Where We Stand Today

|

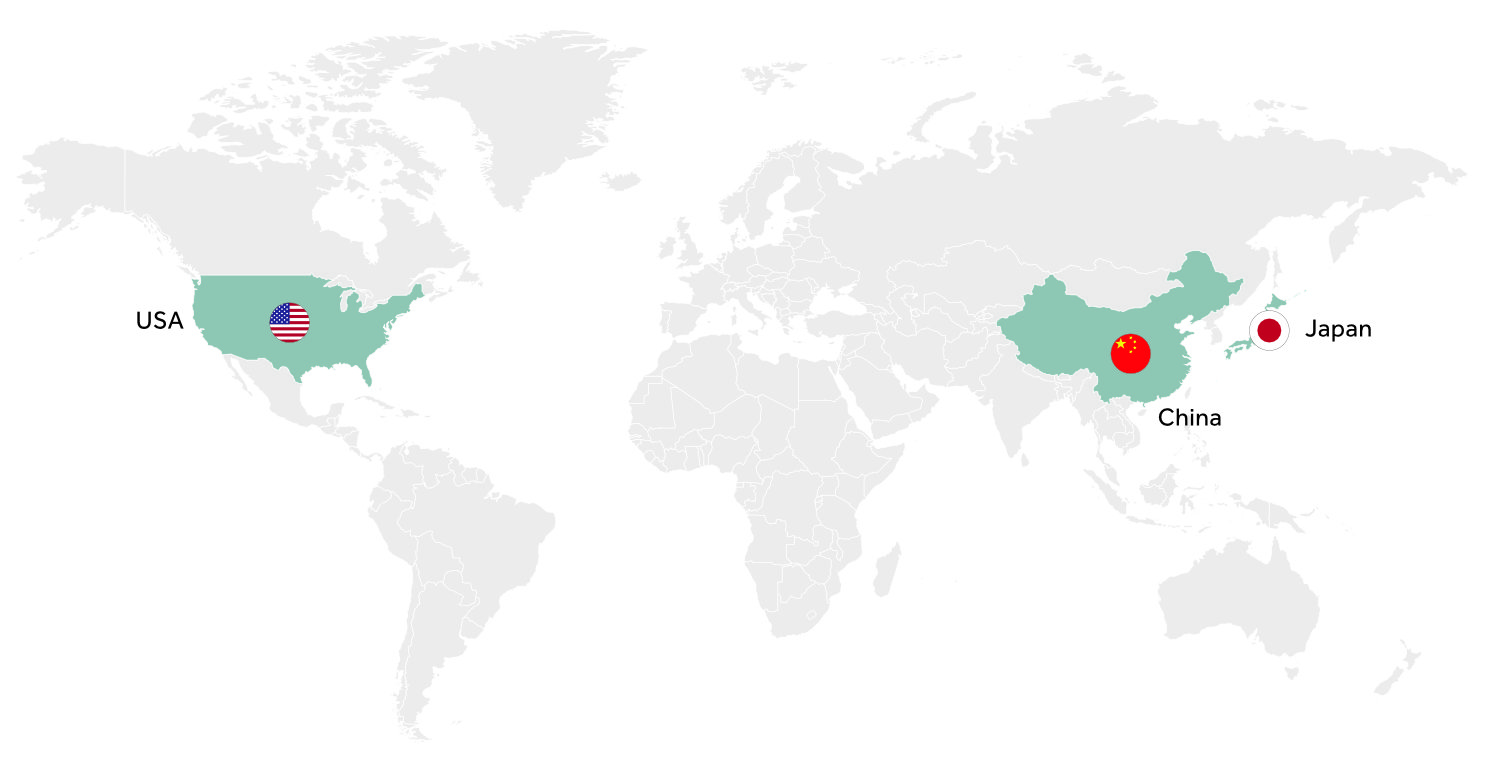

China

|

|

- April 2023 inflation 0.1%, down from 2.8% in September 2022

- Interest rate 3.65%, down 15bps since January 2022

- Real GDP growth 3.0% in 2022, and accelerating this year

- Renminbi trading at 7.00 per USD, 4% weaker than a year ago

- Growth slowly recovering post Covid led by consumption. Investment rebound more muted as confidence yet to be fully restored

|

Japan

|

|

- April 2023 inflation 3.5%, down from 4.3% in January 2023

- Interest rate -0.1%, no change since January 2022

- Real GDP growth 1.1% in 2022, and accelerating this year

- Yen trading at 138.1 per USD, 10% weaker than a year ago but off recent lows

- Growth accelerating at the margin as companies reshore activities. Capital flow back and BoJ action have stabilised currency. Macro generally constructive

|

USA

|

|

- April 2023 inflation 4.9%, down from 9.1% in June 2022

- Interest rate 5.25%, up 500bps since January 2022

- Real GDP growth 2.1% in 2022

- US Dollar Index (DXY) 103.2, flat compared to a year ago

- Activity yet to slow materially despite Fed actions. Inflation remains on a gradual downward path and outlook for rate rises has softened

|

Source: Bloomberg LP for consumer prices, interest rates and exchange rates. International Monetary Fund, World Economic Outlook database (April 2023) for real GDP growth figures in 2022 and 2023f. Exchange rates as of May 22, 2023 and interest rates as of June 7, 2023.