LatAm

Nicolas Escallon: “The dramatic Andean topography sets the scene for Colombia, Peru and Chile’s bountiful endowment of mineral products. These massive rock formations make Chile the world’s leading copper producer, Peru a major copper player (second behind Chile) and gold miner, and Colombia a significant crude and coal exporter. This handful of products account for c. 50% of the three economies’ exports.

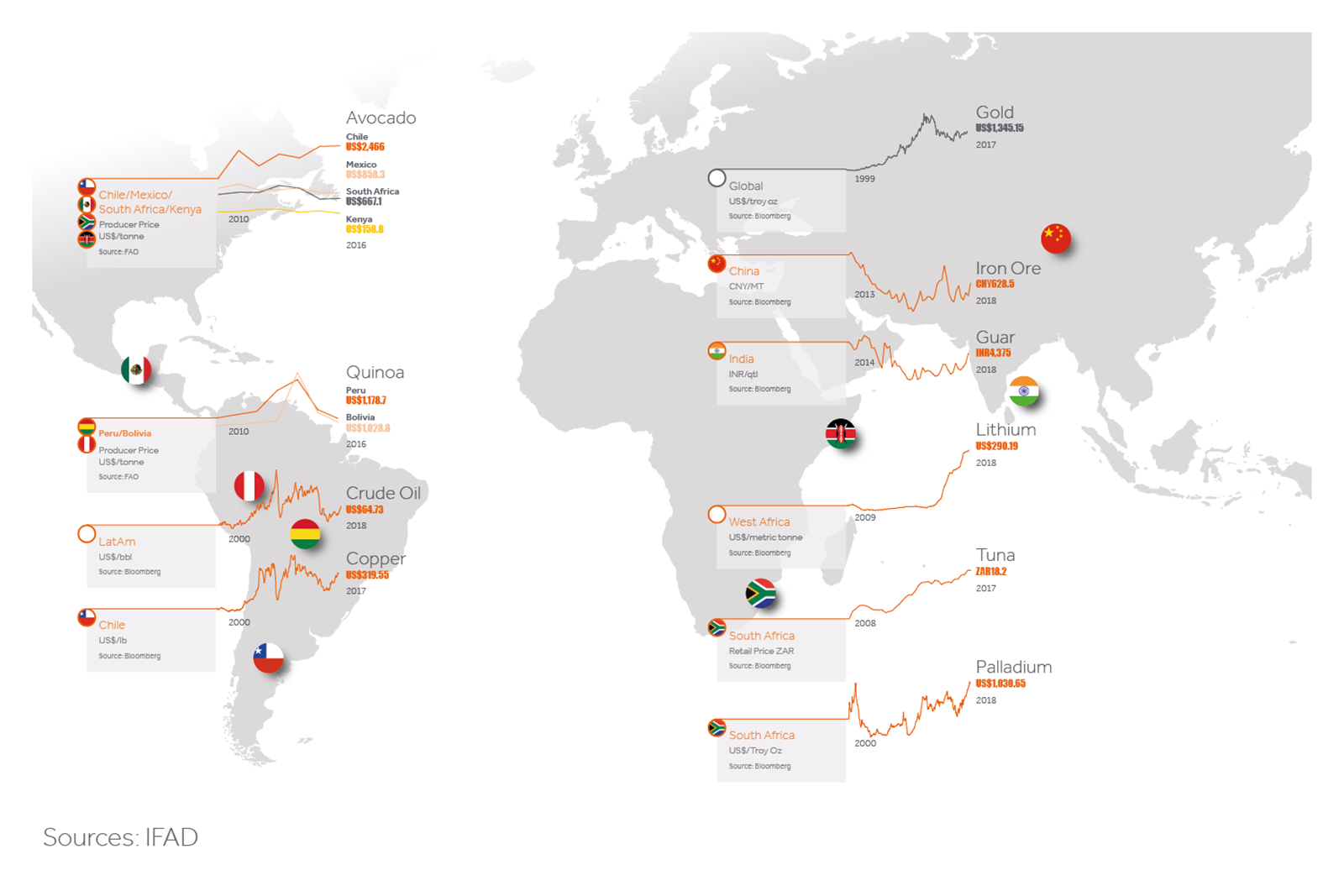

Favourable global credit cycle conditions, demographics, institutional reforms and the commodity boom in the first decade of the 2000’s acted in synchronicity to create one of the most prodigal growth periods for the Andean economies in history. However the opposite side of the blade was revealed during the 2009 and 2015 commodity market corrections, sending shockwaves through these market’s economies, affecting growth, terms of trade and generating fiscal pressure.

Having now lived through several of these cycles, and benefiting from an orthodox policy orientation, these countries managed to create effective policies to manage commodity export revenue management, fiscal stabilization and export diversification, allowing them to channel commodity rents towards needed infrastructure investment and fiscal consolidation. They will continue to be affected by commodity boom-bust cycles (some more than others), but have gone a long way towards creating institutional frameworks that allow them to benefit from their endowments while ameliorating the impact of unavoidable commodity price volatility.”

Nigeria

Funke Okubadejo: “Oil dominates the economy, though only 10% of GDP, it accounts for over 90% of forex earnings and 70% of government revenues. The vulnerability of the economy to oil prices is evident as the economy contracted for five consecutive quarters to Q1 2017 before rebounding from the oil price recovery. Admittedly, the incidence of oil shut ins in this period from activities of militants in the Niger Delta was also a factor.

As expected, diversification away from oil is a key priority for the government with a number of ambitious programs to promote non-oil exports including export grants. Non-oil exports were up 55% to $1.26bln in 9Months to September 2017, though off a very low base. Key non-oil exports include cocoa, rubber, cashew nuts, sesame seeds.

Being an import dependent economy, Nigeria is also vulnerable to imported inflation from an increase in prices of key commodities such as wheat, sugar, rice as well as, ironically, petroleum products. “