COVID-19 has had an overwhelming impact on consumer habits in Nigeria. Low consumer confidence has led to reduced non-discretionary spending.

Admittedly, with over 89 million people living on less than $2 per day pre–pandemic, such spending was limited to a subset of the population. The misery index has grown from lockdown disruptions disproportionately affecting the informal sector, rising unemployment and lower wages, as businesses cut costs to stay afloat and rising inflation-last measured at over 18%.

Another important shift is that basic needs now include communication costs for voice and data, essential for remote working, e-commerce, online schooling and maintaining social connections. Anecdotally, one of the large telecom operators, MTN Nigeria grew data revenue by 52% while voice revenue grew only 6% in 2020.

The biggest change from the pandemic has been the inability to gather for social events due to social distancing rules, which for most of the year restricted the number of attendees at indoor events to between 30 – 50. A far cry from the size of typical events that range from hundreds to thousands of guests, reflecting extended family and community based socialising.

With these restrictions, events, including religious services are now broadcast on-line using Zoom and YouTube Live. Most entertainment businesses have reopened, adopting increased outdoor seating where feasible. Cinemas and night clubs were restricted for the longest period but have now also reopened – albeit at 50% capacity and with restricted operations after midnight. The informal sector was less restricted as it mainly operates outdoors.

The lockdown has generated more activism and increased distrust of Government. Recent protests on police brutality reflect increased activism particularly among the young.

We have seen some trends in terms of digital acceleration

Education: Private K12 schools and tertiary institutions have adopted remote learning to provide continuity during the lockdowns. Unfortunately, publicly funded schools did not have the resources to introduce e-learning and data costs would have been too steep for low income families.

Shopping: The key enablers of online retail have strengthened significantly in the past year. These include mobile banking solutions, digital payment solutions and delivery services. The leading payment switch, NIBBS, recorded 98% growth in transaction values in Q1 2021 over Q1 2020. Given the improved infrastructure for online retail, businesses now actively adopt online sales channels.

Entertainment: Subscriptions to local pay TV and international pay TV businesses have increased, particularly for local content on Netflix and Showmax.

Communication: Zoom and Teams moved from being used predominantly for business interactions to mainstream and a mainstay for all types of business and social interactions.

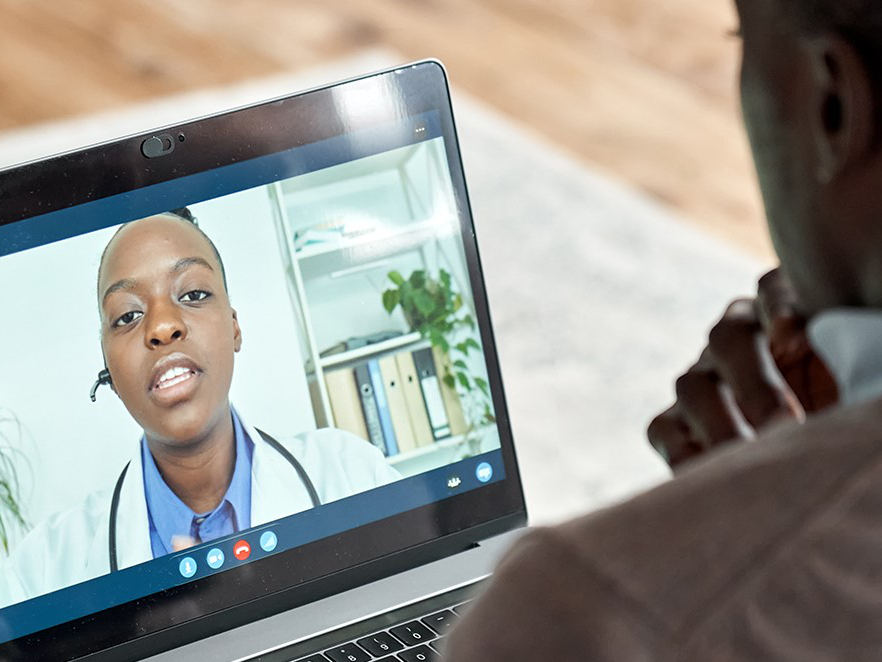

Health and wellbeing: Tele-medicine has emerged as a way of engaging with patients for first line interactions and to monitor the progress of mild cases of COVID-19 remotely.