In a 3 hour 23 minute speech at the 19th party congress on 18th October 2017, President Xi Jinping laid out his vision for the future of China, a new era where China would transform itself into a force that could lead the world on political, economic, military and environmental issues. By 2020, China would become a “moderately prosperous society” and by 2035 a “modern socialist country”. Finally, as an innovative country, using its economic and scientific power, China would become “truly powerful” by 2050.

What is most interesting in his speech is that innovation is identified as a key enabler for achieving this power and that China is putting this front and centre of its strategic agenda. President Xi emphasized this by saying that “China has transformed to high quality growth from high speed growth”. McKinsey has estimated that to realize consensus growth forecasts of 5.5% to 6.5% a year during the coming decade, China must generate 2 to 3 percentage points of annual GDP growth through innovation. If successful, this could contribute much of the required $3 to $5 trillion of annual incremental GDP by 2025.

China is moving away from its image of being the “factory of the world”, and is now the top ranked growth market for innovation in the rankings of the World Intellectual Property Organization (22nd out of 127 countries surveyed). By launching its “Made in China” 2025 strategy in 2015, China aimed to boost innovation in manufacturing and to encourage import substitution, particularly for high tech goods. The focus is firmly on the production of “cheaper and better” local products that are at least as good as global brands but are priced for Chinese markets. In creating innovation hubs, China has provided a foundation for industrial development; for example, the Ningbo hub in East China, where the focus is on smart equipment and cloud computing. It is predicted that the number of these innovation hubs will more than double from 15 in 2020 to 40 by 2025, other examples being in Shenzhen and Beijing, with these two alone accounting for 59% and 20% respectively of China’s overall patent applications in 2016.

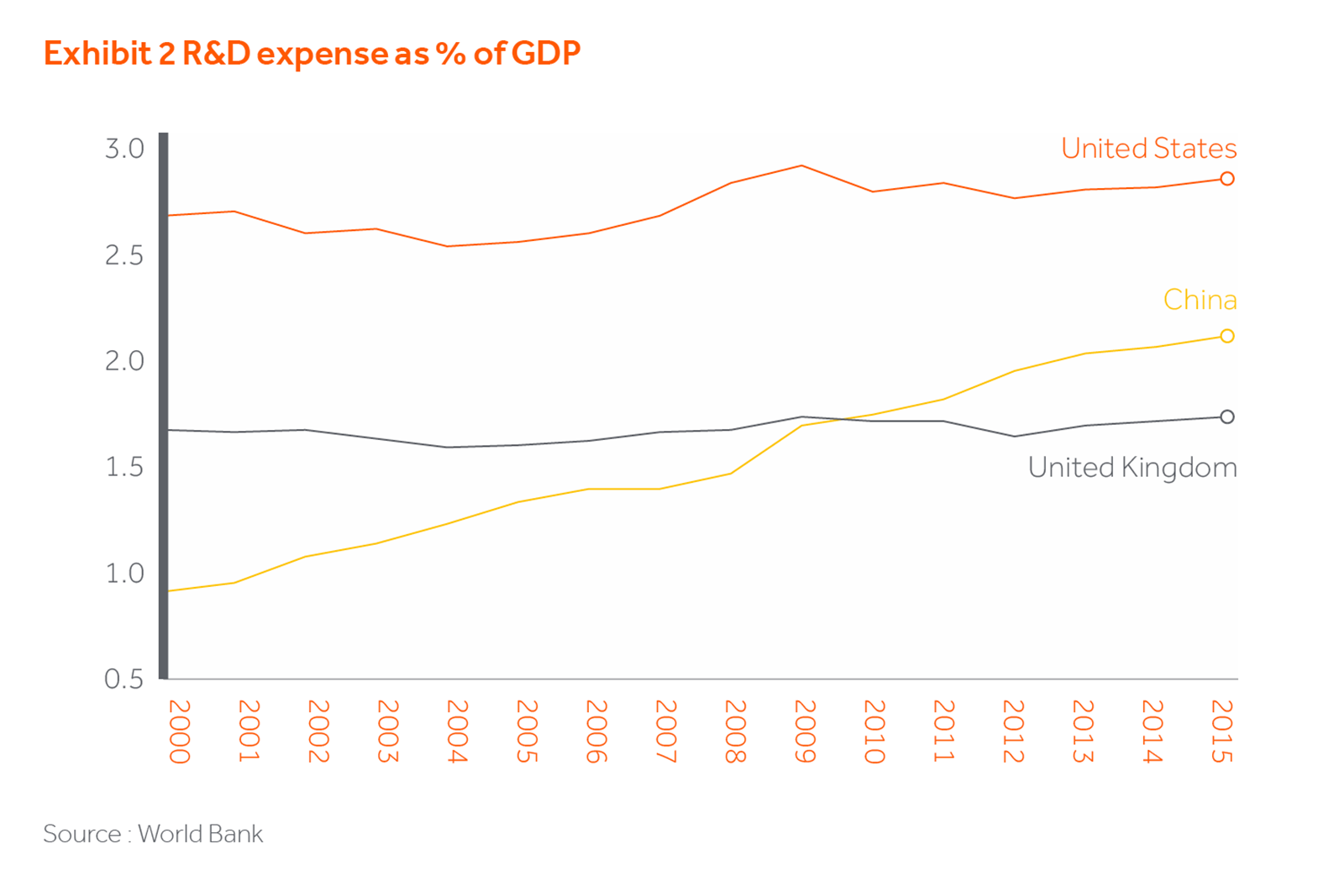

With strong central government support, tax incentives, the flexibility of longer incubation periods, a lower cost of doing research (compared to developed countries) and a huge consumer base, one of the aims of “Made in China 2025” is to increase research and development spending to 1.68% of operating revenue by 2025.

The success of these efforts can be demonstrated within the mobile payments, pharmaceutical, biotech and renewable energy industries and we will look briefly at each one in turn.

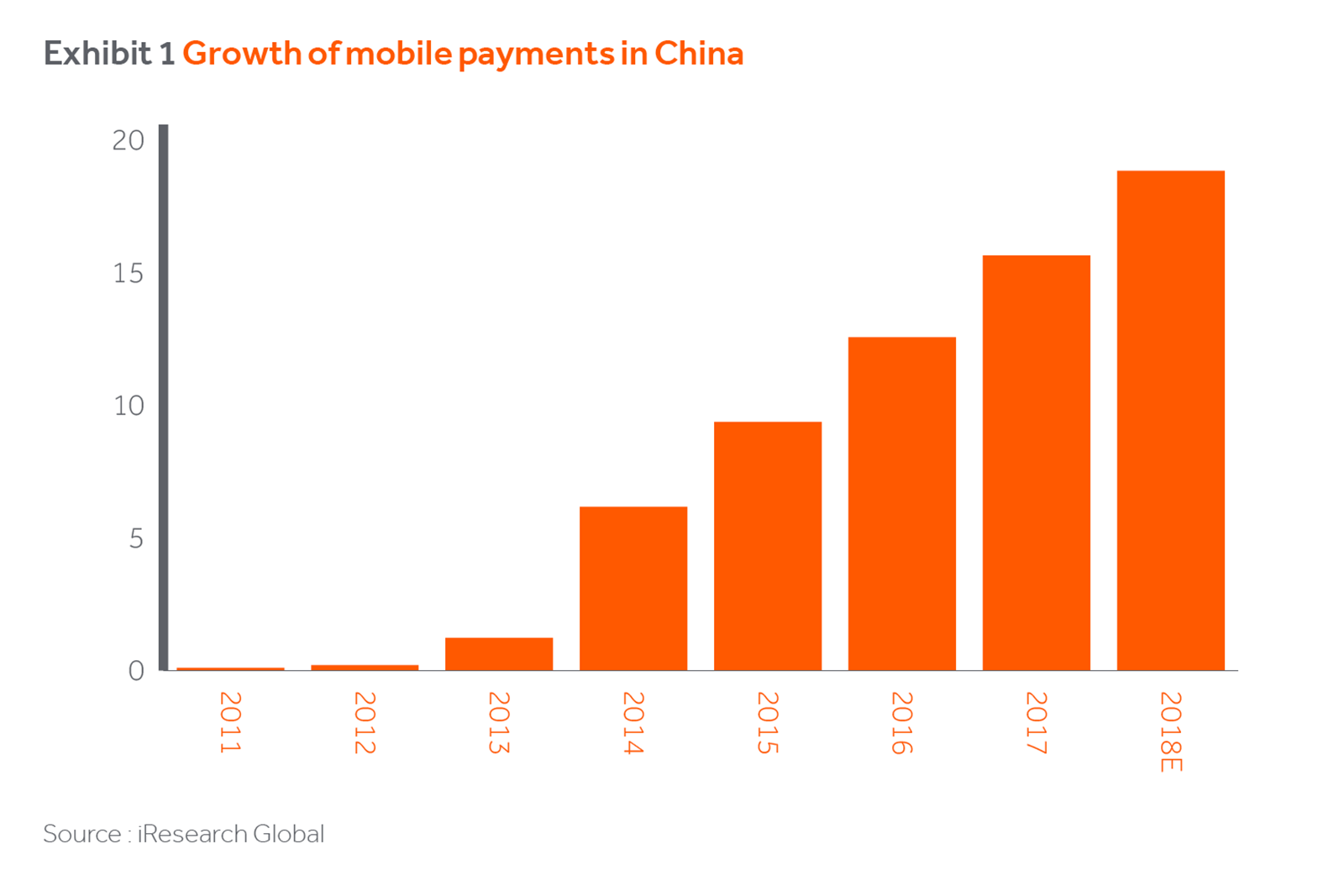

Forrester has recently valued China’s homegrown mobile payments sector at $5.5tn, fifty times the size of the US’s $112bn market. Dominated by local giants, Alibaba and Tencent, what was once local market competition has become global with both companies competing for the mobile payments business of Chinese tourists across the globe through partnerships with global airlines, accommodation and retail service providers.

Alipay, the online payments arm of Alibaba is now larger than Visa and MasterCard in total online transaction volumes. Alibaba’s Singles Day, on Nov 11th this year generated a staggering $25.3bn in sales. 90% of the transactions were done via mobile. In the busiest moments of the day, Alibaba was handling 256,000 transactions per second. This event easily eclipses the combined revenue of the Black Friday and Cyber Monday sales events in the US.

The ubiquitous availability of mobile payment solutions has changed the face of the consumer and retail business. When we look at branded consumer businesses to invest in, online channels have become increasingly more important, and now contribute disproportionately to sales growth overall.

China’s pharmaceutical market, worth $115bn sales in 2015 is number two in the world after the USA and continues to grow through innovation. Examples include contract research organizations such as WuXiAppTec offering innovative platforms for pharma R&D and also innovation in drug development, drawing upon the country’s huge medical needs (114mn diabetic patients and 700,000 new cases of lung cancer each year) and by employing 7,500 researchers, expanding its scope from pre-clinical testing through to clinical trials. Chinese drug companies are also taking innovative approaches to speed up drug development. BeiGene, for instance, has created an approach to accelerate drug discovery by using a proprietary system to test substances on human tissues.

McKinsey research found that the number of new locally developed drugs entering clinical trials increased from 21 in 2011 to 88 in 2016, a compound growth rate of 33%. The opening up of the regulatory environment by the China Food & Drug Administration has significantly influenced drug innovation.

In the renewables industry, China is becoming a world leader in developing clean energy technologies, filling the vacuum left by the US decision to withdraw from the Paris accord to limit climate change. Using innovative practices at factory level, companies such as JinkoSolar and Trina Sola, the world’s biggest manufacturers of solar panels, produce consistently high quality panels at globally competitive prices. Such companies are winning sales across some of the world’s fastest growing solar panel markets by adapting panels to the specific climate needs of each country, for example by manufacturing different types of panel for hot, humid or for moist, wet conditions.

By funding clean energy projects across Asia, East Africa and Eastern Europe, such as in the $1 trillion “One Belt, One Road” plan, China is of course developing economic and diplomatic relationships with countries that will ultimately become additional markets for Chinese goods.

China is also poised to take the lead in the rapidly growing EV (Electric Vehicle) industry. This really should come as no surprise as China has the largest auto market in the world, expected to grow from 28mn vehicles to 40mn in 2025. To cater for the demand from a population with rising per capita incomes and to prioritise its environmental plans, China has had to act sustainably. In 2016, 507,000 EV’s were sold in China, a 53% increase over 2015. Compare this to the 222,200 EV’s sold in Europe and the 157,130 sold in USA. Anticipating that EV’s will account for about 40% of vehicle purchases in 20 years, China has been steadily growing market share in the battery storage industry, leading the charge on battery cell manufacturing capacity that has more than doubled to 125 GWh and will most likely double again to 250 GWh by 2020. By that year, China’s global market share of global battery cell production will be 70%.

These industry examples have similar characteristics – being innovative with reduced dependence on imported technology and goods and having the ability to respond quickly to changing consumer needs. China benefits from the sheer size of its consumer market, and that helps companies commercialize ideas quickly on a large scale. China’s consumer class now numbers more than 100mn households and is expected to reach more than 200mn by 2025. For instance, Xiaomi, a manufacturer of mobile phones uses customers as collaborators in innovation, relying on their feedback to drive developments of its products.

R&D investment has achieved 18% compound average growth over the period 2006-16, expected to get very close to total USA R&D investment by 2020. Investment is likely to be higher than the USA after this date. In 2014, China spent $300bn on research, half of what the USA spends, but this is predicted to rise to $600bn by 2024 compared to $500bn within the USA. Patent applications within China have also increased dramatically, rising by 45% in 2016 with the country expecting to become the largest user of the international patent system within two years.

According to the Chinese bank, ICBC, there are 214 private companies in the world valued at $1bn or more known as “Unicorns”. Half of these are in the USA but 55 are in China. Of the Top 10 Unicorns, China has four with the USA having the balance. About 20% of these Chinese companies have made technology breakthroughs and the remaining 80% have been innovative in adapting their business models. The rate of new business growth in China is truly staggering. In June 2017, Premier Li Keqiang announced that more than 15,000 enterprises were registered every day on average and about 70% of these were active in business.

China’s march towards a technology powered economy will be fuelled by the use of big data, cloud computing and the internet. China’s consumers are tech literature and ready for innovative change. PWC estimate that AI technologies would boost global GDP by a further 14% by 2030, or $15.7 trillion. China will see a 26% boost to GDP by that time, the most in the world, with innovatory practices likely to boost productivity and spur consumption demand.

Whilst we can see that adopting innovation in China is a key enabler of strategic growth, we can also see this trend right across our growth markets. For any manufacturer, it is no longer sufficient to adapt developed market manufactured products to local market conditions through the deployment of cheaper parts and materials together with less advanced technologies and some local manufacturing. This no longer works as customers see such products as “dumbed down”. Over the last few years, we have seen impressive examples of growth markets taking the lead in locally generated innovation and in developing products and services that completely rethink the cost structures and technologies used together with a detailed and local understanding of consumer needs that can readily meet identified value.

We should not just think about local innovators but consider also the increasing number of growth market multi-nationals, defined as those companies who have the local insights, experiences and connectivity to operate successfully within other growth markets, something that developed multi-nationals find more difficult. According to Boston Consulting Group, the number of Asian companies with more than $1bn revenue increased six fold to over 1,000 from 2003 to 2013. In a similar period, the number of $1bn companies in Latin America, Africa & the Middle East doubled to 700.

These companies have the critical advantage of customer intimacy, access to a skilled and lower cost labor base and have an intuitive understanding of the disruptive pricing needed to be competitive. MNC’s will usually account for a dis-proportionate share of total R&D spending in the economy, which will in turn help to create an innovative environment. In China, Haier and Meidi, two of the largest homegrown white goods makers by leveraging local knowledge and skills are now dominating the local Chinese market at the expense of Japanese and Korean MNCs and are starting to export in their own brand names.

One of the key advantages these players have in Growth Markets is their ability to leapfrog to advanced technology or infrastructure without being hindered by legacy systems. Therefore, innovation enabled by insights, experiences and connectivity as well as by customer responsiveness can be that much faster. As Ernst & Young said in 2016, “Many companies in mature markets have more than 20 years ingrained cultures, mindsets, business models, and ways of working and, of course, technology landscapes that are not necessarily conducive to operating with an agile innovation approach”

When we evaluate potential companies to invest, their ability to innovate, in terms of technology, products or business model are increasingly becoming some of the most critical factors to consider. Innovation is not only important for successful companies to grow and prosper, as is happening to Alibaba and Tencent in China’s fast changing economy, it is increasingly becoming part of the growth strategy of these companies to “export” innovation and moving completely away from the association of “Made In China” together with low cost manufacturing practices.