A familiar mantra to long horizon, cross border investors assessing currency risk. Understanding drivers here matters a lot. This applies in our buckets regardless of whether a currency is fixed or floating – they all reflect capital flow volatilities through liquidity, banking, and fiscal dynamics.

Currency risk matters both as a cause and symptom of diverse investment outcomes. Hence, it is important to understand, and whenever possible, diversify exposure to different currency drivers across our portfolio.

A familiar mantra to long horizon, cross border investors assessing currency risk. Understanding drivers here matters a lot. This applies in our buckets regardless of whether a currency is fixed or floating – they all reflect capital flow volatilities through liquidity, banking, and fiscal dynamics.

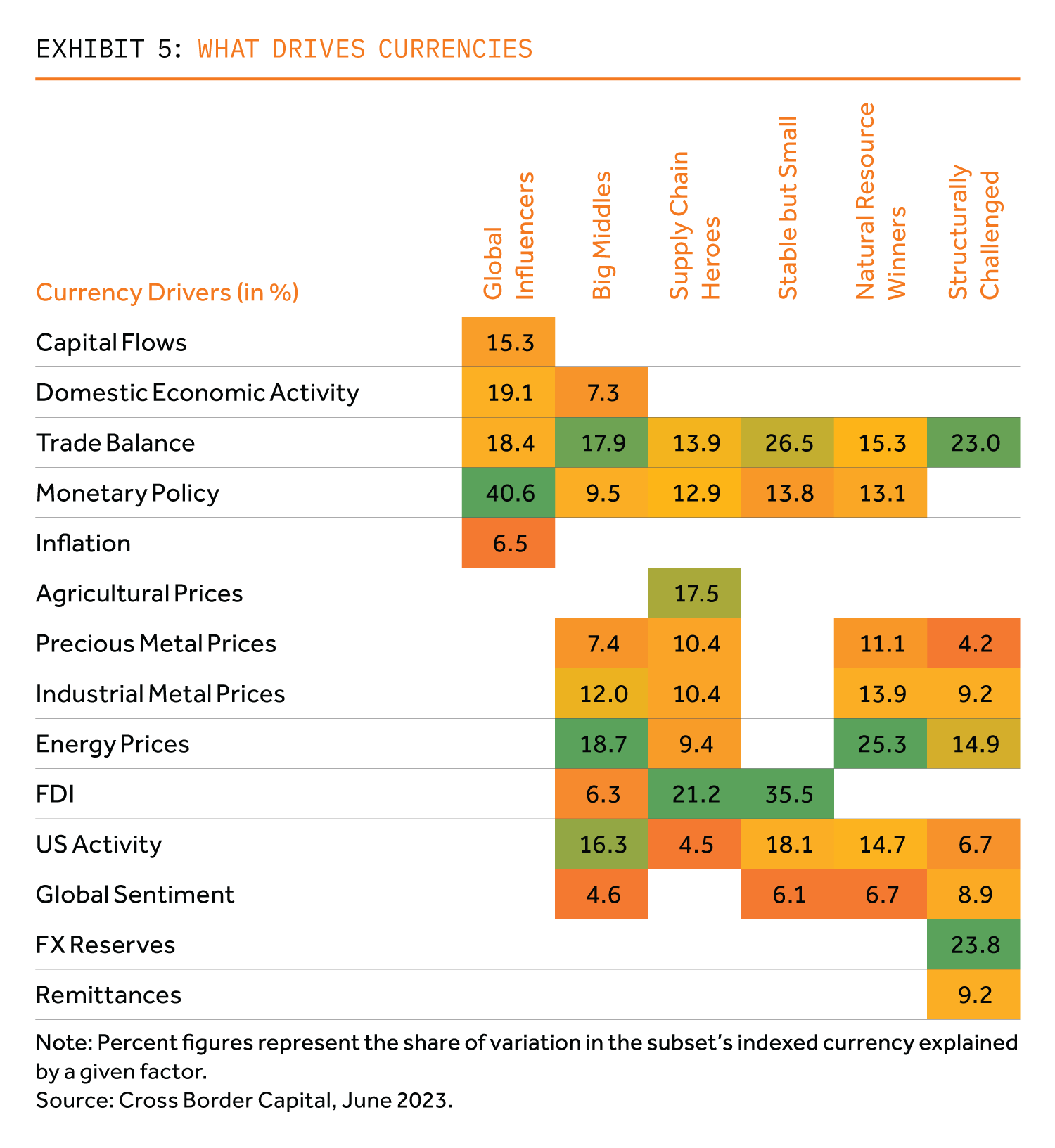

Our FX partner CBC analysed currency drivers across our buckets. CBC’s approach identifies through quantitative analysis a subset of currency drivers that impact each currency. They focus on a 2-year forward horizon as back testing shows that events rather than inflation differentials have a higher explanatory function at short horizon. We assume, as they do beyond two years, that PPP differentials take over given that events become less forecastable at longer horizons. All Actis deals, including exits, use this framework now. The key take-aways:

Global Influencers

Domestic monetary policy accounts for almost half of the variation in this subset (see Exhibit 5). Interest rate decisions, open market operations, liquidity management, Yield Curve Control (YCC) and exchange rate mechanisms drive most event-driven volatility in this bucket’s currencies. Crises tend to be endogenous not exogenous – these are risk givers not takers. Domestic economic activity particularly affects the USD and CNY.

Big Middles

Trade balance, energy prices and US activity dominate, accounting for close to 20% of the currency variation each. But some nuances caveat this general conclusion. Some ‘Big Middle’ countries are large energy importers, making them sensitive to shocks in energy prices (India). Industrial metal prices have a greater impact on the currencies of Brazil and South Korea due to their reliance on manufacturing. Currencies across this bucket, in particular the Mexican peso, are sensitive to US economic activity as the US is a key trade partner for these countries. India’s rupee is, relatively speaking, more sensitive to global risk sentiment.

Supply Chain Heroes

Important drivers for this bucket are foreign direct investment, agricultural prices and trade balances. ‘Supply Chain Heroes’ currencies are primarily driven by foreign direct investment (21%), which has become increasingly important in recent years. Vietnam is a case in point. Benefiting from the relocation of manufacturing bases from China, FDI inflows are a key driver of the currency ‘explaining’ over 30% of movements in the dong. FDI is also a key driver of the Thai baht. Relatedly, these currencies are also reliant on export and import performance, with trade balances accounting for 14% of the bucket’s drivers. Trade balances are the primary driver of Philippine peso. The economies that rely more on agricultural exports like palm oil, rubber, and rice (Malaysia, less so Vietnam) are also sensitive to agricultural prices.

Stable but Small

The currencies in this bucket are sensitive to the economic activity, monetary policy and flows of ‘Global Influencers’ (assuming EU taken together is also one). Lithuanian, Romanian and Bulgarian economies are influenced by their close economic ties to the EU. Foreign direct investment and trade balances, for which the EU plays a significant role, contribute to 62% of the bucket’s drivers and EU monetary policy a further 14%. Export and import measures contribute 30%, 35% and 34% to the overall variation in the Moroccan dirham, Romanian leu and Uruguayan peso, respectively. Uruguayan peso is more sensitive to the US economic activity (27%).

Natural Resource Winners

This group is highly sensitive to commodity prices, with energy and metals prices driving half of the currency movements. This sensitivity is no surprise given the significance of oil, gold, platinum, and copper to these economies. The South African rand has a significant beta (33%) to major precious metal prices. Energy prices drive 41% of GCC currency sensitivities. Middle Eastern currencies are mostly dollar-linked so volatility comes through fiscal, credit and inflation variables rather than FX values. US economic activity and industrial metal prices heavily influence the Chilean peso and Peruvian sol, but also the Colombian peso. The Indonesian rupiah is more sensitive to energy prices (32%).

One aside – energy transition has the long-term potential to create winners and losers in this area. Think declining fossil fuel demand and rising renewables driven industrial materials demand. This is probably a while away but worth flagging.

Structurally Challenged

This bucket is particularly sensitive to FX reserves (24%) and trade balances (23%), and to a lesser extent energy prices and remittances. The currencies in this bucket heavily rely on export and import performance and maintaining sufficient FX reserves to meet external obligations, as large shifts in reserves can lead to significant currency fluctuations. Türkiye is a case in point. FX reserves ‘explain’ almost third of lira’s moves, followed by energy prices and trade balance. FX reserves and trade balances also account for 40% of the variation in the Kenyan shilling. Unlike other buckets, remittances play a significant role in this subset. Remittances are particularly meaningful drivers of the Egyptian pound (19%) and Ghanaian cedi (20%). Energy prices also have a material impact on the Nigerian naira and Ghanaian cedi due to their reliance on oil exports.

One stress factor is when citizens distrust their own currency as a store of value. Gresham’s Law whereby bad money (local currency) is spent quickly, and foreign exchange is hoarded as a source of value applies. And offshore investors demand an unsustainable premium for substituting for local interest.

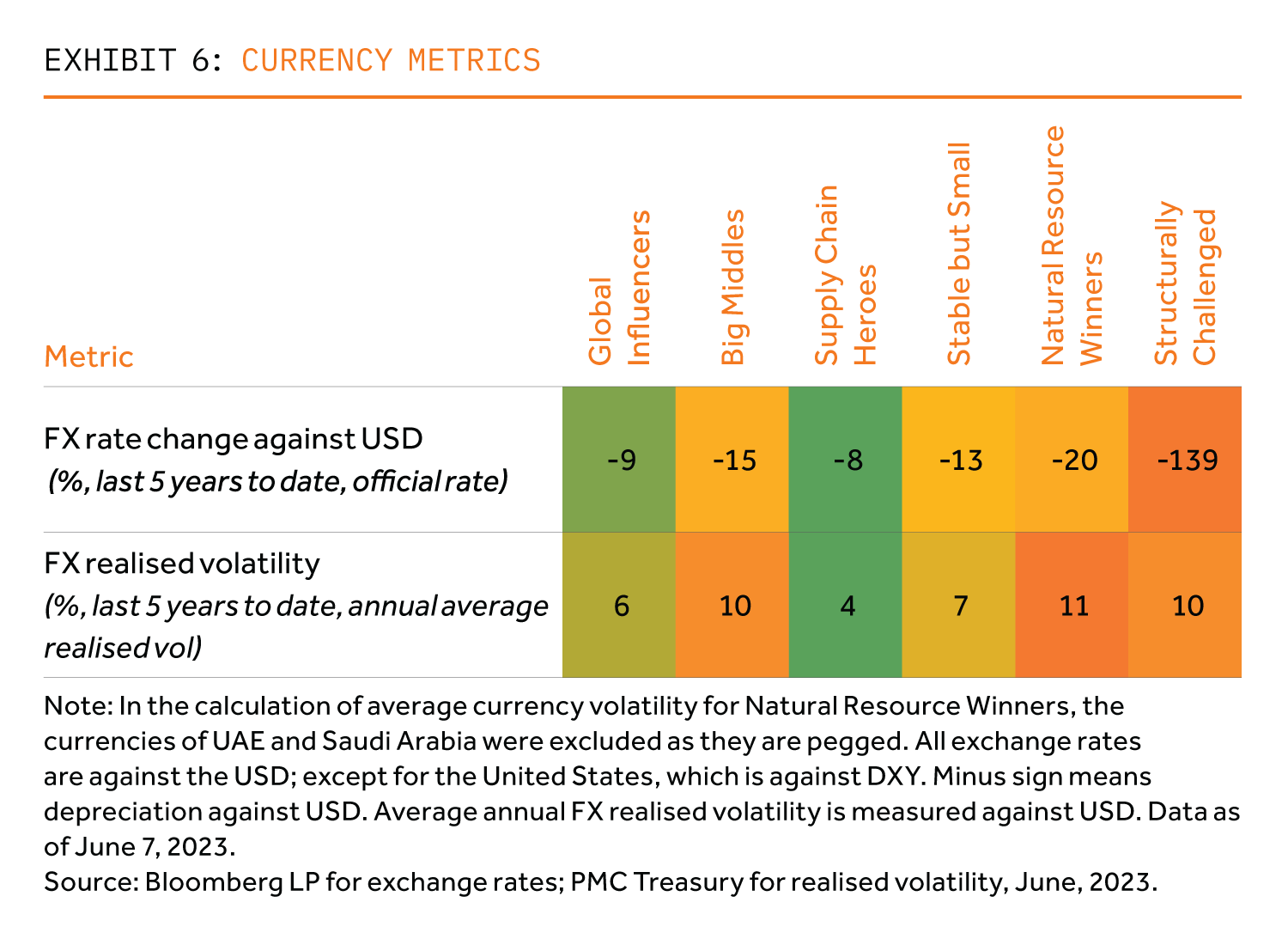

Currency risk is manifested in both currency levels and volatility. This goes partly back to the currency drivers’ analysis above, as some drivers tend to be more volatile than others. For example, economies more exposed to commodity price swings also tend also to have, on average, more volatile currencies, unless their currencies are credibly pegged with solid FX reserves (e.g. UAE, Saudi Arabia). See Exhibit 6.

Lower currency volatility implies lower investment risk, all else being equal. A country with low or improving FX volatility not associated with capital controls, is attractive for new investment flows. Why? If FX volatility is low, the chances of domestic cash flows accruing at a faster rate than the currency depreciates boosts hard currency returns. (It tends to mean lower inflation volatility as well).

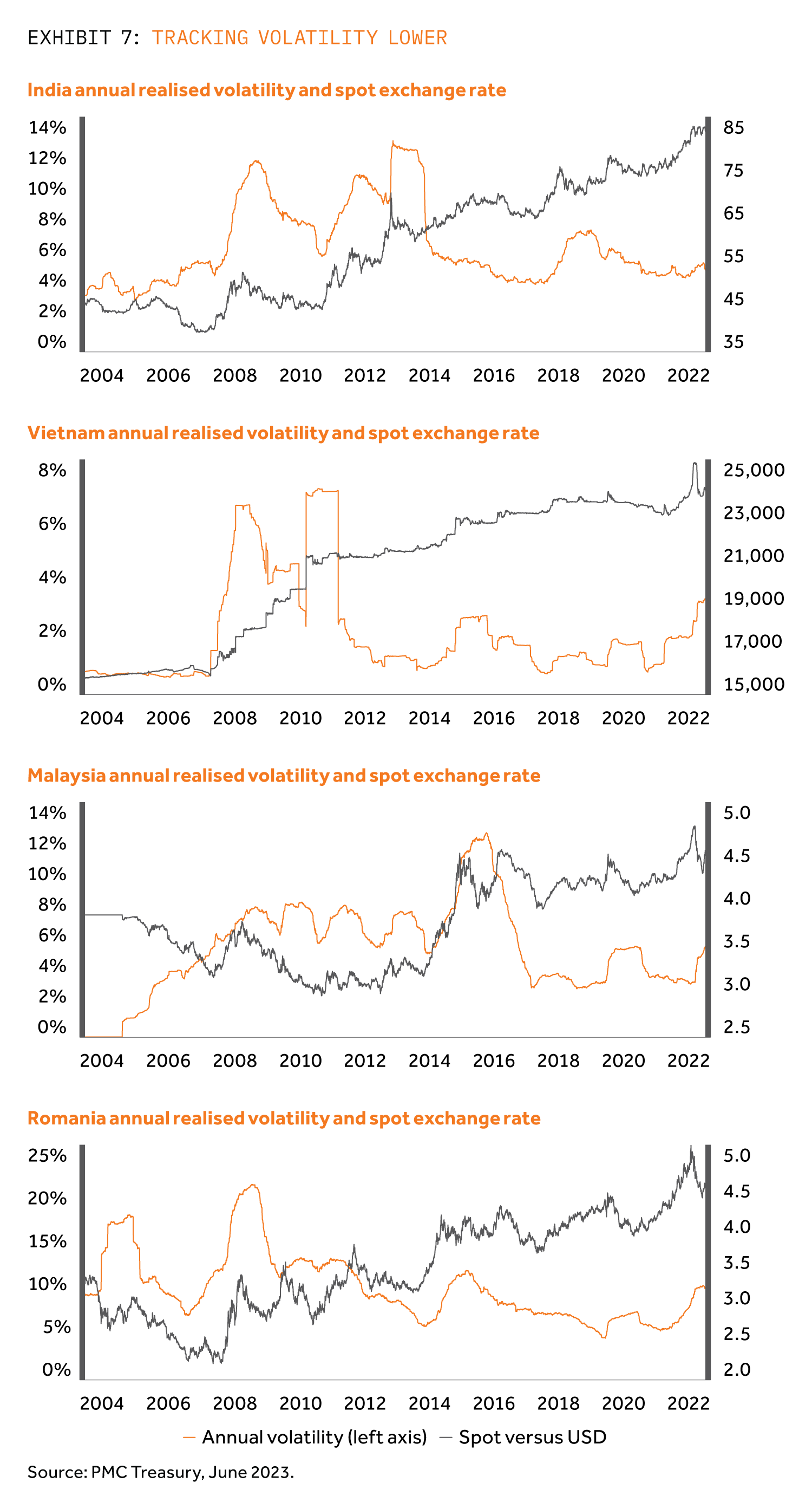

Average FX volatility has come down across most of our investment universe over the past 15 years or so. This finding applies in particular to ‘Supply Chain Heroes’, ‘Stable but Small’ and ‘Big Middles’ groups. Some star performers are highlighted in Exhibit 7.

Despite the recent crisis and dollar strength, currency volatility is lower across these buckets than in the previous decade (which also covers the GFC shock). The ability of currencies to weather external shocks, manifested as historically low FX volatility, is an obvious harbinger of reduced risk.

By contrast artificially induced low volatility (sometimes associated with administrative actions) is a red flag.

Some country differences are worth mentioning. It is justified to look at group averages when mean and median converge. Hence with the ‘Big Middles’, whilst the realised currency volatility has substantially declined over the past decade, and has halved in India and South Korea, Brazil and Mexico have seen more volatile outcomes. This results in a somewhat less impressive group level average for the ‘Big Middles’.

Understanding currency drivers helps make better long term investment decisions. Drivers do differ between countries – see the heatmap – which further supports our distaste for homogeneous judgements.

Currency drivers are central to debate at Actis. We are often able to mitigate it through tariff or revenue indexation to the dollar. In some jurisdictions local finance is freely available which reduces the need to worry about asset liability mismatch. In the event of known flows, we can manage short term risk through financing and hedging strategies.