cheaper to appreciate relative to the other currency. In the aggregate, this principal holds relatively well between developed markets but doesn’t work well for growth markets, most of which have persistently lower prices.

The reason for this is partly because markets are not perfect, there are information costs, trade barriers, tax distortions and transportation costs. What is more significant is that many goods and services are not sensibly tradable, and so not subject to arbitrage. The proportion of tradable versus non-tradable goods evolves slowly and in an evolutionary fashion. The implication is that the real exchange rate (RER) can be different from parity, but should be fairly constant over time.

The RER is not constant. A reason for this is because of differences in productivity impacted through non-tradable goods. The effect of productivity on the RER is known as the ‘Balassa-Samuelson effect’. Basically, if wages are determined by productivity and productivity in an economy increases allowing workers to move between working in tradable and non-tradable sectors, then an increase in productivity should result in an increase in the overall price level or an appreciation of the RER (or both). Therefore, all other things being equal, if a country is ‘catching up’ with increasing productivity relative to another, its RER would likely increase over time relative to the other.

So what does this all mean? Well, it means developing a view on ‘fundamental value’ for exchange rates, independent of the forward curve or other oscillations opens up a ‘pricing’ opportunity for medium and long term capital. If in the long run, exchange rates revert to the inflation rate differentials between countries adjusted for productivity differentials, while the market is primarily driven by short term interest rates and other factors (from commodity prices to the weather) there is a mispricing of exchange rates.

In the midst of the storm that hit emerging market currencies over the last couple of years, it was easy to believe emerging market currencies were following some inexorable depreciating path, or at best a ‘random walk’. Those who held fast to a conviction in fundamental value and reflected on the long run, would be reminded of Keynes’ observation that ‘in the long run, we are all dead’.

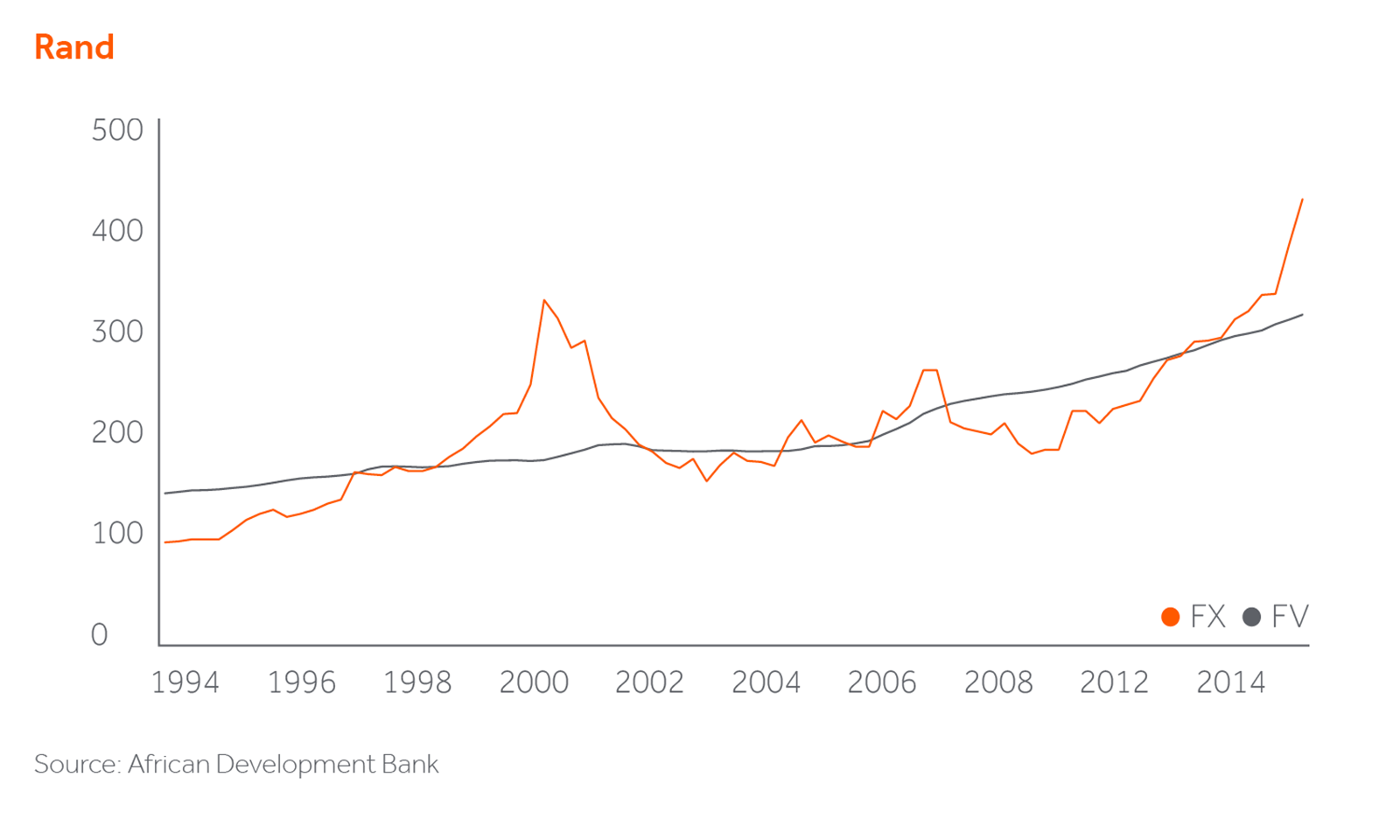

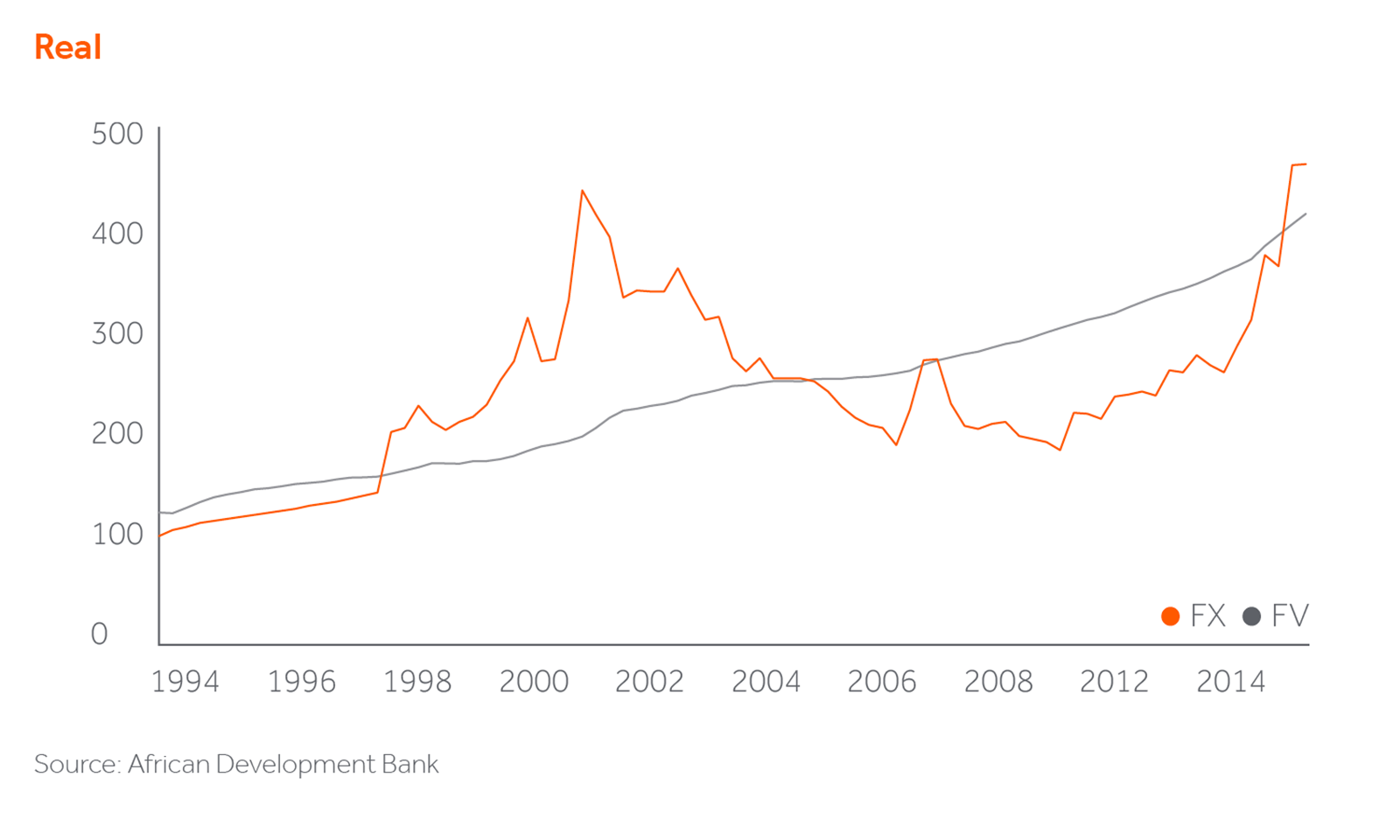

With our sense of history and with the perspective that comes from being a long term investor, we took a step back to look forward. We looked to compute fundamental value across our currencies in order to determine how ‘’long’’ the long run is. A good place to start with such an analysis is the Rand and the Real, the two most volatile currencies. We invest in both.

An important observation is that the FV line is not a ‘mean reversion line’. Whilst such a tool cannot be used to accurately predict where the currency will move in the short run, it can help infer it in the long run…and the long run is within a private equity time horizon. Both currencies cross the FV line several times over a 20 year period.

The analysis shows clearly that from 2009- 2013 both currencies were overvalued relative to the dollar, however, the sharp depreciation over 2014 means that both became undervalued (with the recent appreciation in the Real bringing it back to fair value).

In practical terms, looking at exchange rates through the lens of fundamental value means we are able to make more informed investment decisions both on entry and exit. In early 2016, we formally rolled out the FV Model and as such, investment decisions at Actis are made with reference to where currencies are against their fundamental value. This provides a valuable anchor in short term storms, and a clearer horizon with which to navigate the portfolio in the interest of our investors and to deliver the best absolute US$ returns we can.