Currency plays a central role in global investing. Major trends over time influence portfolio outcomes both in terms of actual currency values and from the information embedded in local asset pricing.

Currencies are like commodities – their prices reflect the laws of supply and demand. A currency is the price of the financial liquidity in the country of origin given that it is only Central Banks can issue fiat currencies.

Nowhere is this truer than emerging markets. Hedging back to base currency is usually expensive or impractical. Emerging Market local currency bonds for instance are almost exclusively a bet on the local currency. Equities offer some diversification through the activities of the underlying companies but still reflect local currency conditions and liquidity.

Over time currencies trend. This reflects their attractiveness or otherwise as a source of value. Local investors hold domestic currency as a source of value and sell it when they lose confidence in the real purchasing power of their rupiah or lira or pesos.

Foreign investors will make assessments based on the strength of the domestic financial system or their own intrinsic risk appetite. Such appetite waxes and wanes with global conditions. Thus, in a crisis, they sell more fringe foreign currency exposure and retreat towards “safer’ currencies. If the domestic investor in the country is unwilling to buy the local currency then values decline, financial conditions tighten and asset prices fall.

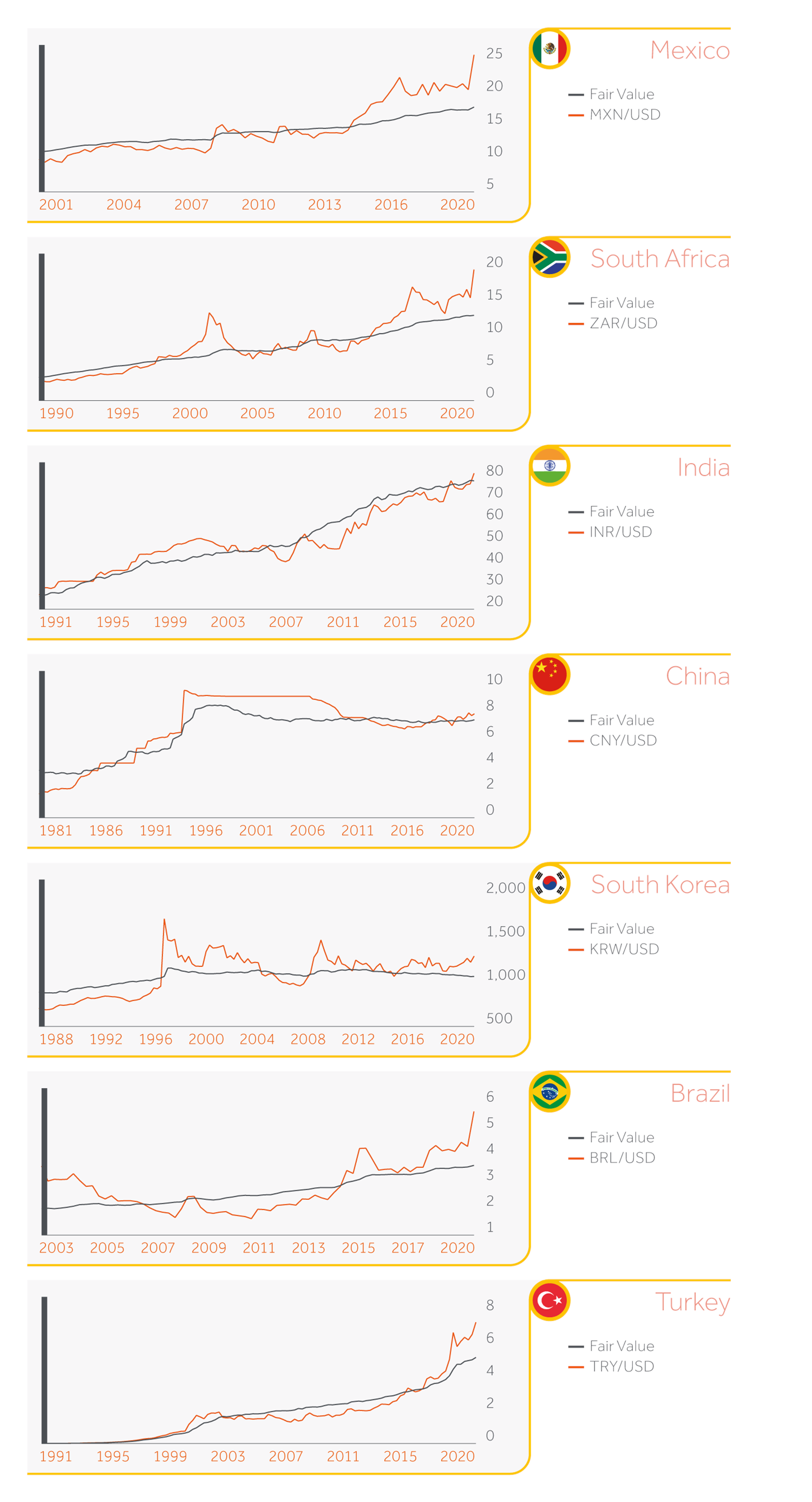

As a long-term investor, Actis has always acknowledged that currency trends can influence returns and the price and attractiveness of assets. The Actis ‘Fair Value’ currency model is designed to look at currency relative to the US dollar through the prism of relative terms of trade, inflation and productivity.

COVID-19 has led to sharp sell offs in floating Emerging Market currencies and consequential tighter liquidity. (As an aside this also works for fixed pegs where capital outflow is met by matched Central Bank intervention).

The enclosed graphs for major Emerging Market currencies point to a marked divergence between commodity exporters and importers. They also suggest that Emerging Market currencies have become undervalued in many cases (when the black line for fair value is significantly lower than the red line spot currency).

This model is not designed as a short term trading model. Values can overshoot for long periods of time. Often the model shows no obvious signal.

Acute weakness may lead to a loss of confidence in the currency by local investors meaning there is no obvious buyer (Turks and Argentines can identify with this today as did Zimbabweans and Venezuelans previously). But if the currency retains attraction for local investors and overshoots in the eyes of foreign investors, then the model suggests mean reversion can occur. This is where outsize gains can arise.

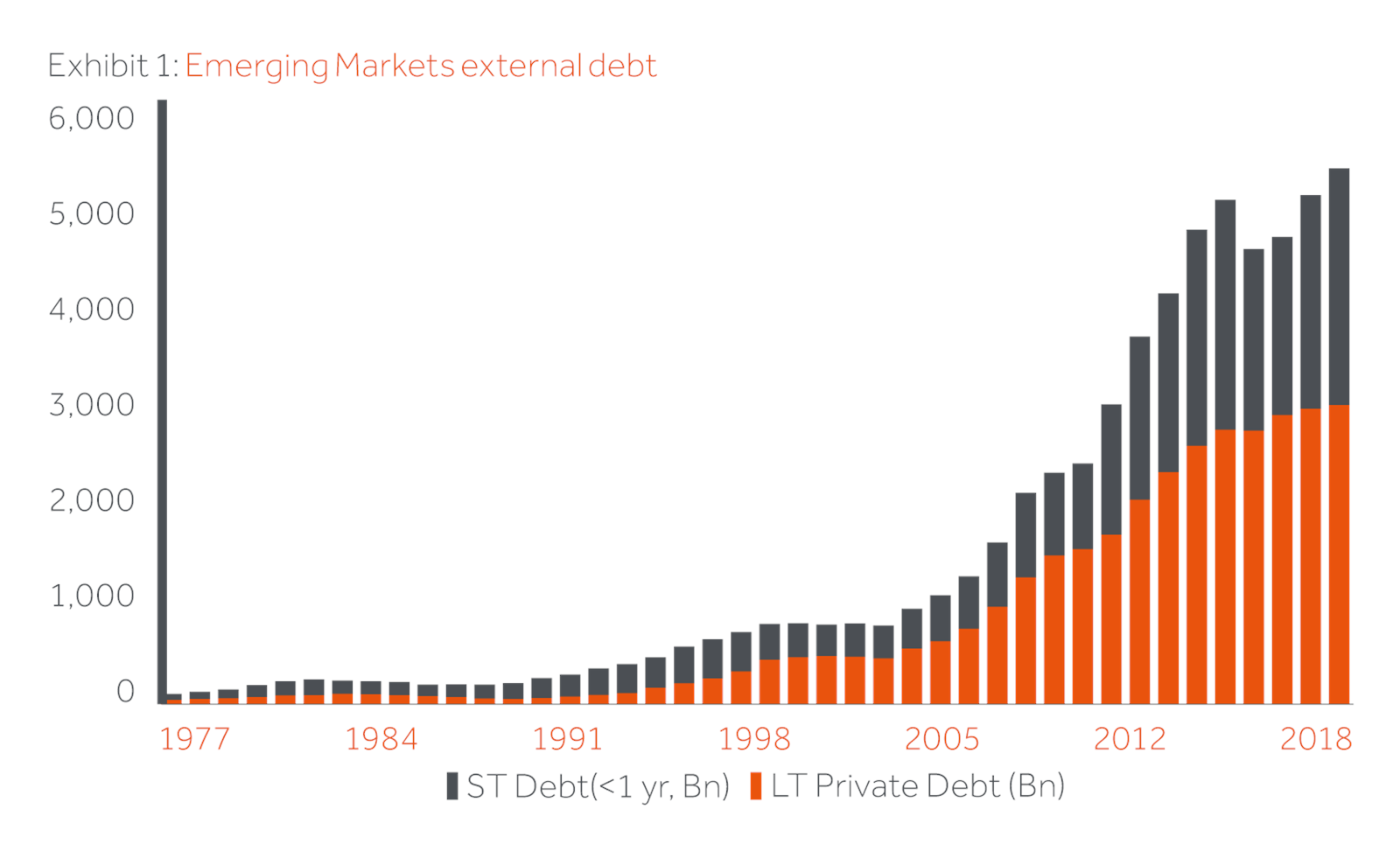

Emerging Markets external financing landscape

FX line above Fair Value line indicates currency is undervalued relative to Fair Value