Actis’ approach to real estate investment centres on developing and repositioning assets that enable the new economy. For Actis, the “new economy” refers to segments of the economy where growth is driven by several global themes: digitalisation – innovation and the adoption of new technology, climate transition and the need to decarbonise the built environment, supply chain transformation driven by diversifying manufacturing locations and changing consumer preferences, and the increased importance of health and wellbeing arising from growing middle classes, ageing populations and longer life expectancy.

Thematic Opportunity

These global themes are well documented and are common to markets around the world, both developed and developing. However, what is unique about the markets where Actis is focused – notably in Asia

– is that these themes are more strongly underpinned by a series of secular trends.

Actis has identified four secular trends in particular – which we refer to as “the four Ds”:

DEMOGRAPHIC SHIFTS

Urbanisation, middle class growth and, more importantly, the densification of wealth in cities.

DIGITAL DISRUPTION

Both the positive and negative impacts of digitalisation on the use of and need for real estate.

DEFICIENT SUPPLY

Shortage of stock, obsolescence of stock and/or a mismatch between end users’ needs and affordability.

DEMAND FOR YIELD

From institutional investors, increasingly domestic ones, who are seeking stable, long-term cash flows from real estate assets.

Collectively, these regional secular trends are accentuating the global themes in our markets. This provides investment opportunities within new economy real estate that are more robust, more resilient and more scalable in much of Asia.

The intersection of these global themes and regional secular trends directs our focus to four main property sectors: logistics and industrial, new generation offices (tailored towards affordability and the high sustainability criteria which are attractive to new economy tenants), Lifesciences, and data centres.

How this works in practice is best demonstrated through opportunities where we are currently investing. One example is data centres where, globally, demand is being driven by digitalisation, innovation and the adoption of new technology. In Asia, this demand is further enhanced by all four of the secular demand trends. Demographic shifts and digital disruption in the region are leading to a surge in mobile connectivity, with digital content and enterprises moving to the cloud. There is a significant shortage of supply – there are simply not enough data centres of the necessary scale, specification and sustainability requirements to meet this increased demand. As a result, the data centres we build are able to generate the resilient and long-term income desired by institutional investors.

Another example is our Lifesciences platform in India which is supported by three of the global themes: digitalisation and the increased importance on health and wellbeing are driving the end user demand for facillities and supply chain transformation means India can harness offshoring and outsourcing of Lifescience operations from other countries. Several of the secular trends further enhance these themes – most significantly deficient supply and demand for yield. At present, there are insufficient facilities for Lifesciences operations to expand within India. The sector has traditionally been owner- occupied, but the growth prospects are now making this both inefficient and unviable. Once developed, the long-term income these facilities can generate is attractive to yield-seeking institutional investors.

Building Sustainably

Our commitment to sustainability is embedded in every investment we make – whether it be data centres in Korea, Lifesciences in India, or any of our new economy real estate investments globally. At Actis, sustainability is not a check-the-box exercise, but is grounded in the fundamental belief that real estate must be sustainable to attract demand and generate income over the long term and thereby maximise and maintain its value. As our corporate strapline holds: ‘Values Drive Value’.

At the outset of any investment opportunity, we conduct a comprehensive sustainability review to determine what initiatives are necessary to achieve market requirements, end-user requirements and Actis’ own ambitions. This review considers both short and long term implications of each of the proposed initiatives, including the extent to which an initiative is permitted in a market and/or requires us to push new boundaries with local regulators and/or contractors. For example, in Korea, our experience has taught us that deploying more meaningful /renewable power, novel solar facades or the use of green concrete will require further education of both the building regulators and contractors. In India, we already have the ability to wheel power through the grid as the key to delivering clean energy to urban developments. This provides the opportunity to deliver Net Zero aligned developments and we anticipate that other regulators and utilities will follow suit across our markets. The variability in pace and approach to sustainability across our markets places a premium on deep local market expertise.

There are simply not enough data centres of the necessary scale, specification and sustainability requirements to meet increased demand. As a result, the data centres we build on time and within budget- are able to generate the resilient and long- term income desired by institutional investors.

We target a green building rating for all our developments. We also look for ways to reduce, to the greatest extent we can, the embedded carbon in the building process. We closely examine the design of our projects, material selection, and material procurement, using local suppliers where possible. We also assess the extent to which each of our assets supports the global drive to Net Zero carbon emissions, through designing for the reduction of power usage, operating in accordance with such design, and, where possible, using renewable energy. Actis’ Energy team’s deep experience in renewable power development is a great benefit as in-house advisors to our Real Estate team. We take great care to examine the long- term resilience of a location and an asset; a building cannot be truly sustainable if it is not resilient over a long period of time. In addition, when building an operating platform we systemitise our sustainability initiatives, we establish international standards of practice around health and safety, we focus on inclusion, diversity and robust governance. As a way of giving back to the communities in which we operate, we also strive to implement skills training programmes related to either the construction or operation of our assets.

Risk and Rewards

As the old adage goes, investing is not without risk. Currently, the key risks we face are supply/demand mismatch for the products we build, protracted development timeframes, cost inflation and geopolitics. Interestingly, these risks have not changed materially pre/post COVID-19, although clearly there is greater influence of geopolitics and inflation is more prevalent.

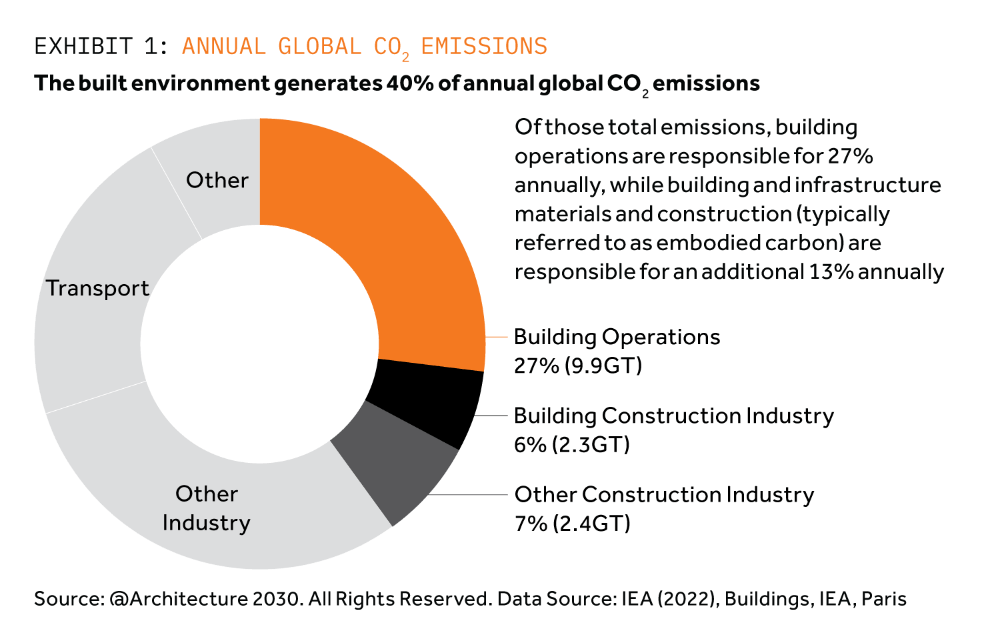

The need for a more sustainable built environment is not going away. achieving a net zero world is impossible without positive contributions from real estate, which is responsible for c.40% of global carbon emissions.

For years, we have evaluated each investment opportunity through four lenses – market, product, operating partner/management team, and structure. Our experience has proven that the best way to manage risk through the cycle is a near pedantic prioritisation of the first three. Getting structure right is important but it will never compensate for a weak market, inappropriate product or misaligned operating partner – and Western markets are currently demonstrating the impact that an over-reliance on higher leverage can have on investment outcomes. More specifically, we manage the risk of supply/demand imbalance through a deep understanding of end user requirements, affordability and micro-market analysis. Development timeframes are best controlled through years of in-market experience and operating partner strength. Cost inflation is best managed through intense value engineering and a focus on local procurement. Finally, geopolitics – representing both a risk and an opportunity depending on the market, are best managed through targeting both local end user and exit demand.

The variability in pace and approach to sustainability across our markets places a premium on deep local market expertise.

Actis’ focus on the fastest growing markets of the world and ability to manage the risks therein, coupled with our approach to sustainability as a value driver, is a key reason investors look to us to generate returns. The combination of our in-house expertise and the know-how of our local partnerships with strategic partners around the world is fundamental when it comes to driving returns. The ability to execute locally with best-in-class teams is key to being able to pursue a thematic and secular demand-based approach to investment on the ground. Our builder-operator mindset is a further differentiator as the world moves away from a real estate investment environment driven by the low cost of debt to one in which the fundamentals of an asset’s value become the most critical driver of returns.

We believe our approach to investing in sustainable, new economy real estate is well-positioned to take advantage of future opportunities in our target markets. The global themes and regional secular demand trends that are at the core of our strategy are deep, broad and long term. The need for a more sustainable built environment is not going away. Achieving a Net Zero world is impossible without positive contributions from real estate, which from most estimates is responsible for c.40% of global carbon emissions.

The opportunity in our target markets, particularly Asia, remains robust.

Many real estate markets in Asia have demonstrated their resilience during COVID-19 and we anticipate greater regional stabilisation as a result of China’s recent decision to lift its COVID-19 restrictions and reopen its economy to the world. In comparison to more developed real estate markets currently experiencing significant structural disruptions, painful deleveraging and potential recession, Asia’s major real estate markets are in markedly more favourable positions, poised for increased stability and the resumption of growth.