Where We Stand Today

|

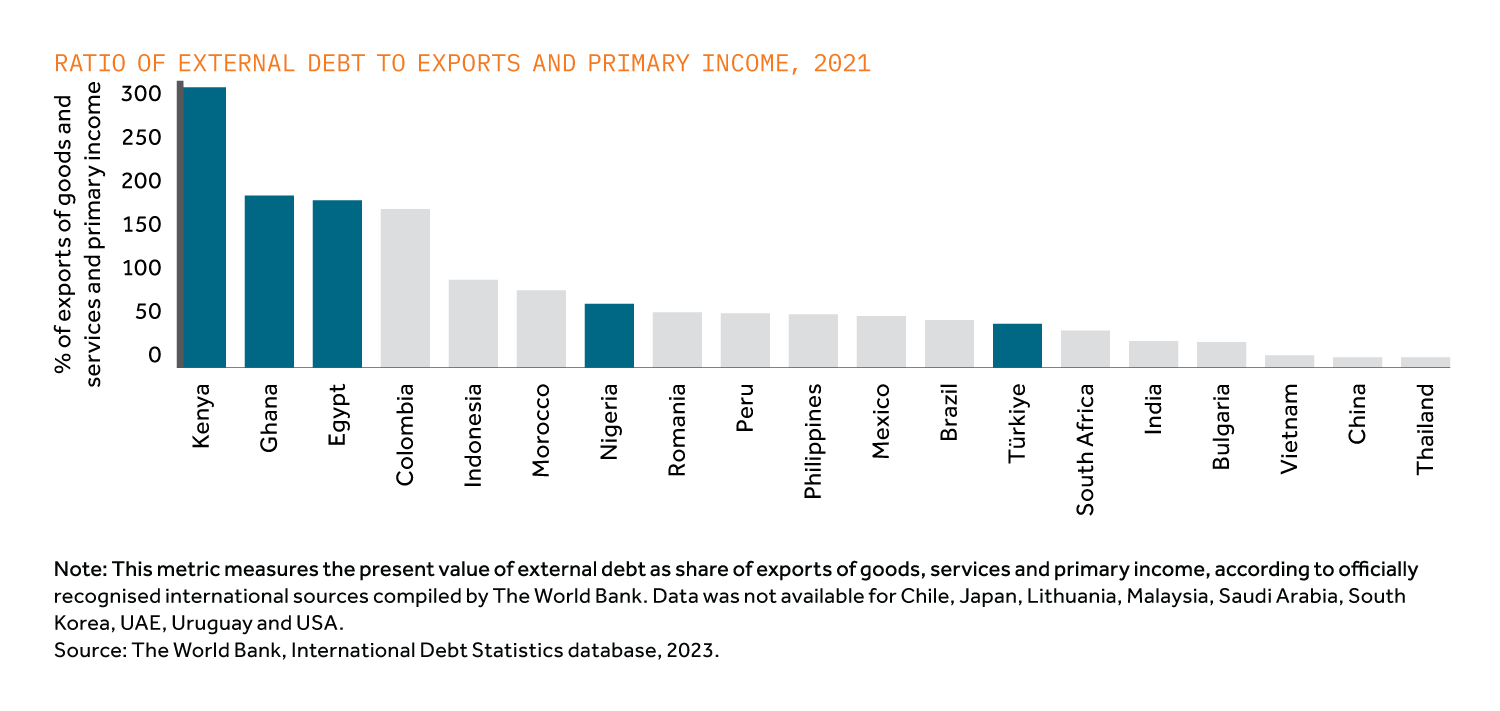

Egypt

|

|

- April 2023 inflation 30.6%, down from 32.7% in March 2023

- Interest rate 18.25%, up 1,000bps since January 2022

- GDP growth 6.6% in 2022, a relative outperformer

- Egyptian pound trading at 30.9 per USD, 68% weaker than a year ago

- In the middle of a structural adjustment programme with IMF. Still needs to show credible commitment to reform and FX flexibility

|

Ghana

|

|

- April 2023 inflation 41.2%, down from 54.1% in December 2022

- Interest rate 29.5%, up 1,500bps since January 2022

- GDP growth 3.2% in 2022

- Cedi trading at 10.7 per USD, 38% weaker than a year ago

- Effectively defaulted on debt with IMF negotiations on going. Elevated government and external debt ratios

|

Kenya

|

|

- April 2023 inflation 7.9%, down from 9.6% in October 2022

- Interest rate 9.5%, up 250bps since January 2022

- GDP growth 5.4% in 2022

- Shilling trading at 137.6 per USD, 18% weaker than a year ago

- Domestic funding challenges remain material but relationship with multilateral agencies constructive

|

Nigeria

|

|

- April 2023 inflation 22.2% and yet to peak this cycle

- Interest rate 18.5%, up 700bps since January 2022

- GDP growth 3.3% in 2022

- Naira official trading at 462.5, 11% weaker than a year ago

- Record rates and inflation levels but little relief in sight. Productive capacity is constrained and oil price decline could spell more trouble

|

Türkiye

|

|

- April 2023 inflation 43.7%, down from 85.5% in October 2022

- Interest rate 8.5%, down 550bps since January 2022

- GDP growth 5.6% in 2022

- Lira trading at 19.6, 28% weaker than a year ago

- After Erdogan’s victory the strategy of promoting nominal GDP is likely to continue; further devaluation and domestic currency banking system risks remain material

|

Source: Bloomberg LP for consumer prices, interest rates and exchange rates. International Monetary Fund World Economic Outlook database (April 2023) for real GDP growth figures in 2022. Exchange rates as of May 22, 2023 and interest rates as of June 7, 2023.