Asia has been the prime beneficiary of the trend towards openness in international trade in goods and services and cross-border investments over the past half-century. So, is it consequently correct to argue that it will also be the biggest potential victim of this trend reversing?

The at least partial counter is that the region is increasingly trading and investing amongst itself which might suggest that over the longer-term there is potential for economic decoupling should America really seek a permanent and fundamental change in the nature of its trade relationships.

So independently of the long run outcome, nearer-term, Asia will certainly feel the pain should trade and investment volumes start to slow or even contract. Moreover, this pain is likely to be shared, not least by US consumers who in a higher tariff and re-localised production world, will find themselves paying significantly more for goods and services of potentially lower quality. This has implications too for inflation more broadly and hence the cost of servicing elevated debt burdens.

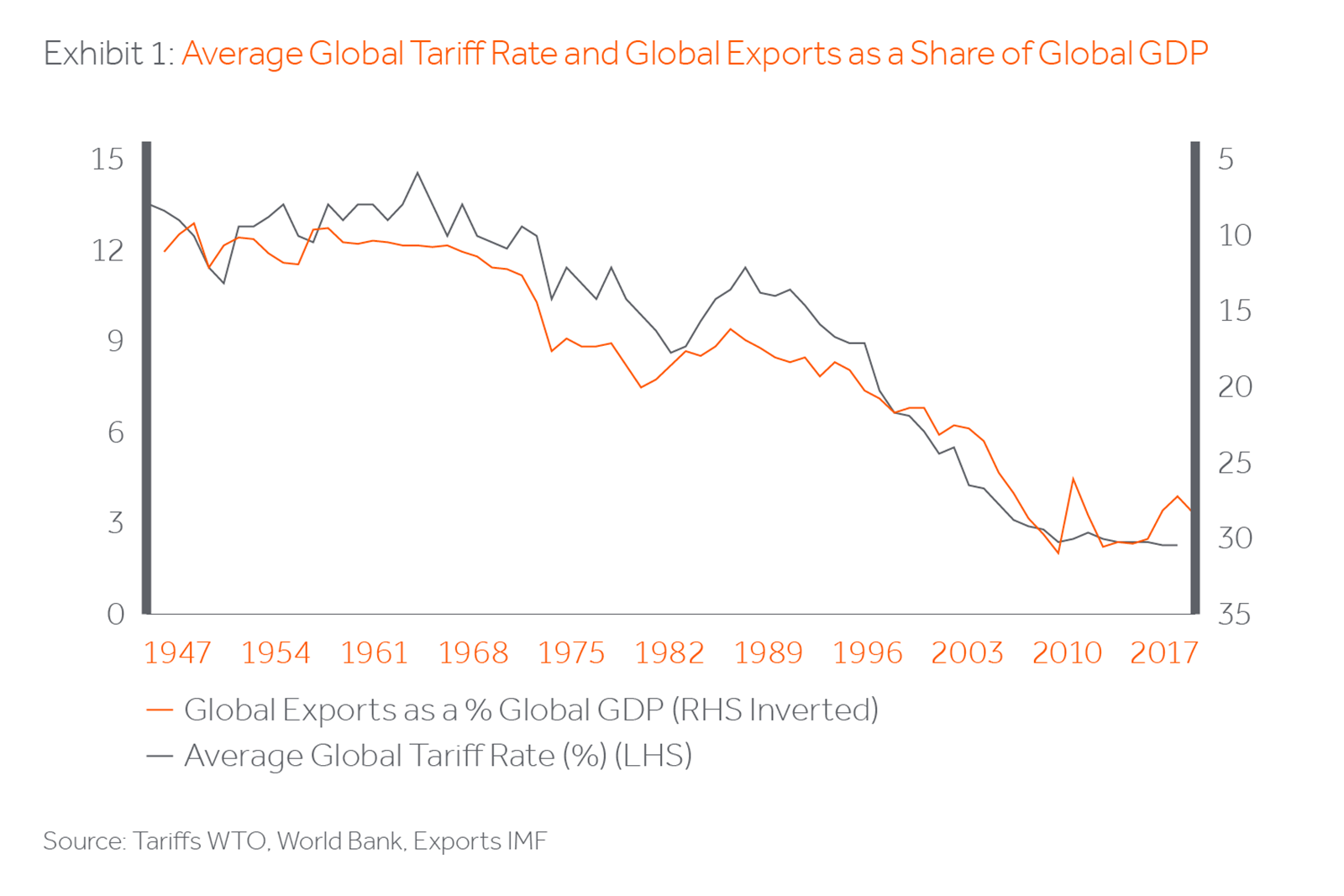

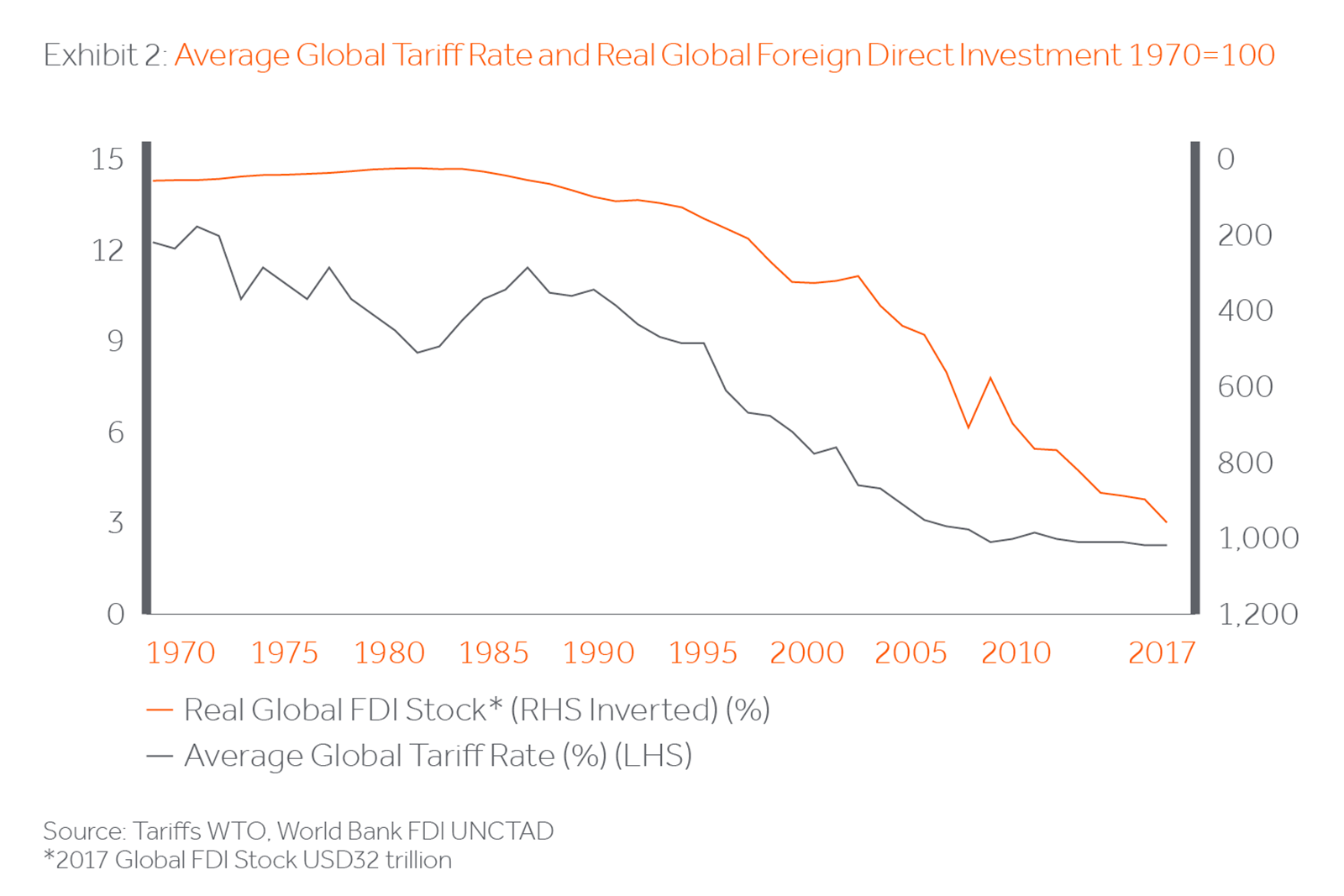

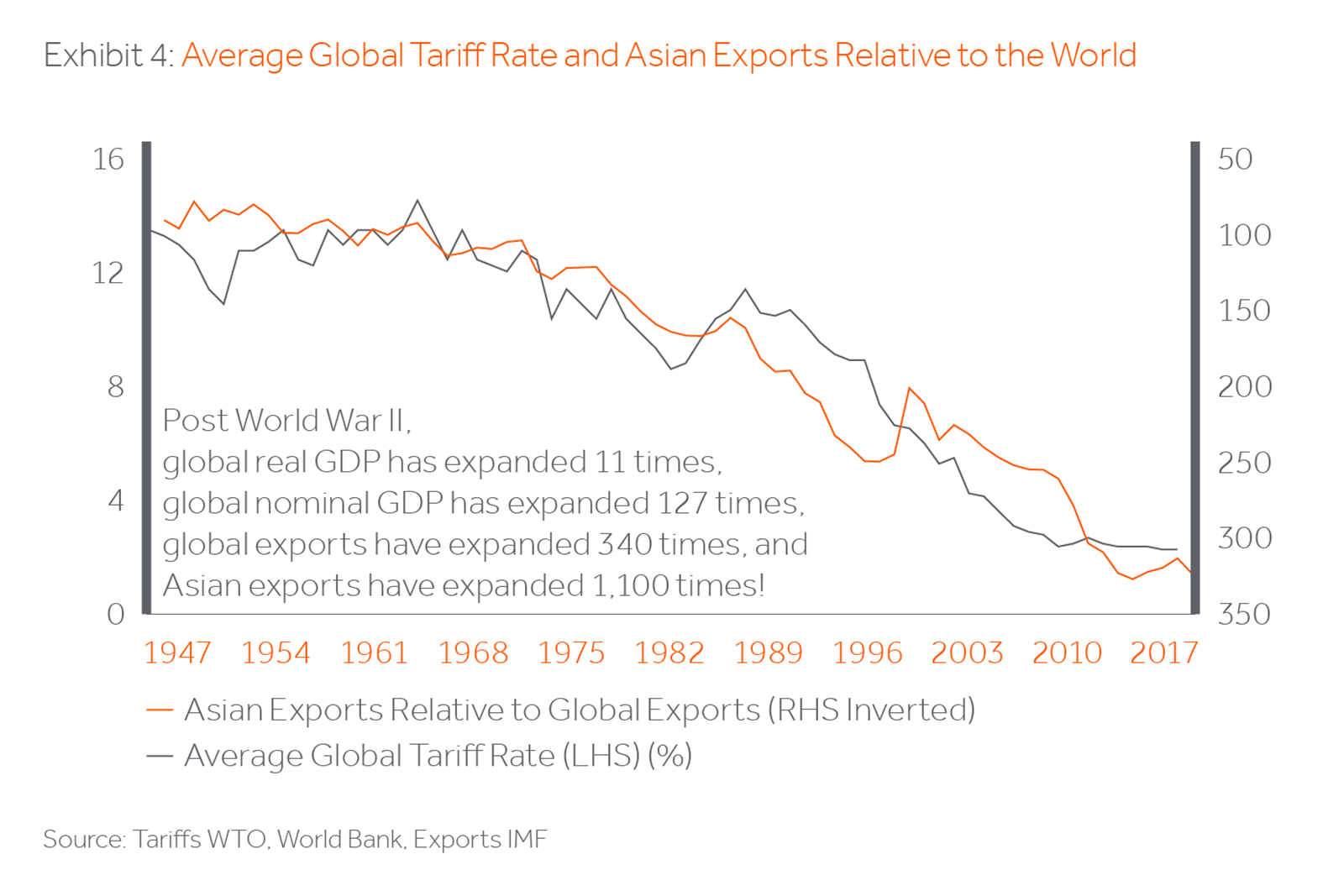

Over the last fifty years, the global economy has become increasingly open to international trade in goods and services and cross-border investments. Successive rounds of trade negotiations and agreements have resulted in progressive tariff reductions. Accordingly, the export share of global output and the global stock of foreign direct investment have surged.

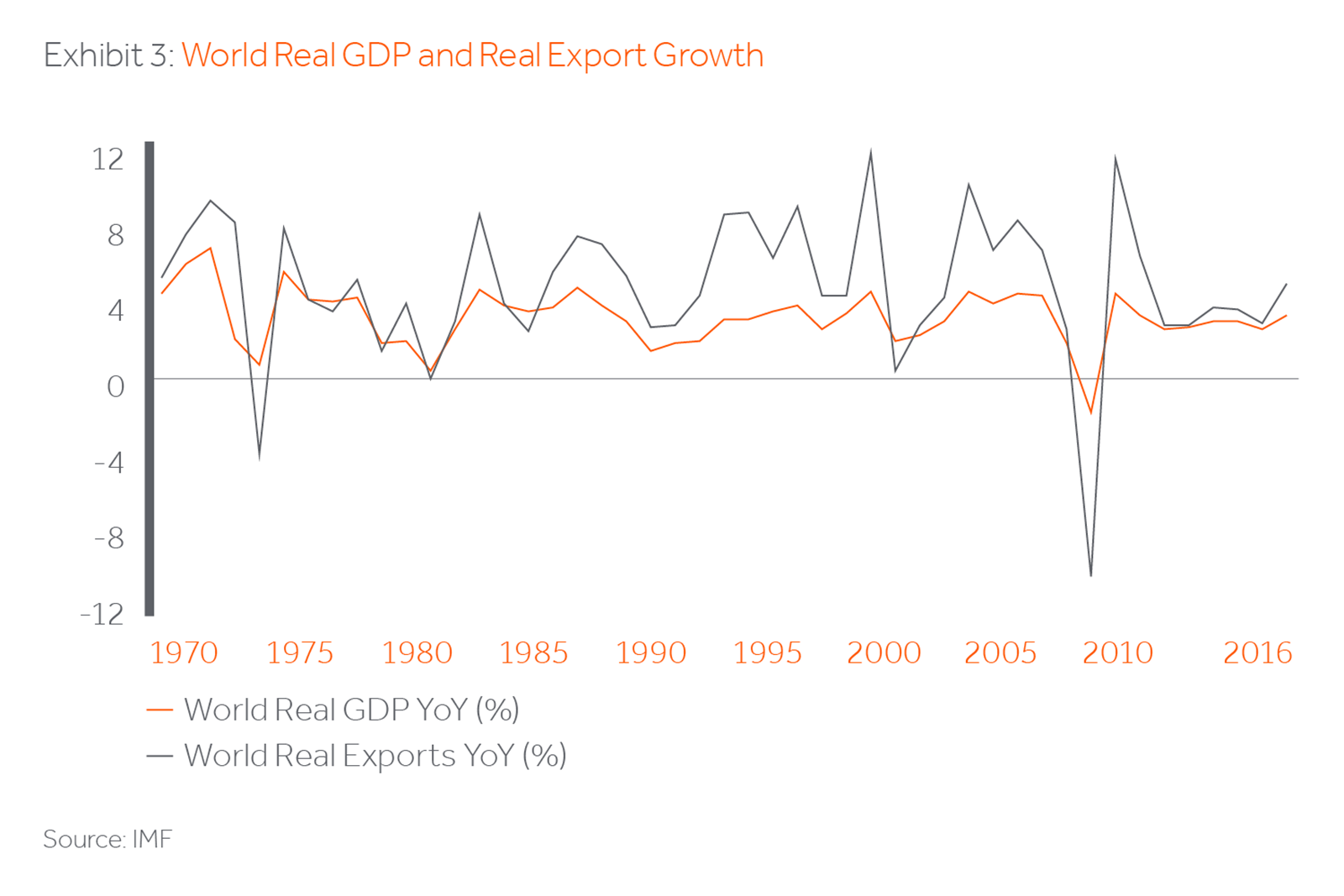

During this half century, the real rate of global trade growth has generally outpaced that of real global GDP, except during periods of synchronised global downturns.

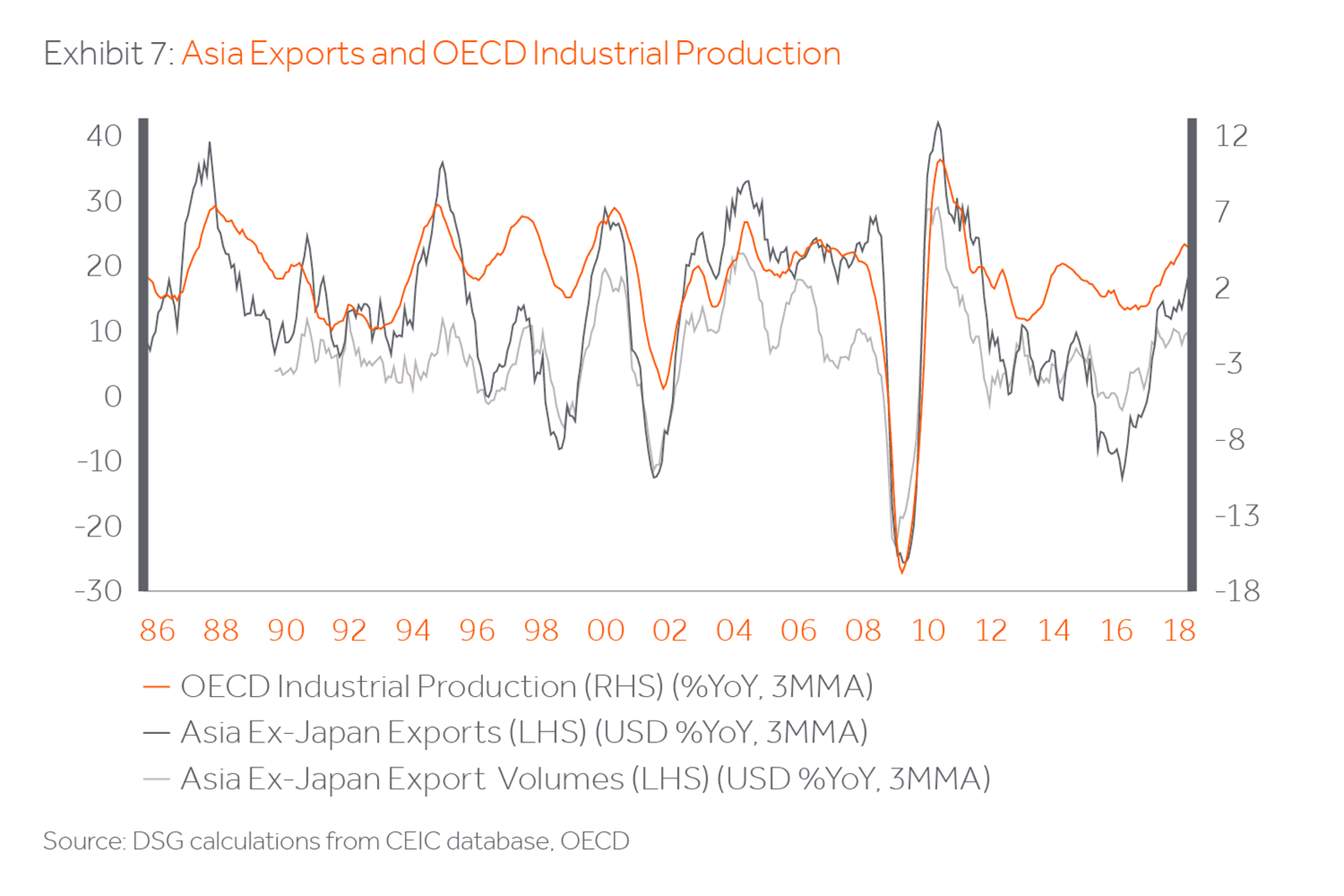

In the post-2008 environment, worries about secular stagnation and weak productivity growth have been accompanied by an extended period of tepid global trade growth. Correlation does not imply causation, but the GFC’s legacy has been one of unresolved bad assets, and international financial institutions constrained by regulation, which have both suppressed aggregate demand and restricted funding for real economic activity. The same constraints have also disproportionately impacted small and medium sized companies which are crucial and integral components of global supply chains.

And the longer-term returns from trade liberalisation have been far from evenly distributed. Asian economies, the focus of this article, have been the principal beneficiary of the freer movement of goods and capital having placed themselves at the epicentre of the emergence of increasingly specialised global supply chains and winning huge market shares in the process. Other major non-Asian economies such as Mexico and Turkey have also successfully plugged themselves into such networks, but for the vast majority of countries still hoping to emerge, such trends have largely passed them by. A cursory explanation for this divergence might revolve around variables such as openness to foreign investment, the ease and consistency of doing business, and the availability of skilled and flexible labour.

And whilst consumers in the developed world have, in aggregate, reaped the benefits of lower prices for internationally traded consumer goods, less-skilled and less-educated workers whose jobs have moved to other locations have also experienced an extended period of stagnant real income growth and a marked reduction in job security. The period of rising protectionist sentiment which has contributed to the electoral success of President Trump and others, stems at least in part from this sense that there have been “losers” from globalisation.

Since Asia has been the prime beneficiary of the trend towards openness of the past half-century, it is in consequence the biggest potential victim of this trend reversing. Positively, major economic risks such as out-of-control inflation, significant currency misalignments and major balance of payments and foreign debt strains are largely absent at this point, but the short-term pain will still be felt. To counter this threat, the region is increasingly trading and investing amongst itself which might suggest that there is potential for economic decoupling should America really seek a permanent and fundamental change in the nature of the trading relationship.

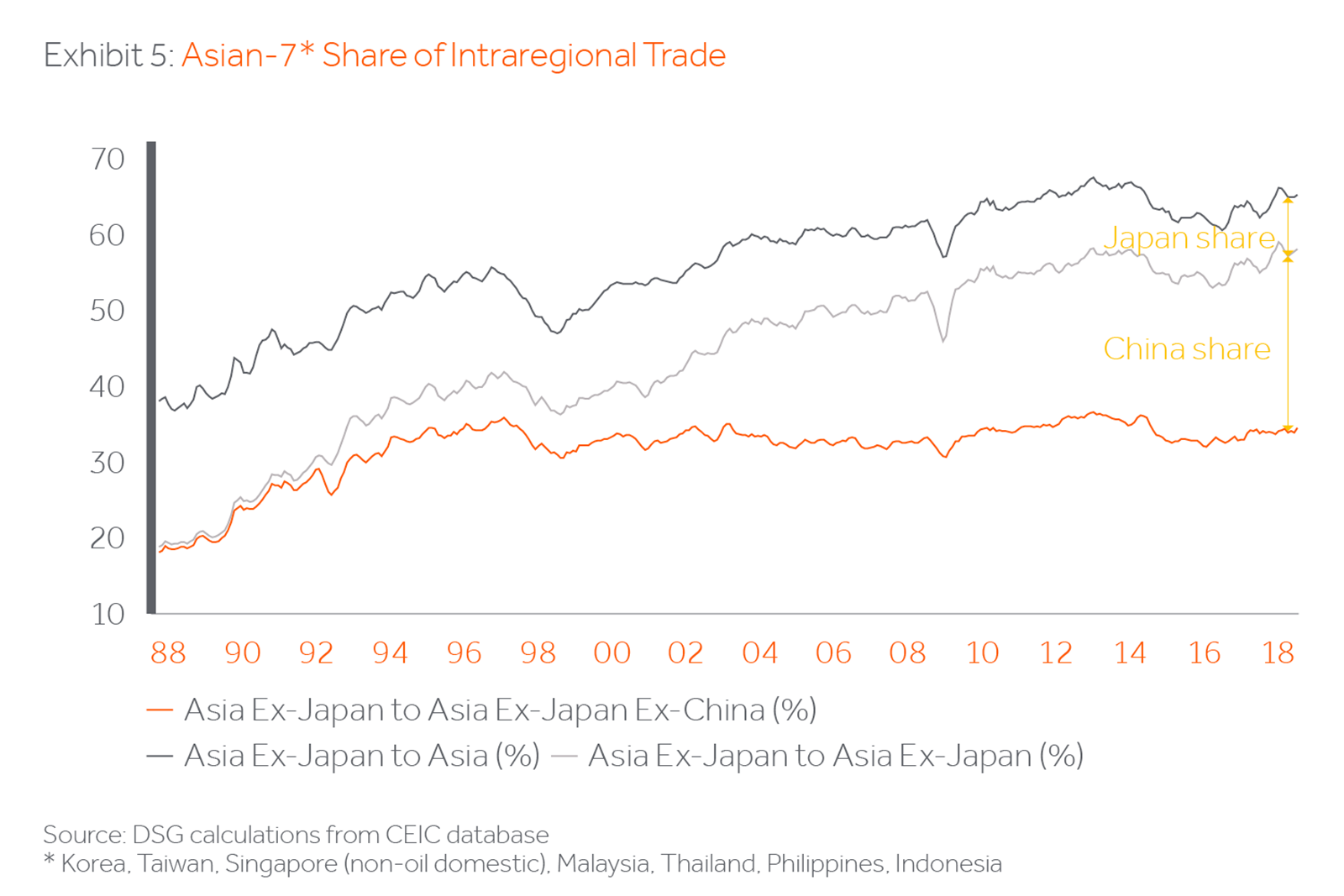

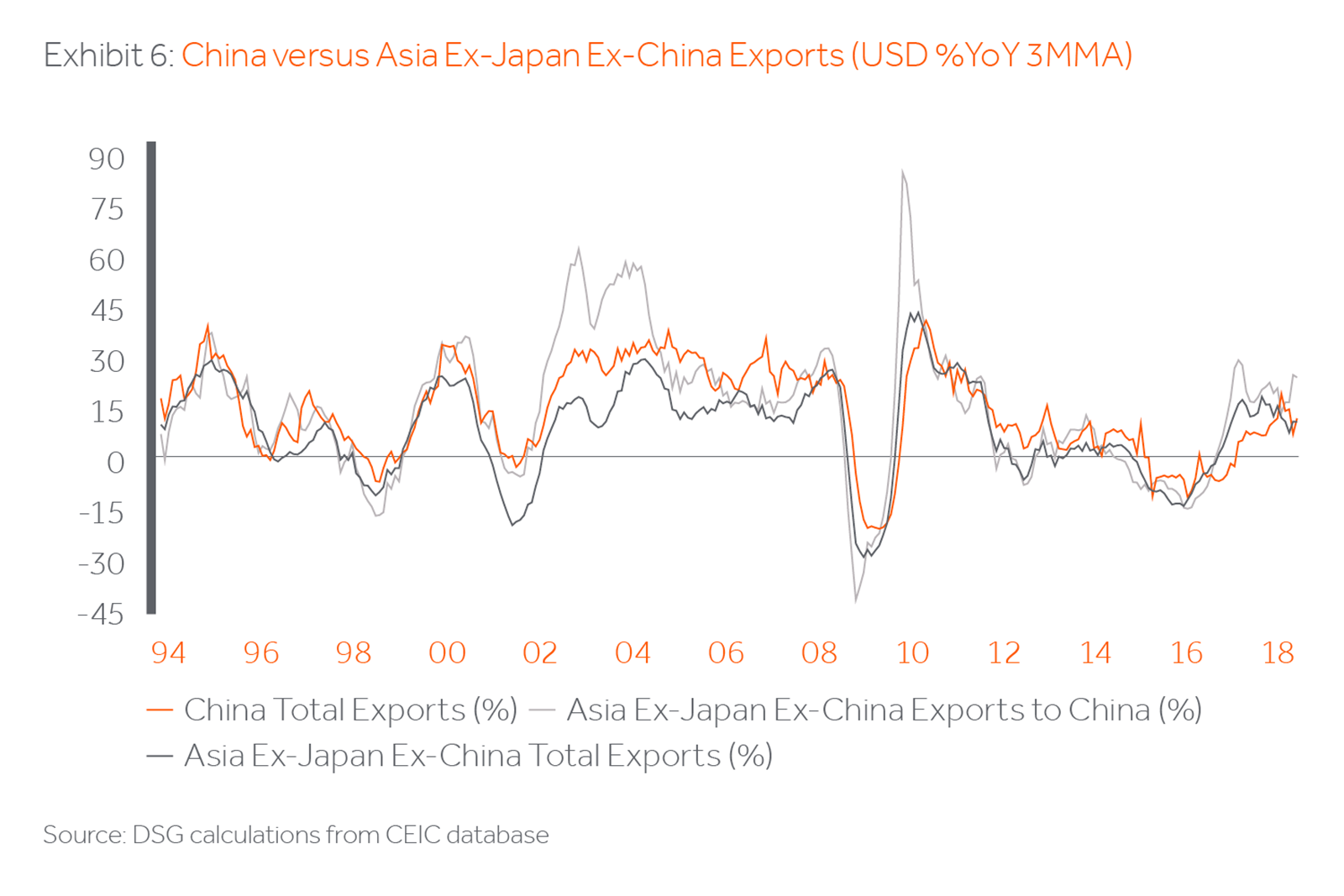

To declare that Asia will emerge largely unscathed would be a step too far. The charts below suggest that intraregional trade has been on a steady rise over the past three decades, and the importance of trade with China has grown especially fast. However, the reality remains, for now at least, that the majority of this growth in intraregional trade has been associated with the increasing disaggregation of the global supply chain. Were true decoupling being witnessed, one might expect to see a marked divergence between Asia ex-China export growth to China and that to the rest of the world. But as the charts suggest, traditional linkages would appear to hold firm for now.

Indeed, Asian exports continue to live or die by the vacillations of the global production cycle and should this be interrupted by either a cyclical downturn in developed world demand and/or regulatory and tariff interventions that deliver the same, the region will again feel the heat.

To be fair, the region has been trying to wean itself of its dependence on developed world demand. Notably China has been attempting to rebalance its economy away from an over-reliance on investment and exports. Although China’s fixed capital formation-to-GDP rate remains historically elevated in excess of 40%, exports as a share of annual output have fallen from a third to around a fifth over the past decade.

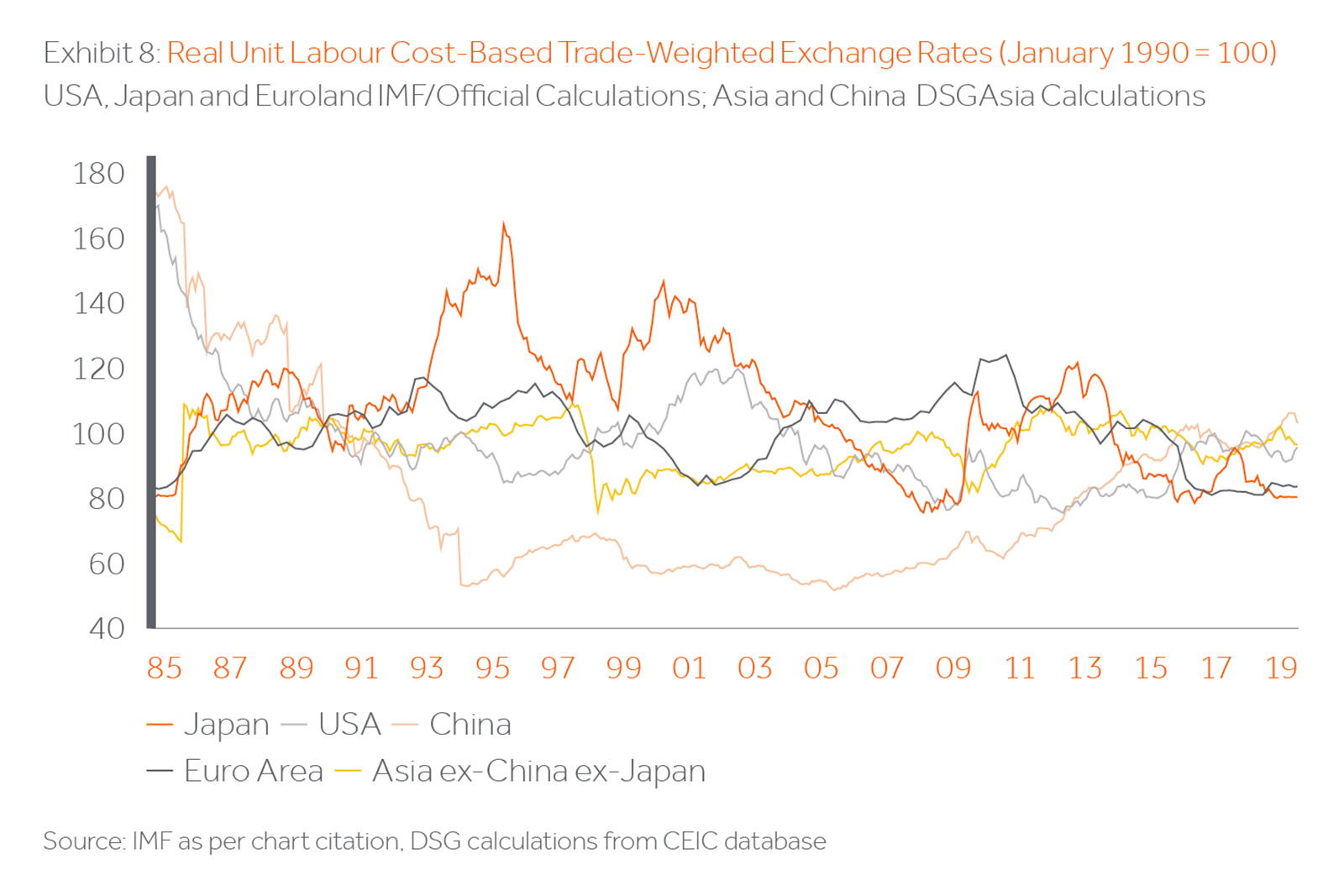

Many of the accusations being levelled at China concerning its mercantilist trade practices, its theft of intellectual property, and its policies to force technology transfers are not wholly without merit. Nevertheless, manipulation of an undervalued exchange rate is a story whose time has come and gone. Partly in response to international pressure, and partly in an attempt to force Chinese producers to move up the value-added chain, the Chinese Yuan or RMB has been allowed to appreciate significantly to the extent that it is probably more overvalued than undervalued these days. And while the bilateral US-China trade deficit continues to yawn, the PRC’s overall current account surplus has all but disappeared.

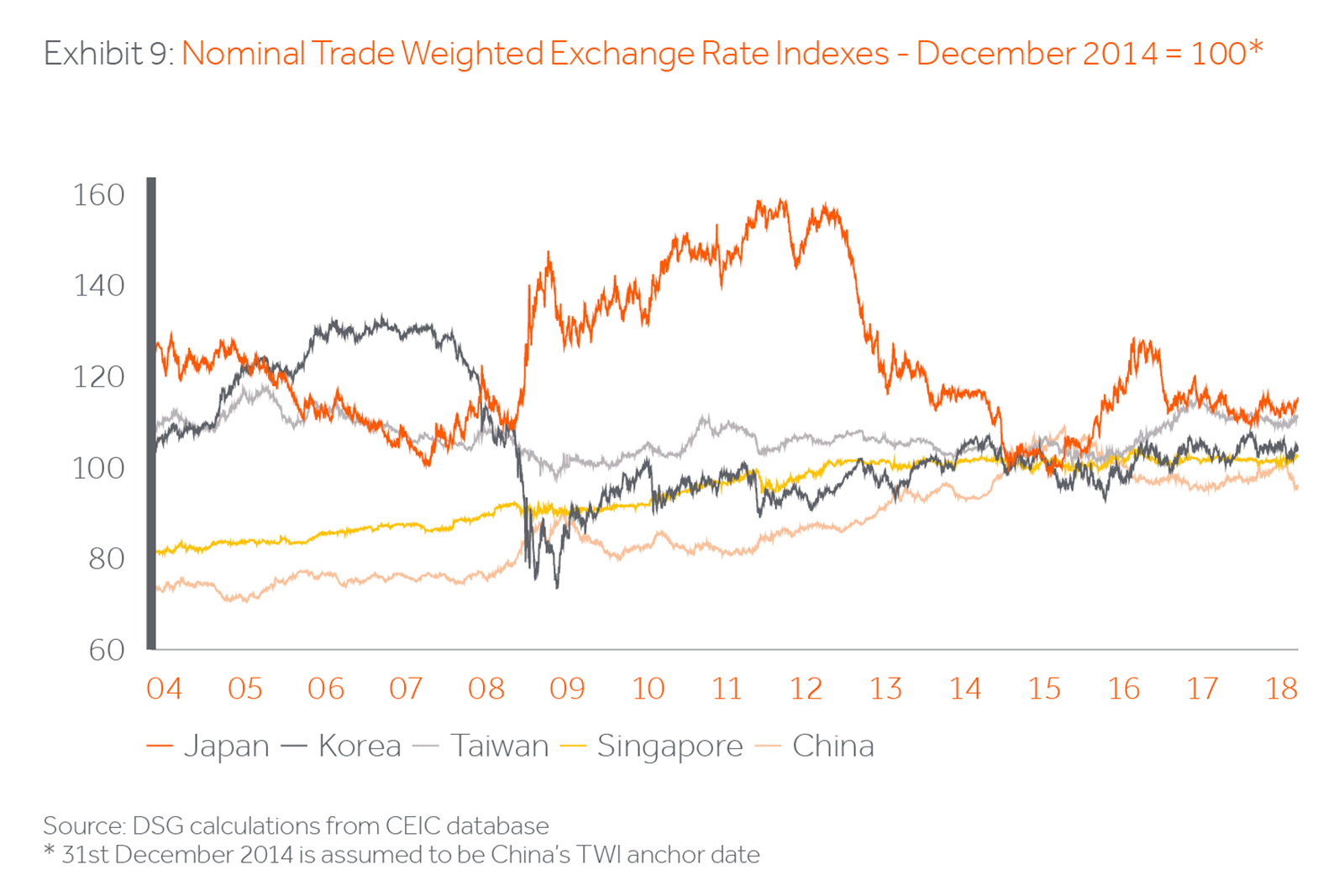

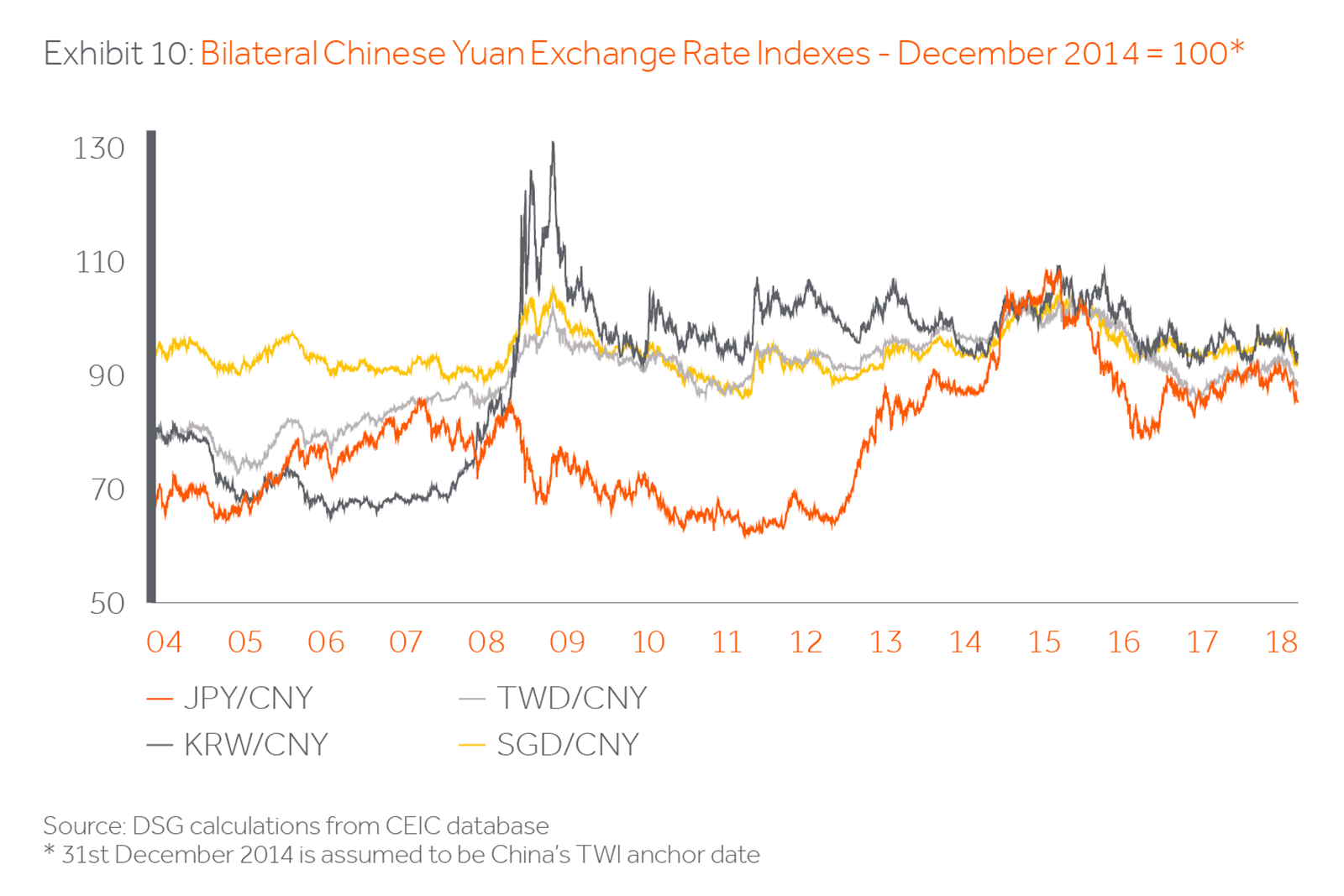

The rather more freely-floating RMB may still be far from fully convertible, but China’s heft in global trade flows means more of its neighbours are having to take greater account of its movements in calibrating their own exchange rate policies. Since the middle of the decade, Beijing has increasingly managed its currency against a nominal trade-weighted basket as opposed to the bilateral CNY/USD. Traditionally, this was a form of exchange rate management pursued (in a somewhat different manner) by only Singapore, but increasingly Japan, Korea and Taiwan are giving additional weight to currency movements within north Asia. In short, the RMB is assuming increasing importance relative to the USD in terms of economic and financial risks in Asia.

The question arises as to whether the RMB’s recent fall against the USD and against its own TWI basket is an attempt to re-weaponise the currency and act at least as a partial offset to higher American tariffs. The near-term evidence suggests that the downward move in the RMB has been more market driven and like many other moves across Asia, more a reflection of generalised dollar strength. Nevertheless, if Beijing were to put the currency properly into play, it would be a dangerous game which could invite further US retaliation and destabilise markets more generally. As noted above, China no longer runs significant surpluses on the current account balance of payments, nor indeed on the direct investment account albeit, Chinese outward investment has again become more constrained in recent times. In the absence of a significant robust balance of payments cushion, a country needs to both rely on shorter-term international capital flows and on its own population keeping its funds onshore. A weaker RMB could potentially feed on itself if locals players seek to hedge against further expected depreciation.

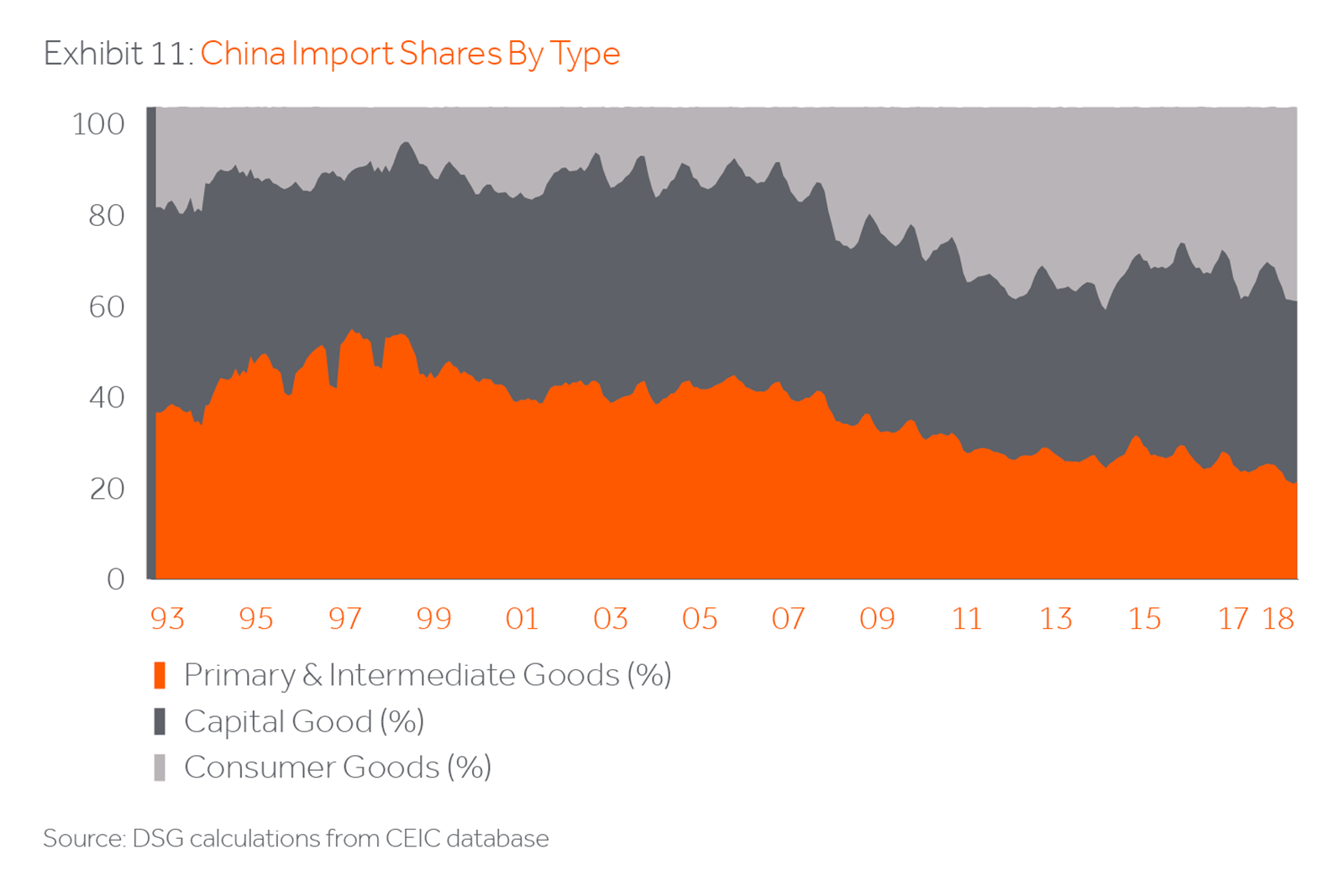

Currency matters aside, as the PRC’s productive capacity has moved up the value-added chain, so its import share of production inputs have fallen and that of final consumption goods have risen accordingly. This shift has not as yet been sufficient to meaningfully impact overall final intraregional demand patterns, but the direction is encouraging.

A similar story emerges on the intraregional services side. Local Asian banks are increasingly funding local trade finance and cross border investment deals, while intraregional tourism is also steadily on the rise as Exhibit 12 suggests. Furthermore, as Asian consumers become wealthier and more sophisticated, so they will increasingly seek to travel as higher-spending individuals rather than on lower-yielding group tours.

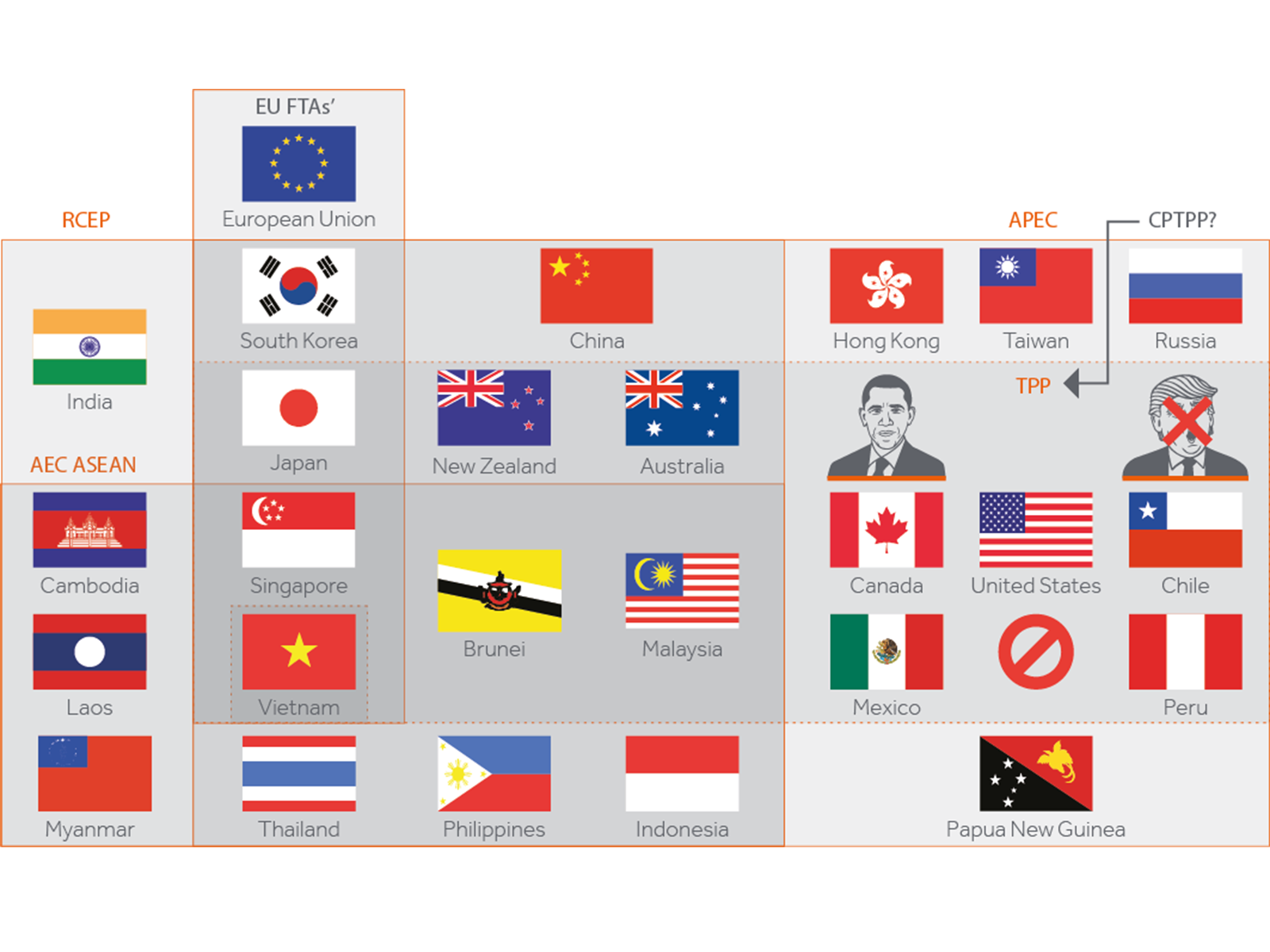

Finally, although the Trump administration seems minded to withdraw from international trade agreements and aggressively employ tariffs in an attempt to divert trade flows, much of the rest of the world, and Asia in particular, continues to seek broader trade and investment integration. The region continues to push for the consummation of Transpacific-Pacific Partnership (TPP), now rebranded after America’s withdrawal as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). Meanwhile China continues to champion its own Regional Comprehensive Economic Partnership (RCEP) grouping. The quality and substance of these various initiatives may fall short of the lofty declarations of their protagonists, but their continued pursuance is arguably rather better than the alternative of trade re-atomisation.

Copyright © DSGAsia, DSG Asia.

This report has been prepared from sources and data we believe to be reliable but we make no representation as to its accuracy or completeness. Additional information is available upon request. This report is published solely for information purposes and is not an offer to buy or sell, or a solicitation of an offer to buy or sell any security or derivative. This report is not to be construed as providing investment services in any state, country or jurisdiction where the provision of such services would be illegal. Opinions and estimates expressed herein constitute our judgement as of the date appearing on the report and are subject to change without notice.

The price and value of investments mentioned herein, and any income which might accrue from them, may fluctuate and may fall or rise against an investor’s interest. Past performance is not necessarily a guide to future performance. This report has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this report and investments discussed may not be suitable for all investors. Investors should seek financial advice regarding the suitability of investing in any securities or following any investment strategies discussed in this report. If an investment is denominated in a currency other than the investor’s currency, changes in the rates of exchange may have an adverse effect on value, price or income. The levels and bases of taxation may also change from time to time.

DSGAsia is a trademark of DSG Asia Limited.

The Trade Agreement Matrix