Where We Stand Today

|

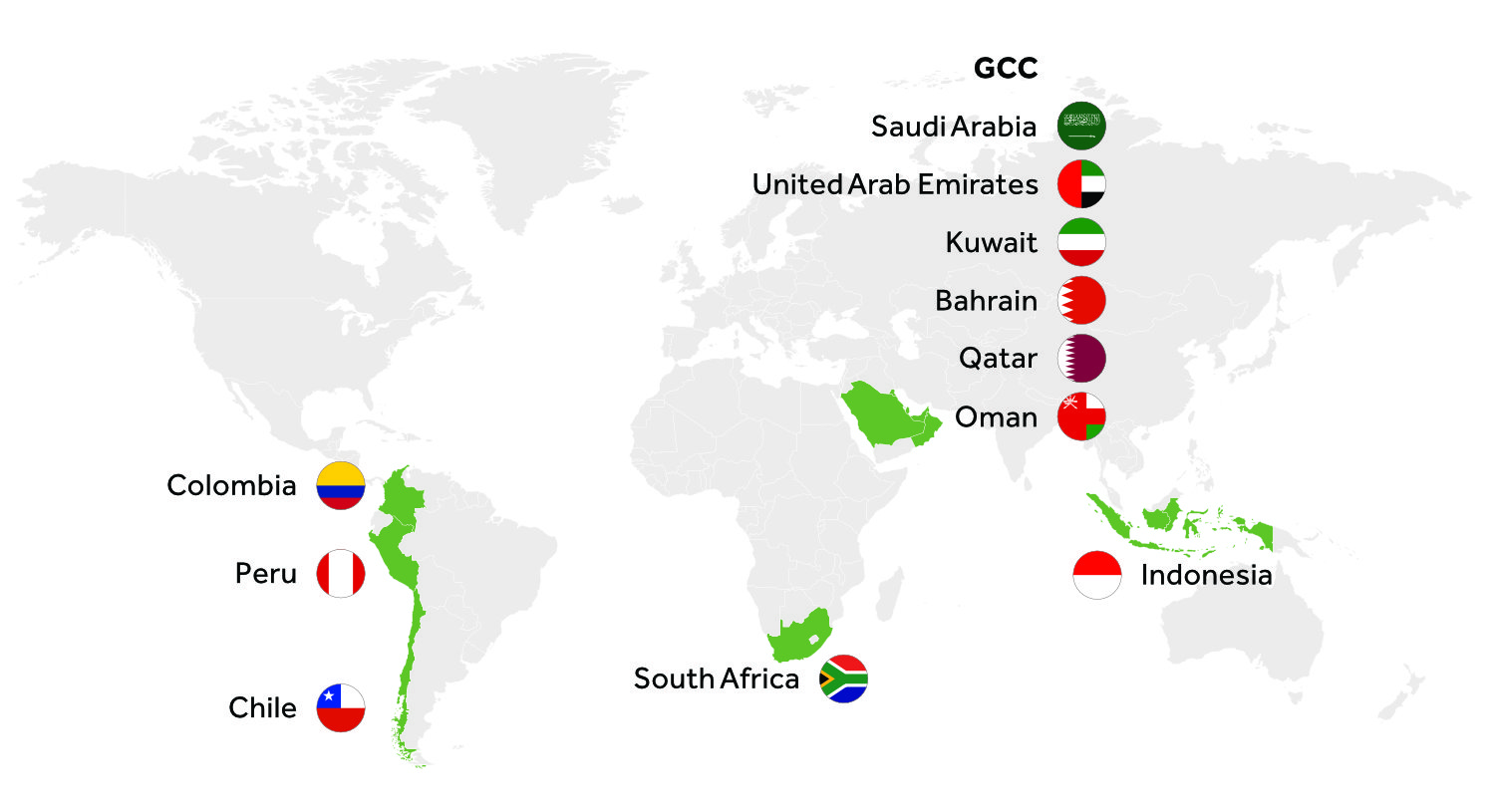

Chile

|

|

- April 2023 inflation 9.9%, down from 14.1% in August 2022

- Interest rate 11.25%, up 725bps since January 2022

- GDP growth 2.4% in 2022

- Chilean peso trading at 793 per USD, 5% stronger than a year ago

- Despite higher economic volatility recently, long term copper and lithium outlook very benign

|

Colombia

|

|

- April 2023 inflation 12.8%, down from 13.3% in March 2023

- Interest rate 13.25%, up 1,025bps since January 2022

- GDP growth 7.5% in 2022

- Colombian peso trading at 4,567 per USD, 12% weaker than a year ago

- The president’s reform agenda is colliding with slower growth and efforts to bring down CPI

|

Indonesia

|

|

- April 2023 inflation 4.3%, down from 6.0% in September 2022

- Interest rate 5.75%, up 225bps since January 2022

- GDP growth 5.3% in 2022

- Rupiah trading at 14,925 per USD, flat compared to a year ago

- Growth to stay solid as resilient domestic demand buffers receding commodity tailwind

|

Peru

|

|

- April 2023 inflation 8.0%, down from 8.6% in September 2022

- Interest rate 7.75%, up 525bps since January 2022

- GDP growth 2.7% in 2022

- Sol trading at 3.70 per USD, flat compared to a year ago

- Political instability a way of life but growth and currency performing well

|

Saudi Arabia

|

|

- April 2023 inflation 2.7%, down from 3.4% in January 2023

- Interest rate 5.75%, up 475bps since January 2022

- GDP growth 8.7% in 2022, an outperformer

- Riyal trading at 3.75 per USD, flat compared to a year ago (pegged)

- Fiscal position remains strong, liquidity plentiful and OPEC action supportive

|

South Africa

|

|

- March 2023 inflation 7.1%, down from 7.8% in July 2022

- Interest rate 8.25%, up 450bps since January 2022

- GDP growth 2.0% in 2022

- Rand trading at 19.4 per USD, 23% weaker than a year ago

- Despite inflation starting to soften, power shortages pose a material challenge to outlook

|

UAE

|

|

- April 2023 inflation 3.3%, down from 7.1% in July 2022 (Dubai)

- Interest rate 5.15%, up 365bps since January 2022

- GDP growth 7.4% in 2022, an outperformer

- Dirham trading at 3.67 per USD, flat compared to a year ago (pegged)

- Huge benefits from oil price and strong tourist inflows; economic activity going very well

|

Source: Bloomberg LP for consumer prices, interest rates and exchange rates. International Monetary Fund World Economic Outlook database (April 2023) for real GDP growth figures in 2022. Exchange rates as of May 22, 2023 and interest rates as of June 7, 2023.