The outlook for the Francophone West Africa (FWA) region continues to raise concerns. The collapse of oil prices in 2014-16 weakened one of the two regions that make up the area, to the point of driving new rumours about a potential devaluation of the CFA Franc. IMF programmes implemented in many of the FWA countries, (especially for CEMAC countries) coupled with a subsequent oil price recovery, have supported fiscal and external adjustment. As a result, the economic outlook may not be bright for many FWA countries but it has improved and furthermore IMF programmes implementation are starting to have an impact.

CEMAC: Challenging times ahead…

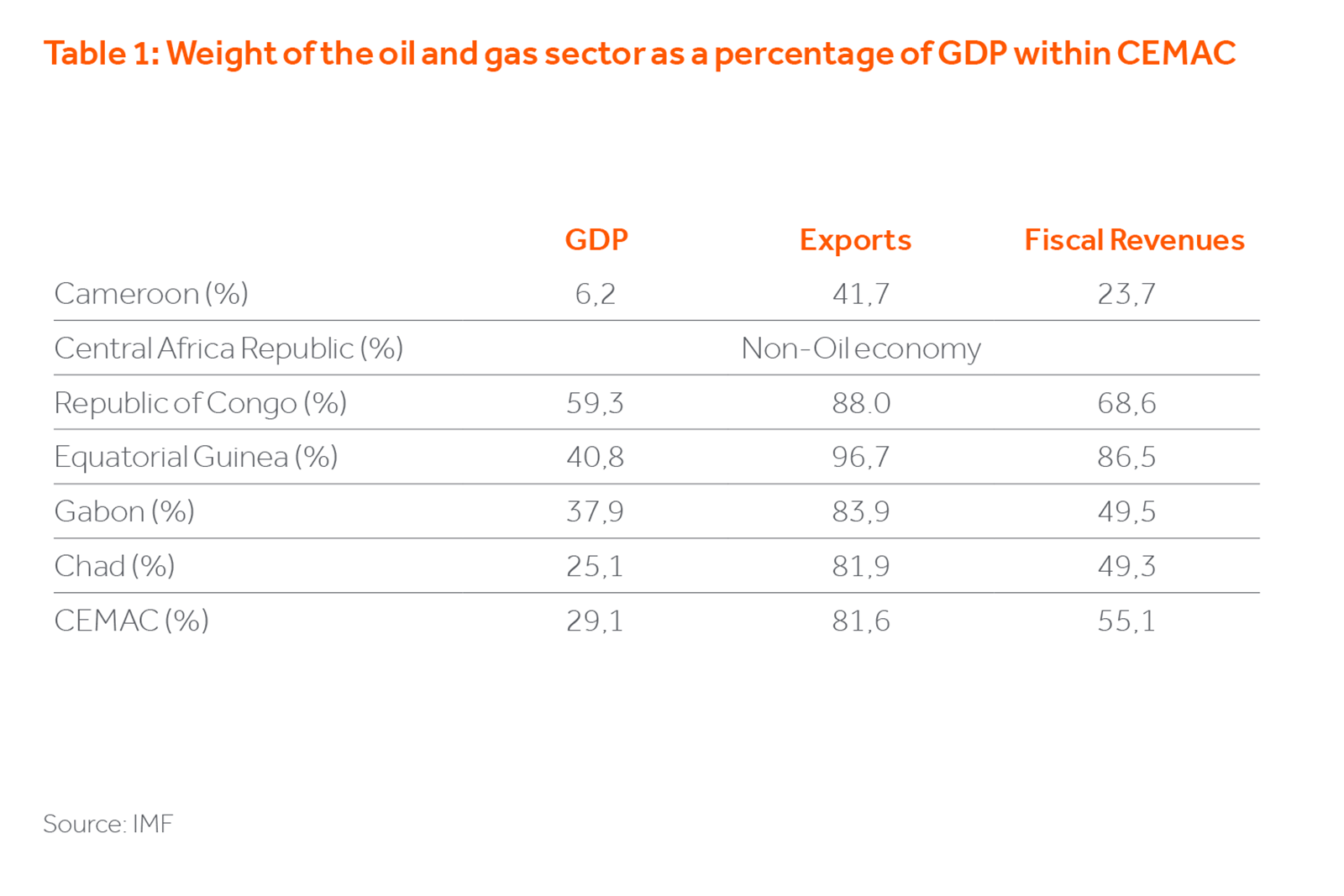

Of the six countries that make up CEMAC, five are oil producers, with Cameroon differing from others because of its more diversified economy. At CEMAC level, revenues generated by the oil sector accounted for 82% of exports and more than half of budget in 2014. In addition, many ambitious public investment programs were ongoing when oil prices collapsed, which accentuated the macro-financial crisis and the situation quickly became critical. Between 2015 and 2016, the CEMAC lost 2/3 of fiscal budget revenue and half of its export revenues. Despite a significant public investment contraction from 14% of GDP in 2014 to 8.4% in 2016, macroeconomic imbalances continued to widen. The regional budget deficit thus reached 6% of GDP in 2016 against 4.5% in 2014. The deterioration of the external position has been even more notable. From 1.5% of GDP, the current account deficit soared to 13% of GDP in 2015 before slipping slightly to 10% in 2016. At the end of 2016 reserves covered only 2.4 months of imports while the IMF sets the warning threshold at five months for fixed exchange rates economies.

Discussions were therefore initiated with the IMF to stop this downward spiral. Cameroon and Gabon quickly managed to sign multi-year funding agreements, while the Central African Republic and Chad, already under program, have seen theirs strengthened. Initial results are encouraging, FX reserves have finally stabilised in the CEMAC region thanks to higher oil prices and IMF support. The foreign exchange reserves for CEMAC have recovered to US$5bn at end-2017, up by US$1.3bn in the second half of 2017 (a 35% increase in six months). The recovery is mainly driven by Cameroon (reserves up US$ 965m since June 2017) and to a lesser extent Gabon (US$271m since June 2017), supported by continued fiscal consolidation efforts, the slight rising of oil prices, and disbursements from the IMF and other donors. The timeframe for the conclusion of IMF deals with Republic of Congo and Equatorial Guinea is unclear but if a deal is reached with one or both, this would improve the outlook further.

…but the region is starting to get its head above water

According to the latest macroeconomic forecast from the IMF published in January 2018, the outlook should continue to improve but many hurdles remain. The improvement of external liquidity at regional level mainly reflects that of Cameroon, whose contribution to CEMAC FX reserves stands at 55%, far more than its economic weight (40% of the CEMAC GDP). On the other hand, the contribution to CEMAC FX reserves of Equatorial Guinea is now almost zero and that of the Republic of Congo could zero rapidly, as the country continues to face a decline in foreign exchange reserves. Chad is in a similar situation and the country contributes little to the pool of reserves.

Without external funding in all CEMAC countries (Equatorial Guinea and Republic of Congo have yet to reach an agreement with the IMF), adjustment efforts needed to improve public finance are likely to be even more severe in the region, which would further impact an already weak economic recovery. Growth is back in positive territory but remains weak as spending cuts and domestic arrears constrain economic activity. Slowing economic growth is putting pressure on public finances. After two years of contraction in 2016-17, growth is expected at only 1.6% in 2018 before it accelerates to 3.2% in 2019, in line with population growth.

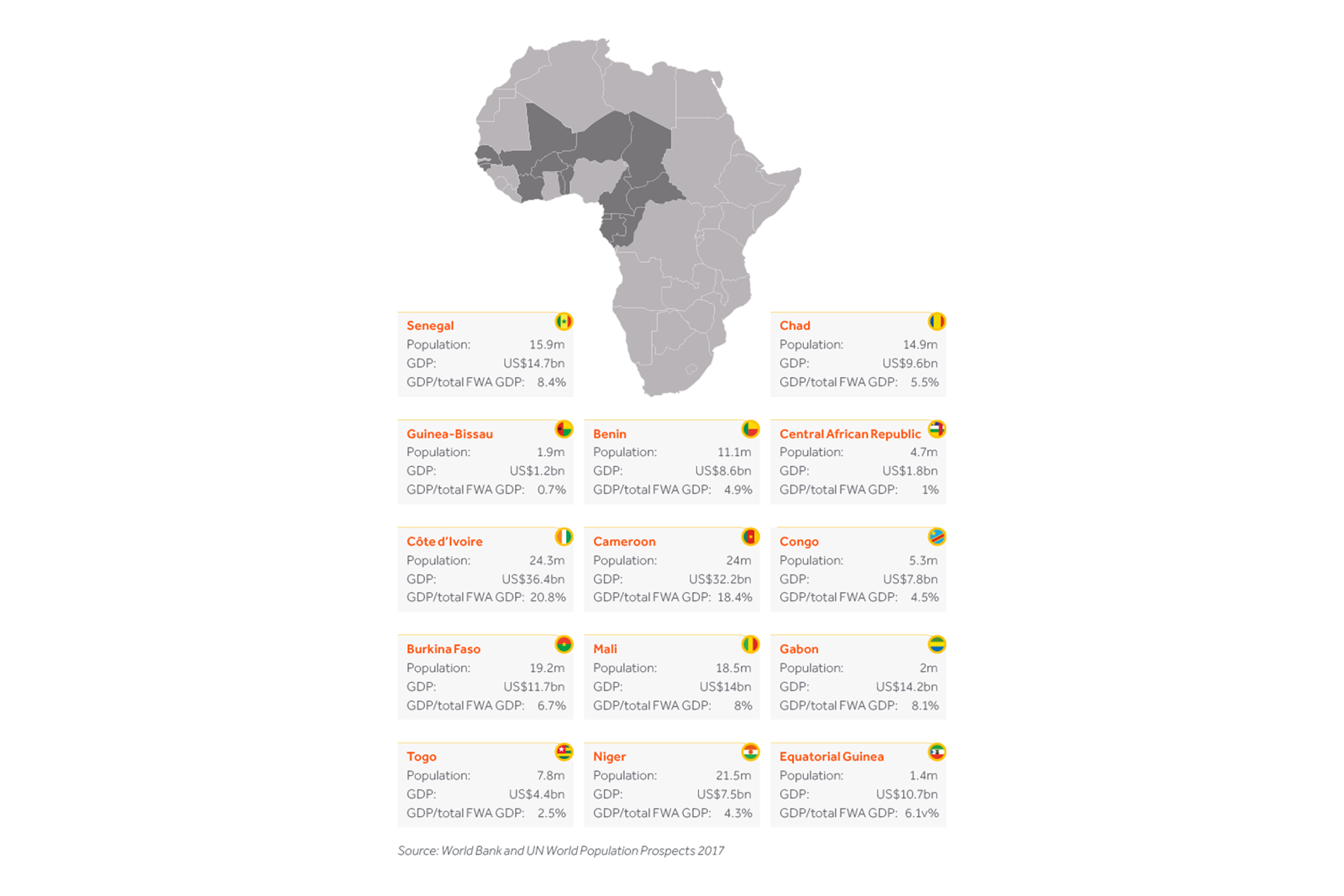

WAEMU: Successfully navigating through the downturn and holding steady in challenging times…

At a glance, there are green shoots of optimism for WAEMU. The regional growth rate has exceeded 6% in 2017, for the sixth year in a row. This growth is remarkable given the difficult context for sub-Saharan Africa, whose average growth rate (excluding South Africa) has been decreasing since 2015. The region was driven by recovery in the two main economies Côte d’Ivoire since the end of the post-electoral crisis of 2011 and Senegal. Growth has also remained solid in other countries despite the multiplication of tensions (insecurity in the Sahel, political transition in Burkina Faso and Mali). Unlike many African countries, WAEMU countries were not affected to the same extent by the downturn in commodity prices and the tightening of external financing conditions. Activity continued to benefit from the strength of household’s consumption (low inflation, high population growth rate) and new investment programs in infrastructure.

…However, the growth situation in WAEMU requires a cautious stance

At 9.6% of GDP in 2017, public investment in the region has never been so high and its progression has been sustained since 2011. WAEMU is one of the few regions in sub-Saharan Africa where investment continued to grow in recent years. These investment programs generated strong pressures on public finances and created growing macro-economic imbalances such as high current account deficits and unsustainable external indebtedness. In 2017, the regional budget deficit reached 4.8% of GDP compared with less than 3% in 2012. The current account deficit reached a historic high in 2017, at 6.8% of GDP, such levels were last seen during the financial crisis in 2008. Foreign reserves have been significantly restored, but at the end of 2017, expressed in US dollars, they were still 9% below their 2011 high. Reserves decreased from 6.6 months of imports of goods and services in 2011 to 4.2 months in 2017, slightly below what the IMF considers appropriate.

Cautiously Optimistic

Many key macroeconomic variables are to be improved within FWA (low banking penetration rate, depth of the capital markets), however, the ability of governments to strengthen tax collection is critical for the outlook of the region. From 42% of GDP in 2010, WAEMU’s public debt rose to 49.5% in 2017, except for Senegal, no WAEMU country has non-oil revenues accounting for over 20% of GDP, despite some significant progress made in recent years. The road to an effective tax collection is much more daunting considering the dominant weight of the informal sector in WAEMU and FWA in general. Without additional fiscal revenue, WAEMU countries risk having to readjust their investment program to reduce the pressure on external accounts, and thereby impact economic activity.

The situation is even worse for CEMAC with regard to financial distress which affects the region. CEMAC’ s public debt has soared since 2014, from 35% of GDP to 60% of GDP and the aggravation of the twin deficits weighs on the indebtedness of CEMAC countries. Although 60% debt to GDP may seem low by some developed market standards the limited tax base and low per capita income mean this is only supportable by external assistance.

We remain cautious of medium and long term intermittent risks for FWA and view mobilization of domestic resources as a critical component for the outlook of the region. Actis is one of the largest investors in Cameroon and is the Strategic Partner to the Government of Cameroon in ENEO, the national electricity utility under a concession which has been extended until 2031. Actis is also constructing Douala Grand Mall (DGM), the first world-class retail shopping experience in central Africa in Cameroon. Construction of Phase 1 of Douala Grand Mall (DGM) commenced in January 2018, consisting 18,000 m2 of lettable retail on two levels, with an extensive offer in fashion, lifestyle and services for all age groups. DGM is set to become the premier shopping destination in Cameroon. A ground breaking ceremony was organised to create awareness and leverage the start of construction to boost leasing, ensure government and public authorities support and show existing and prospective tenants progress on site while also giving reassurance on completion date. The ground-breaking event was placed under the patronage of the President of the Republic and under the mentoring of the Minister of Commerce. The government understand the importance of such a project especially because Cameroon’s formal retail sector, especially beyond the main urban centres, remains rudimentary. There is also an opportunity to introduce retail and fast-food chains (such as KFC) and entertainment facilities (such as cinemas) which we are providing within Douala Grand Mall.

Finding a credible franchisee is a requirement that could stall location in Cameroon from an international brand’s perspective. We have therefore engaged with many international retailers and are helping them in matching these retailers with prospective franchise partners (a prerequisite to their entry into Cameroon).

Investors here have the potential to be the first movers in the market and there is an underserved middle and upper middle class consumer in the market, offering opportunities for multinationals that move in early with competitively-priced quality products. Fast-food chains, modern retail centres and entertainment facilities are all untapped opportunities in Douala. In addition, there is also a need to build branded hotels to cater to foreign travellers and tourists – there is not a single branded hotel in Douala which is why we are currently accelerating Phase 2 of the project which includes a 4 star branded hotel and an office park.

Risks remain to the outlook and linked to the implementation of IMF programmes, security and politics. Cameroonian security forces have been fighting Boko Haram since 2014 in northern Cameroon and secessionist movements have taken place in the in the two Anglophone regions. These two issues come against the backdrop of presidential elections due by October this year.

1. The Economic and Monetary Community of Central African States (CEMAC) includes Cameroon, CAR, Chad, Republic of Congo, Equatorial Guinea, Gabon. Of the CEMAC states, five are heavily dependent on oil revenue with Cameroon being less dependent due to the more diversified structure of its economy.

2. The West African Monetary Union (WAEMU) has eight member states, Benin, Burkina Faso, Cote d’Ivoire, Guinea Bissau, Mali, Niger, Senegal and Togo.