The urban myth would have you believe that investment in growth markets is inherently and unavoidably high risk, involving as it does a need to assess and price in the impact of political instability, macro-economic volatility and exposure to FX movements where the underlying investment is not hard currency denominated. Indeed, when we look at data from Hamilton Lane and others, we can see that their broadly defined group of Emerging Market GPs have in general under-performed their developed market peers over the fund vintages since the global financial crisis in 2008. However, as we look at the relative attraction of our markets today, we see a different picture developing, and one which suggests that the rear-view mirror is no longer the right tool for investors to use in deciding on how best to allocate capital.

The picture is dominated by two foreground elements. Firstly, the relative risk no longer favours developed markets in the same way as it has historically. Why is this? One reason of course is the significantly greater political risk we see in the US, Europe and developed Asia. Previous articles in this publication have reflected on the impact of President Trump on global economic growth prospects, but it seems undeniable that the continuation of the populist movement that brought him to power risks unleashing a powerful backlash in developed market economies as the reality of isolationism bites in the form of increased inflation and a worsening balance of trade. In addition, the factors that have driven asset price inflation (and the performance of alternative assets) in developed markets – supply of capital and demand for assets, yield curve compression and increased risk tolerance – all seem to be at or close to their peak.

Secondly, the developed world appears to be stuck in perpetual low growth, already almost 10 years down the path established by Japan. Sustained loose monetary and fiscal policy do not appear to have stimulated anything other than growth in asset prices and the concentration of wealth in the hands of the few, and yet no developed economy seems able to wean themselves off the drug of easy money and focus on what we would argue are the only two sustainable drivers of growth in an economy – population and productivity. And it is this simple truth that we would suggest requires that investors put aside their rear-view mirror as they consider their asset allocation decisions.

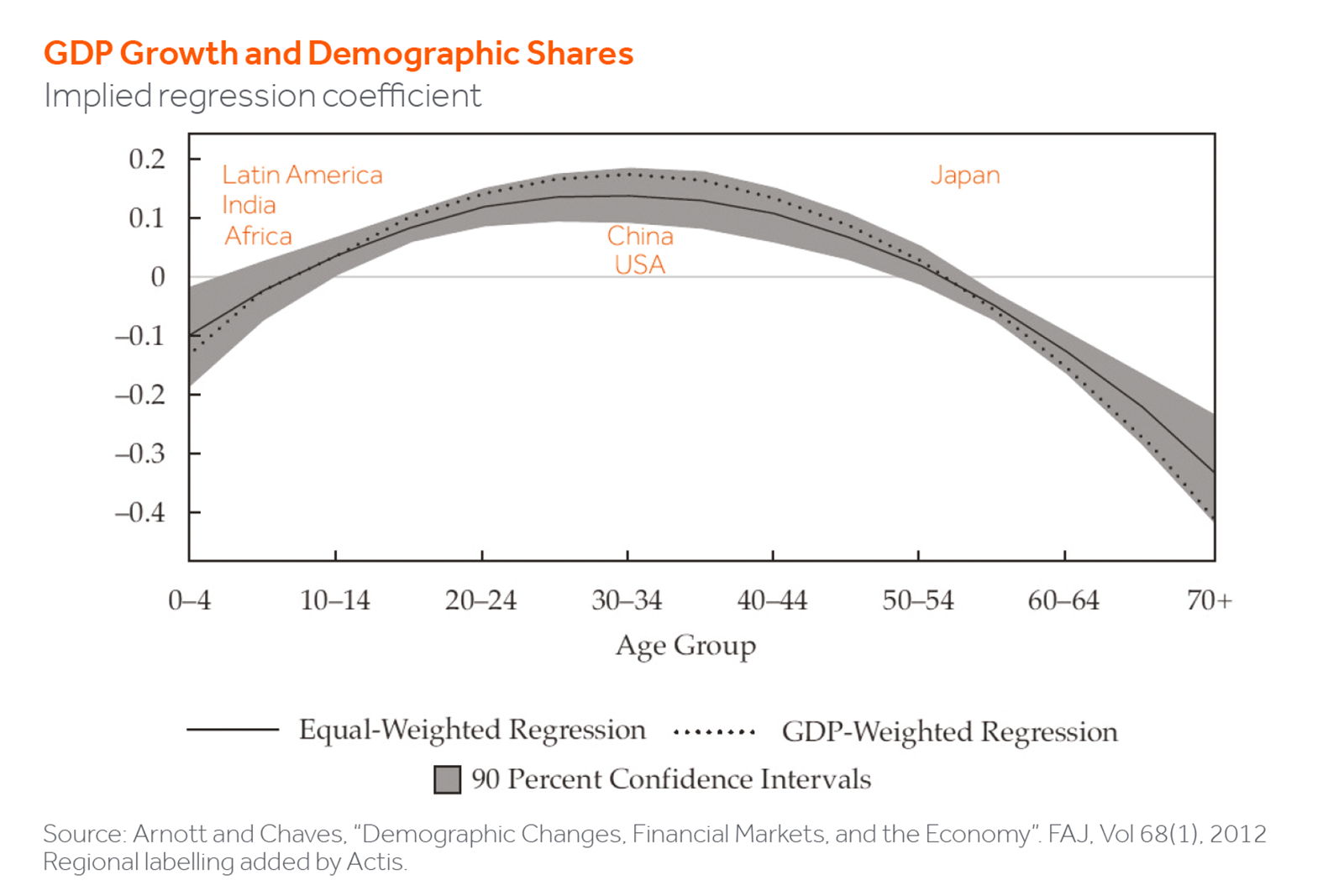

In growth markets, both population and productivity are driving sustained growth. Of course, there will continue to be bumps in the road, particularly as the less mature democracies occasionally stumble, but the correlation between positive demographics and economic growth are evident. Recent research has shown conclusively that the rate of growth in GDP is highly correlated to the average age of the population, peaking when this reaches 30-35.

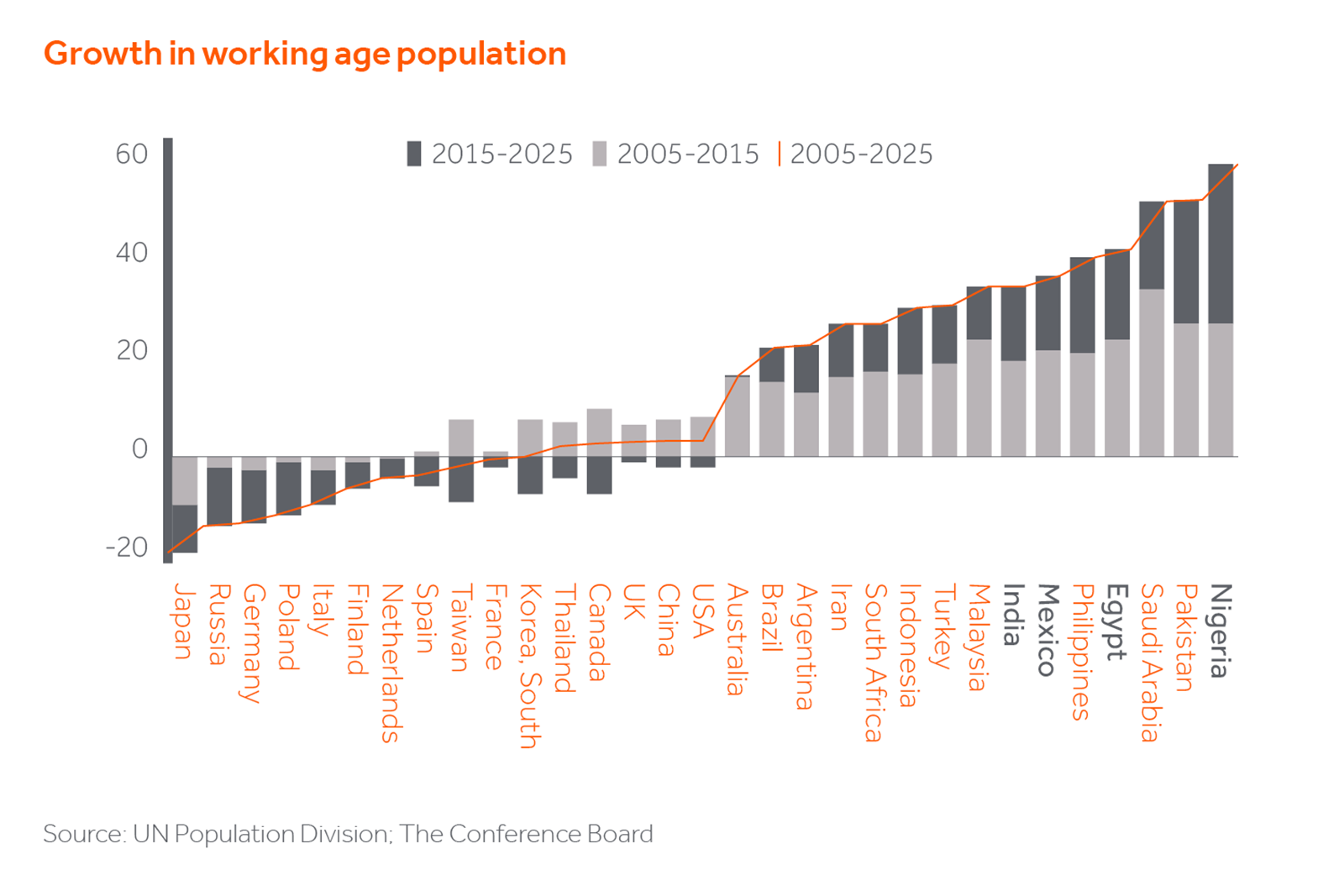

A growing working age population

So are our growth markets really younger? The evidence confirms this, with UN data placing Nigeria, Egypt, India and Mexico at the upper end of forecast growth in the population of working age. This stands in stark contrast to the forecasts for the EU and Japan, and this is before taking into account the impact of post-populist reductions in net immigration.

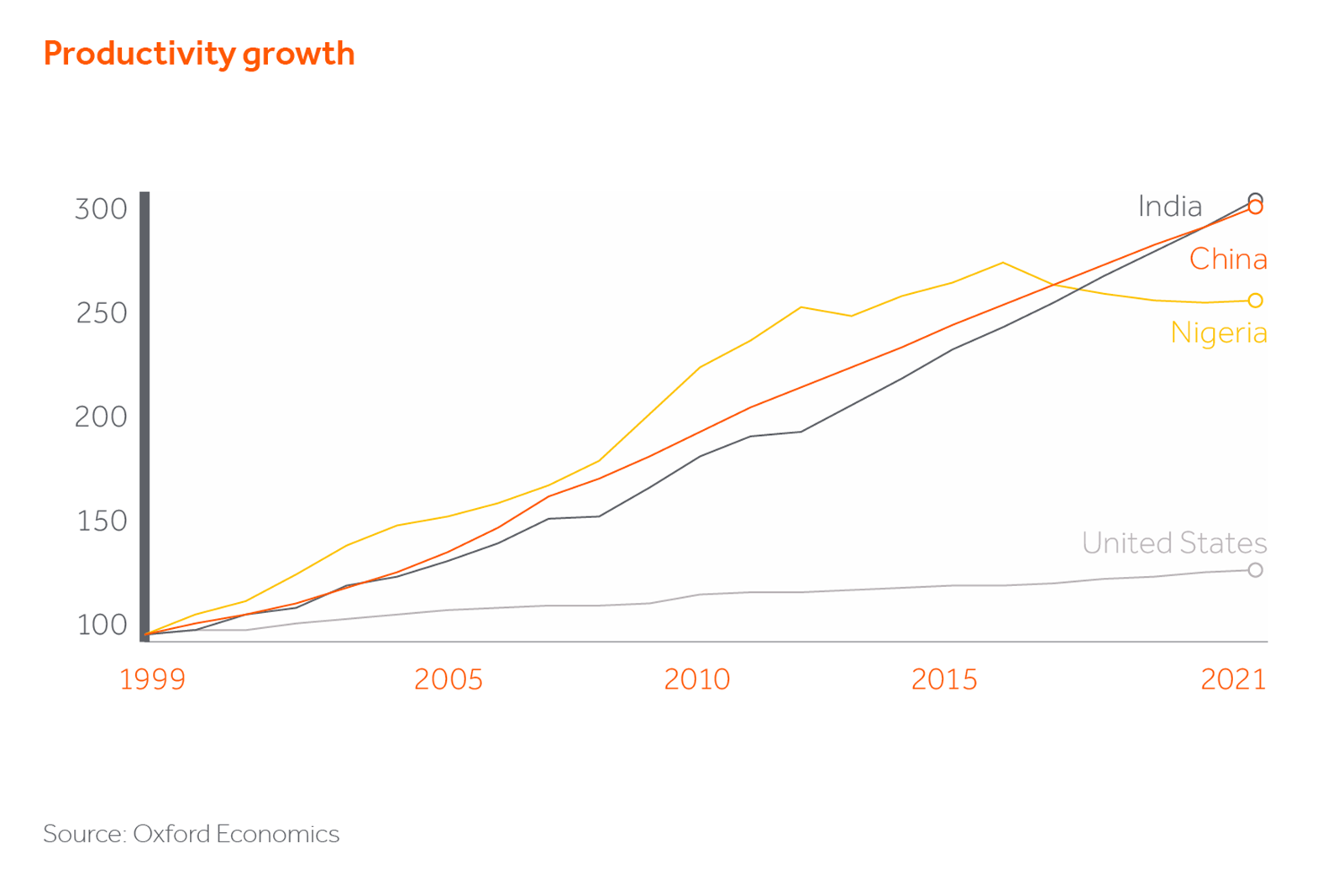

Productivity is also improving

Turning then to productivity, long the factor on which the US has relied in retaining its crown as the world’s largest economy. Again, the evidence shows us that productivity is demonstrably greater in economies with growing populations, and particularly those where the average age of the population is low. This seems intuitive, as once populations start to age to the point where the elderly outnumber the working population, as we are seeing in Japan, the ability to replace lost economic output must necessarily impact GDP growth, even where there is significant investment in infrastructure and automation. When you then remove or limit immigration, a significant source of historical population and productivity growth in the US, and you do so for political reasons, you place a further burden on the existing working population and you remove from your armoury the one socio-economic weapon that can reverse the trend.

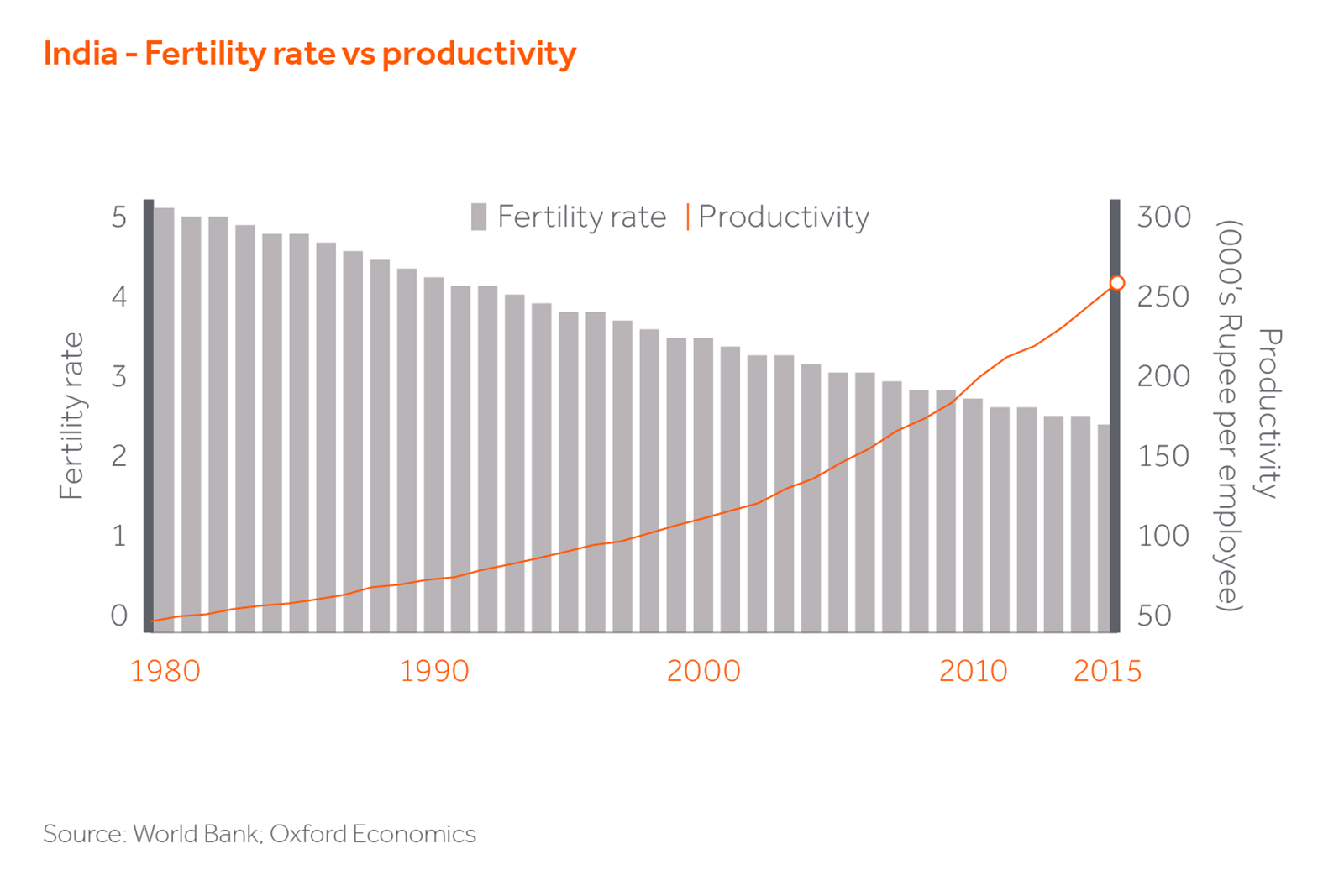

Correlation between fertility and productivity

The data also demonstrates that fertility rates and productivity are correlated, and that once fertility starts to decline, observed productivity increases, and in all growth markets outside Africa, this trend is evident in the historic data. As and when the benefits of better female education, improved access to healthcare and reduced infant mortality start to come through in Sub-Saharan Africa, we would expect to see productivity improve as it has in the rest of the world. Perhaps not tomorrow, but with the continued and unflagging support of committed donors and responsible investors in the region, we see these improvements starting to bear fruit locally.

Finally, many of our markets have historically been net exporters of human capital, but with the tide turning in the developed world, we anticipate that a global diaspora could easily contribute to their relative competitive advantage, by bringing skills and an influx of investment back home. This is also not something that is going to impact dramatically on growth in the next few years, but it contributes to the sustainability of the growth we are already seeing, and potentially to an acceleration in the development of an affluent middle class, one of the key themes that growth market investors like ourselves have sought to invest behind.

So pulling these themes together, what we observe is that the monetary factors that have stimulated developed market out-performance post-global financial crisis appear to have peaked, whilst the two drivers of long term sustainable growth are notable by their absence. In contrast, the growth markets have not seen significant benefits from accommodative economic policy, but are poised for strong and sustained growth, particularly on a relative basis.