Established in 2015, United Nations’ Sustainable Development Goal 7 (“SDG7”) – to ensure access to affordable, reliable, sustainable and modern energy for all by 2030 – signals a recognition of the importance of access to energy services and of the centrality of energy in achieving many of the other development goals.

In previous editions, we have discussed how increased access enables higher value-add economic activities to advance. However, despite some good progress, there remain 1 billion people globally without access to electricity, 590 million of which are in Africa.

Development in technology and declines in cost of solar panels and lithium-ion batteries are unlocking alternative electrification options, including distributed generation and off-grid solar.

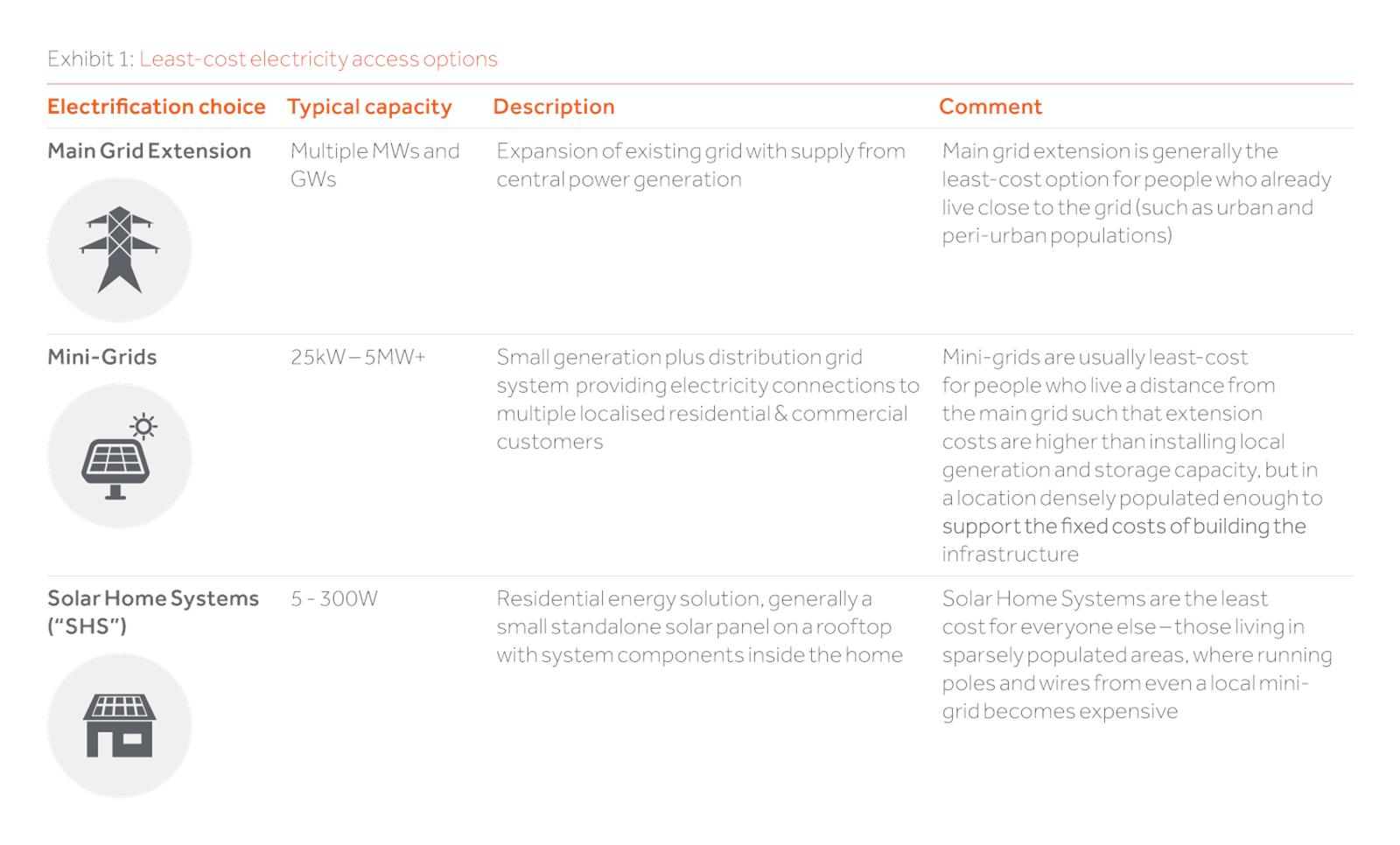

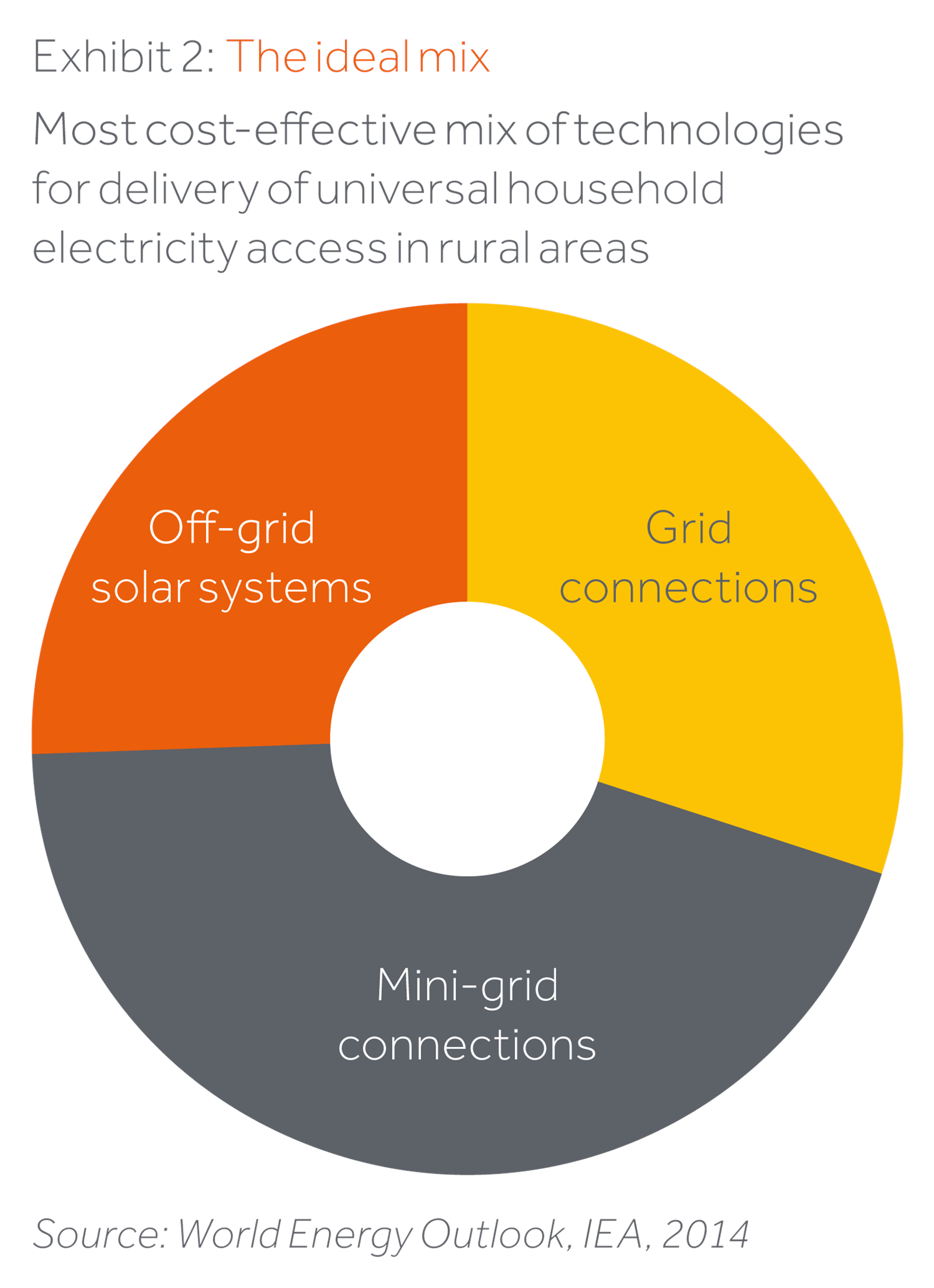

Off-grid solar is the most cost-effective solution for a significant proportion of people lacking electricity access

For the 1 billion people without electricity at a global level, 30% of new electricity access is expected to come from traditional grid extensions, with the remaining 70% coming from off-grid decentralised systems, particularly solar home systems (SHS) and mini-grids.

This is the cheapest way to provide power to these people, driven by a combination of factors, primarily distance from the existing grid, population density and intensity of energy demand.

The Solar Home Systems market today, and the financial services industry emerging behind it

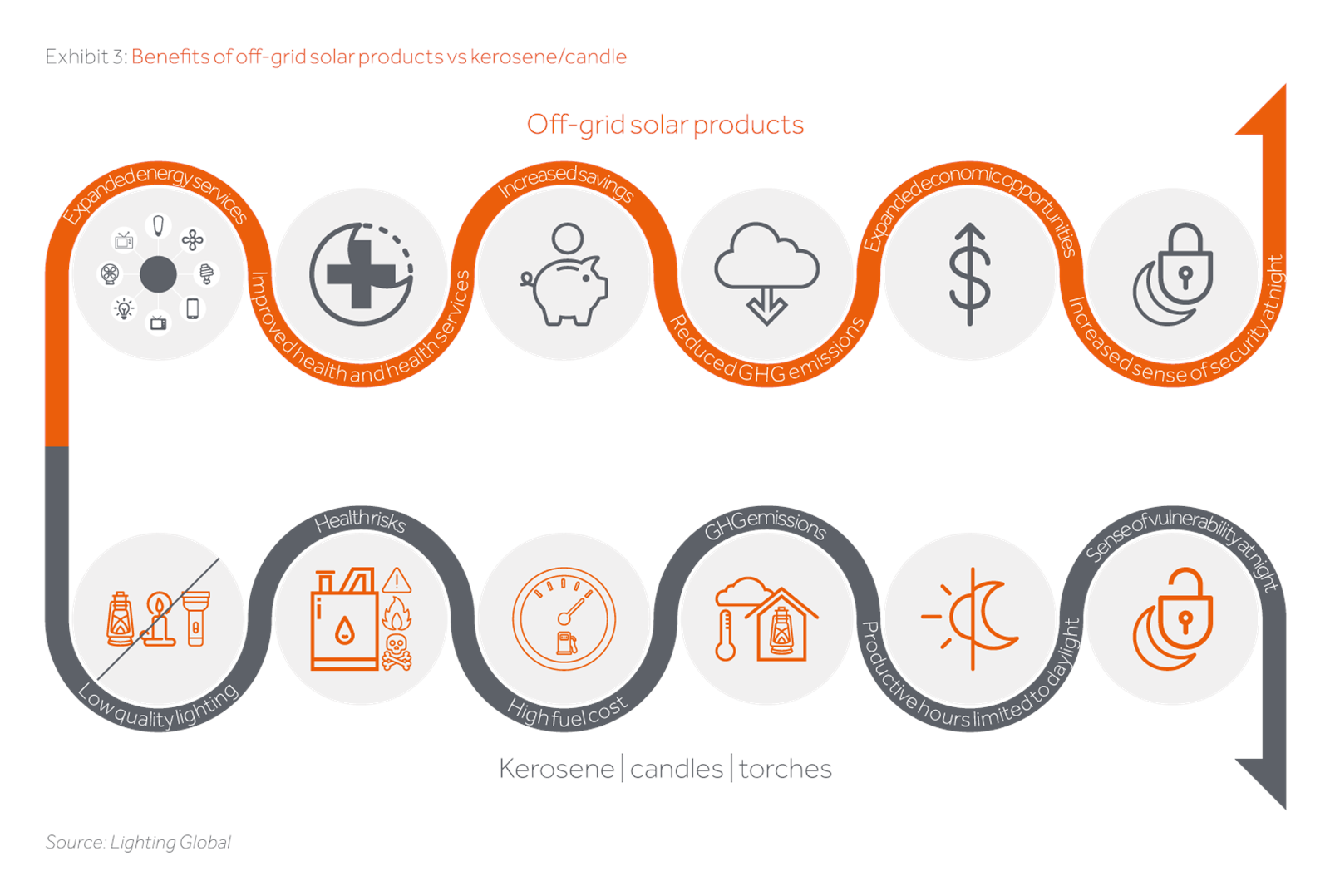

Collectively the 1 billion people off-grid are spending US$27 billion each year on basic lighting and other energy services from traditional energy sources (kerosene, candles, battery torches, other biomass and fossil fuels).

Off-grid solar products are not only cheaper than these conventional solutions; they are also safer, cleaner, and more reliable. Importantly, this means off-grid solar products substitute existing customer spend into unsatisfactory products for the provision of a necessary service, they are not nice-to-have.

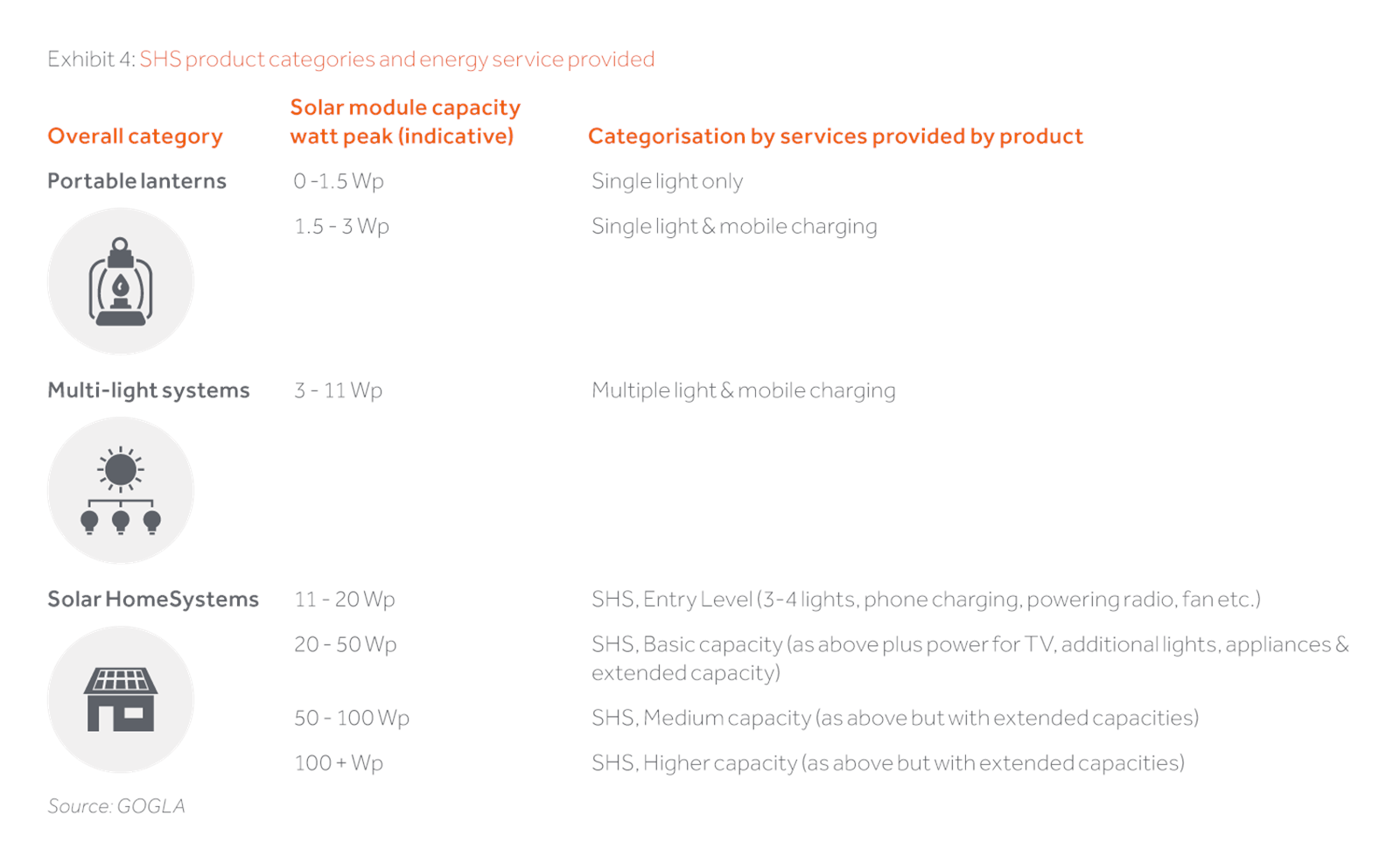

The early off-grid market has been dominated by small “pico” solar lanterns to provide basic lighting, led initially by government support and innovative charities like SolarAid.

Today larger solar lights and plug-and-play solar home system products are in high demand. These products can not only provide lighting but also power for phone charging, radios, televisions, fans, refrigeration and a variety of other services from highly efficient appliances designed specifically for off-grid.

Solar lights and home systems are now readily available in many hard to reach regions of Africa and Asia, more than 150 million off-grid solar devices have been distributed to customers, providing electricity access to more than 400 million people.

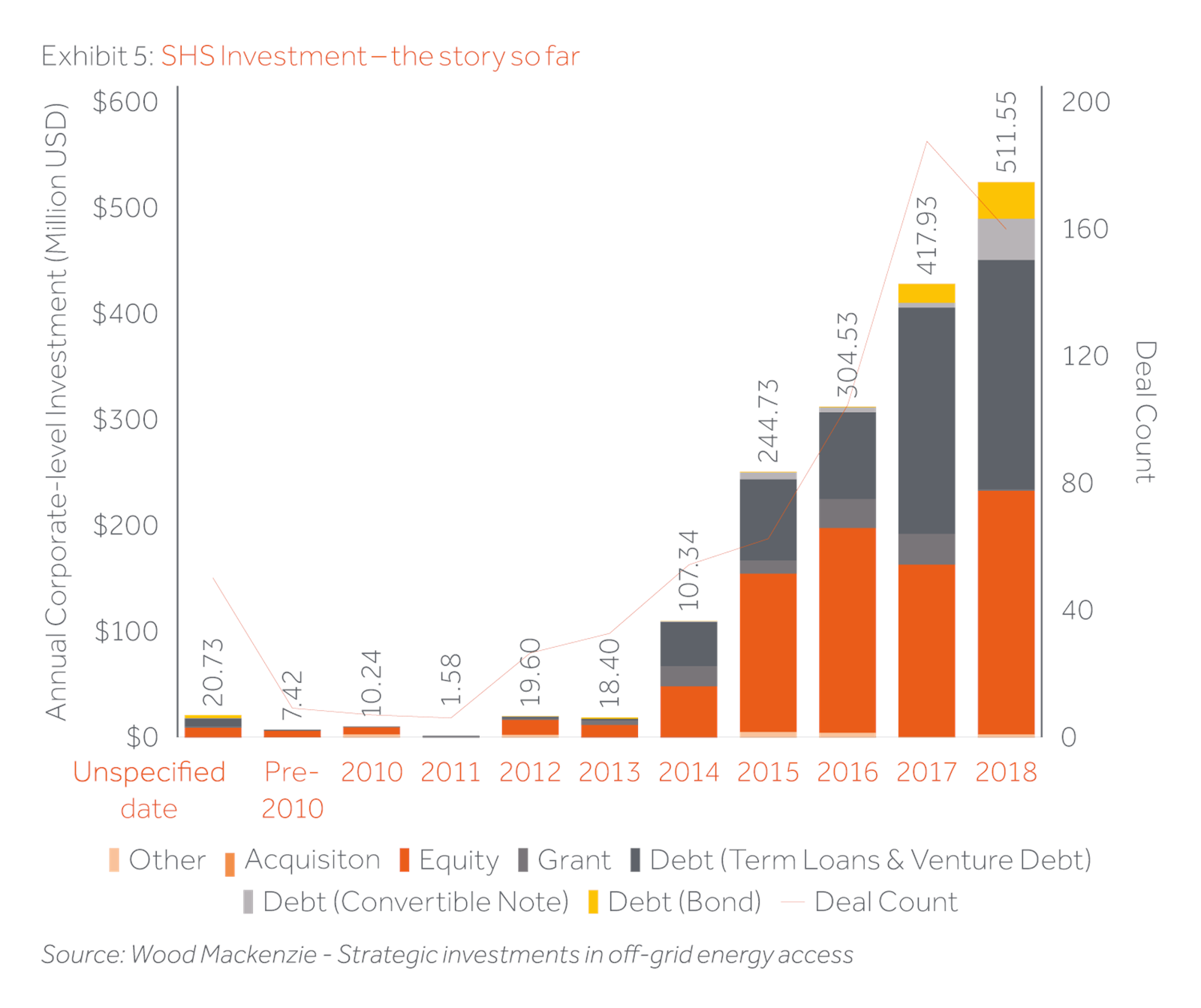

The industry is in high growth mode and investors are paying attention, 2018 saw a record $500+million invested globally in off-grid energy access companies, taking total investment to over $2 billion to date, including commercial debt and equity players.

Two distinct business models have emerged; cash-sales and Pay-As-You-Go (PAYGo).

The PAYGo model allows customers to finance their solar system through a lease-to-own arrangement, with a small down payment and regular affordable instalments over a period of 1-5 years via mobile money, airtime or scratch cards, overcoming the issue of upfront cost for the customer. This is driving the growth of the SHS market currently under way.

PAYGo SHS typically incorporate technology that allows remotely controlled shut-off in case of non-payment, helping to minimise default rates but also providing access to interesting and proprietary customer consumption and credit data.

This opens up the market to a completely new way of thinking as a route to provide financial services for the first time to hundreds of millions of underserved customers who have never had a bank account or credit rating.

PAYGo companies are monitoring their data closely to cultivate long-term customer relationships that can be leveraged to upsell larger systems and are expanding into other financed-product offerings for appliances and wifi, but also pure-play financial services like insurance and cash loans.

We are also hearing of PAYGo companies considering models for on-grid consumer financing.

Further, SHS businesses do not reflect the profiles that we usually see in the energy and infrastructure space. Payments are based on a fixed US$ amount a month or day irrespective of the electricity produced, rather than a US$/kWh tariff that we are used to.

The distribution and operational model for SHS is sprawling and complex, credit risk is based on basic consumer surveys and diversification rather than single customer offtake contracts with credit enhancement.

As such, most PAYGo SHS companies could (and should) be classified as a consumer finance and services business.

The industry is still working this out, SHS companies don’t know how to classify themselves as they approach a broad range of tech, financial services, consumer, energy or infrastructure investors for backing.

At Actis we have participated in fundraising pitches from the leading SHS businesses and observed senior management team disagree live as to whether they are a consumer finance or an energy business. We have seen some large European utility players investing in the market, such as Engie’s backing of Fenix.

This is providing credence towards the sustainability objectives of these utilities, whilst providing early access to the sector’s large potential, and helping a continued move towards the global trend of “Utility 2.0”; the Utility of Future ideal of being an integrated customer-centric service provider rather than a producer and mover of kWh.

The SHS-led consumer finance sector is set to be a huge market opportunity, but needs careful consideration on how and when to participate

Forecasts are for 80% CAGR in off-grid SHS sales to 2022. With a giant opportunity available across multiple geography and service offerings, SHS businesses are moving in different directions, at different speeds, with different models, and we are seeing the emergence of the industry’s first winners and victims as these routes are tested.

The exciting fundamentals and clear impact story of SHS dressed up into crisp PowerPoint presentations led by enthusiastic young entrepreneurs has proved alluring, as shown by the recent influx of investment. However, the sector remains young and the ultimate industry picture is still being determined.

Too many well-funded management teams have focused on growth at all costs, rather than profitability and the customer. Some investors may have moved too quickly as demonstrated by the spate of recent SHS company geographical retreats, product recalls due to technology failure, high default rates as a result of poor credit controls, over indebtedness, and the insolvency of the high-profile East-African focused Mobisol in 2019.

Mobisol closed on a significant investment in 2016 from leading international development and commercial investors and provided electricity to more than 500,000 customers. Whilst some are retreating and rationalising, others march on with their expansion plans at all costs. There is not a clear “right path” today.

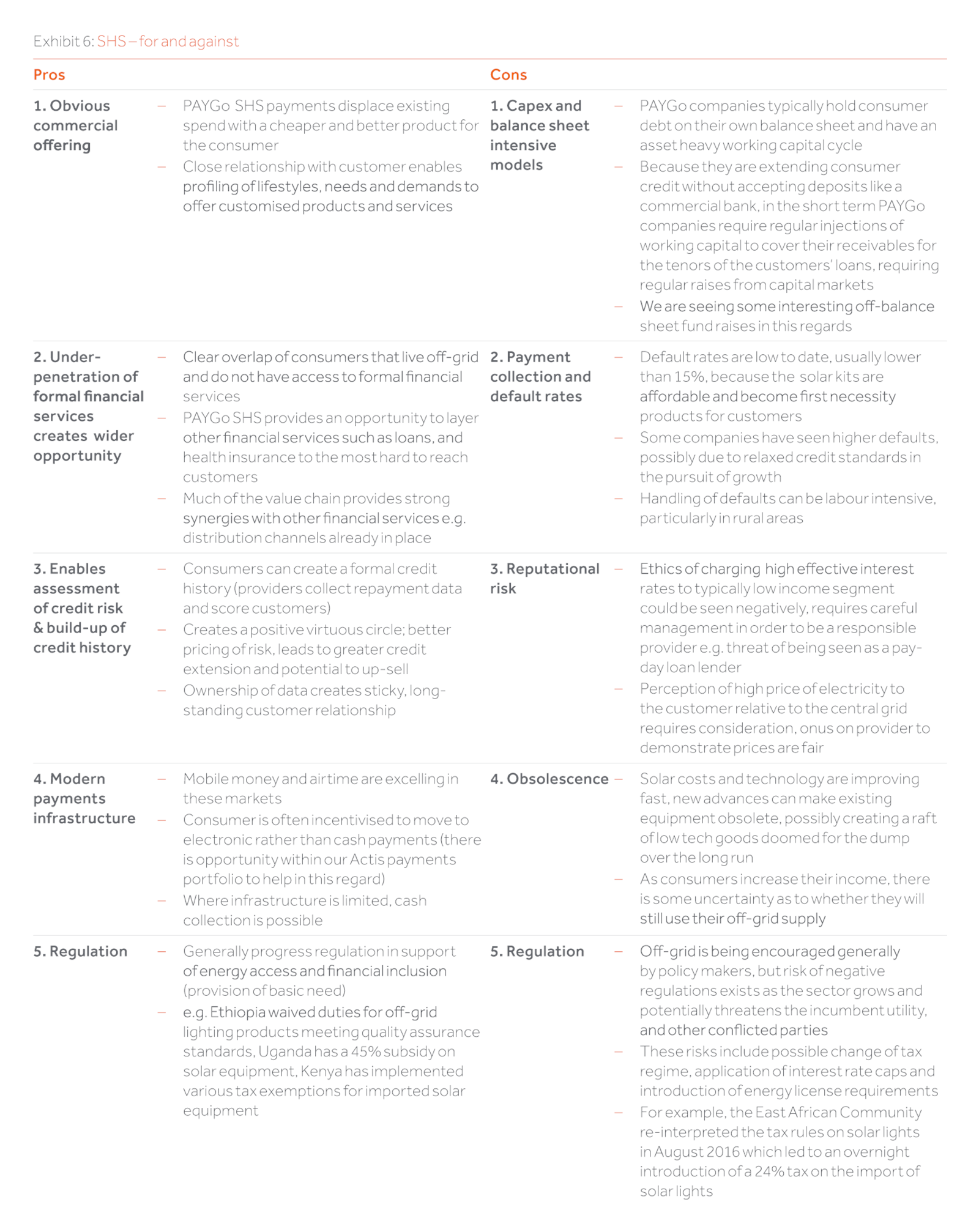

Below we outline the current pros and cons that we see in the sector through a Financial Services (“FS”) lens.

Looking to the future

Off-grid solar demonstrates that installing a solar system in a home, an apparently small intervention, can enable out-sized gains in welfare, productivity, and income generation.

In emerging markets, the sector could lift millions of households out of energy poverty and provide them a route to financial inclusion, opening up new economic opportunities for the next generation.

In many ways the business models being deployed in this space are on the cutting edge of emerging trends shaping electricity and financial service markets in developed economies; decentralised technologies, complex data analysis, the Internet of Things, mobile banking, and so on.

We could see a double leapfrog; over traditional electricity-grids and traditional financial services, straight to distributed generation and mobile banking. With $26 billion expected to be invested in the SHS sector by 2030, the private sector has a vital role to play in scaling the off-grid industry.

As off-grid SHS providers look to enter the next phase of growth, the business models being deployed will continue their refinement. There will likely be an increasing focus towards strategic M&A in order to scale and deepen customer worth through value-stacking of adjacent services on top of basic electricity connections.

When our pre-conditions for growth, scale and success are met, Actis is uniquely positioned to participate in this exciting sector given our knowledge and experience of Energy, Financial Services and the emerging markets.