South Africa is the only African country that is a member of the G20 group of advanced nations. As the second largest economy in Africa its fortunes are important both for itself, surrounding countries and general EM sentiment.

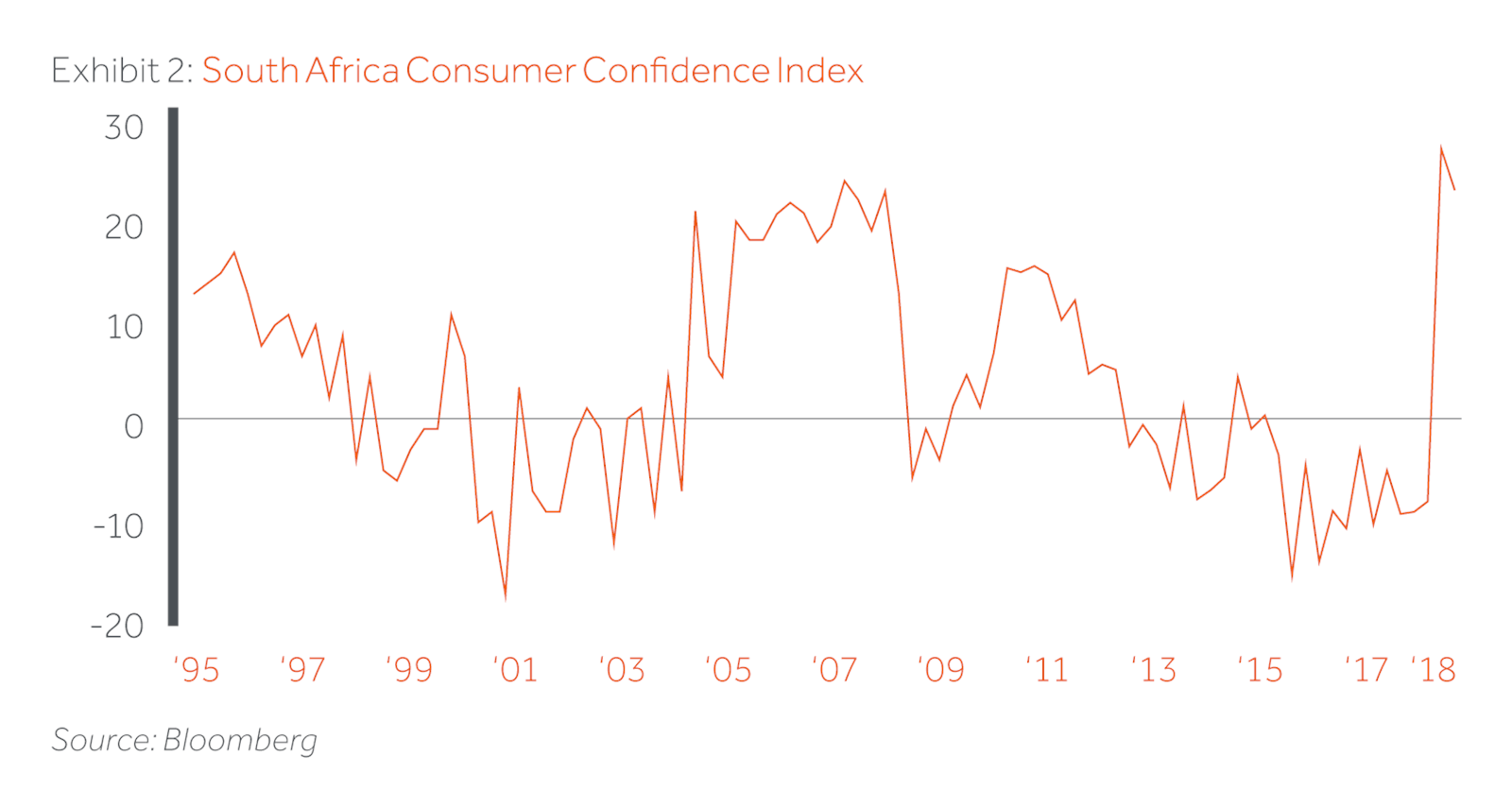

After strong progress in the immediate post-apartheid era, the economy and currency stumbled under the leadership of Jacob Zuma. The landscape altered dramatically with the hairpin election of Cyril Ramaphosa in December 2017 and the promise of a wholesale clean up. The rand strengthened along with expectations of future growth. Yet ‘Rama-phoria’ has since given way to ‘Rama-reality’ in a climate of economic turbulence and growing impatience and uncertainty on the ground. A critical election is due before the end of May 2019. Meantime, as general EM volatility rises, the country’s dependence on portfolio flows to finance substantial twin deficits simply adds to uncertainty.

With this in mind, we recently convened a brains trust of Actis investment professionals drawn from across our energy, private equity and real estate franchises. We took time to pool our thoughts drawing on our local knowledge and the experience of our portfolio companies. This ‘Street View’ drawn from nine corporates employing over 30,000 people throws up some interesting contrasts with the general macro gloom.

So what’s the problem?

Our primary concerns are the lack of growth -in the economy, in productivity and in tackling deep problems of inequality and poverty. In 2018 South Africa dipped into recession with the economy shrinking by 2.6% in Q1 and a more modest 0.7% in Q2. Whilst some recovery is expected after the drought impacted H1, estimates for 2019 stand at a tepid 1.4%, insufficient to tip the balance of per capita growth into positive territory. This continues the lacklustre trend of recent years with the last year that GDP exceeded 2% being back in 2013. Breaking out from here requires tackling structural reforms head.-on including the inefficient state-owned sector and an inflexible policy mix.

Agriculture, struck down by recent droughts, should see recovery, yet stagnates in part because of uncertainties over the application of ANC land ownership reforms. Land reform is a pressing issue in the challenge of tackling inequality. Ramaphosa’s March 2018 announcement that he intends to accelerate land reform by instituting expropriation without compensation raises important questions. Soon after the March announcement Ramaphosa made early attempts to calm investors with statements claiming that applying land reform in practice will not hinder food security, growth and stability. This ongoing pattern of trying to calm investors was illustrated with the recent statements to the visiting German president that “There will be no land grabs. Investors should have no fear”. However as long as lack of policy and implementation clarity remain, investor concern will remain.

Fixing underlying structural issues after a decade of misallocation takes longer than the attention span of many public market and currency investors. Yet progress is hampered by Ramaphosa’s perceived lack of a full power base within the ANC, plus pre-election harrying by the opposition EFF and Democratic Alliance parties. This makes the election a crucial point along the road, and we expect Ramaphosa will accelerate progress after the poll.

Cleaning the Stables

First up in the line-up of reform progress is addressing the problem of ravaged state-owned companies. Ramaphosa instituting commissions of enquiry and appointing new boards is central to progress. The recent replacement of Revenue Services Commissioner, Tom Moyane, who has been named as a key figure in State Capture (translation rake off) is a case in point, as is the resignation of Home Affairs Minister Gigaba. Our expectation is that reforms in this area will reduce fiscal leakage and improve overall productivity, albeit that such benefits will take a while to emerge.

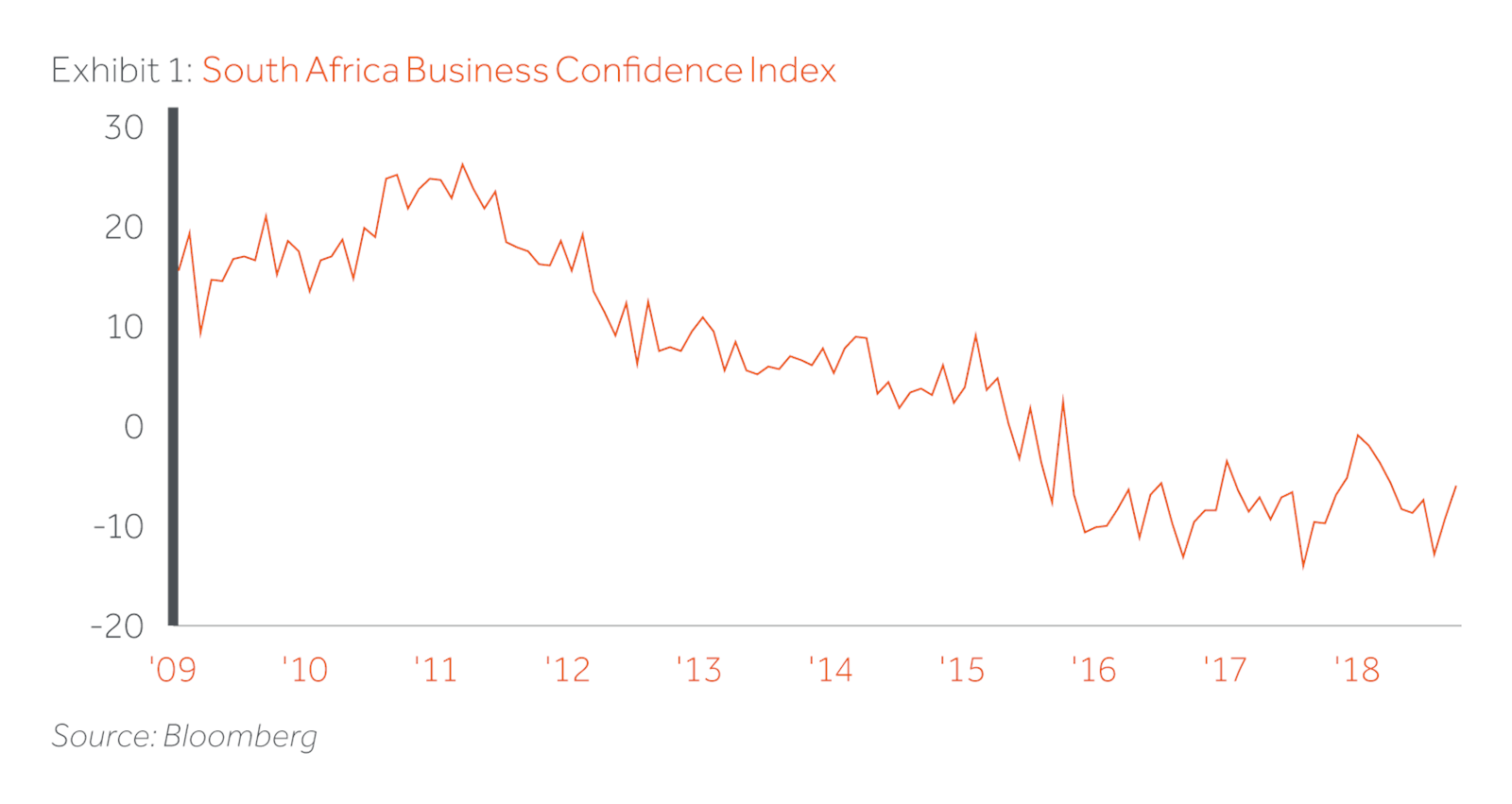

Other current and future measures focus on stimulus and investment, positive in themselves but with considerable implementation time lags. September 2018’s Economic and Stimulus Plan includes measures on visa reform to attract skilled workers, finalising the mining charter and increasing telecoms broadband spectrum allocation. It also calls for reallocation of existing budgets rather than increased spending or borrowing, hardly surprising given a fiscal deficit approaching 5% of GDP and ever-increasing social welfare liabilities. A well-publicised investment conference in October 2018 led to announcements of an extra R290 billion in private sector investment commitments as well as an additional R400 bn pledged by local and international businesses. Our strong sense is that such uplifts only arise in practice as business confidence recovers and are Macro Forum insights and perspectives hence intertwined with governmental and election progress.

Emerging Market Tensions don’t help

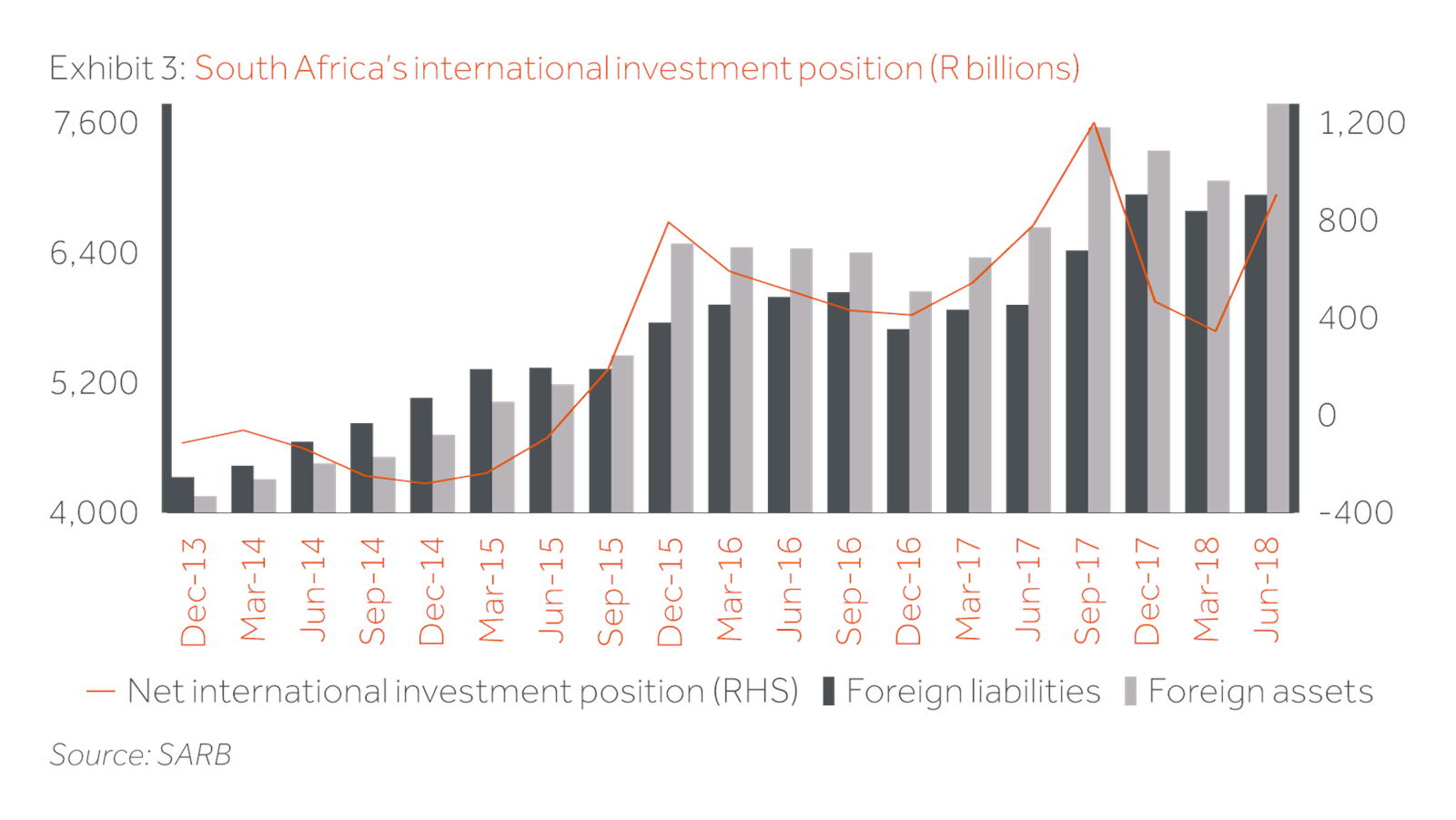

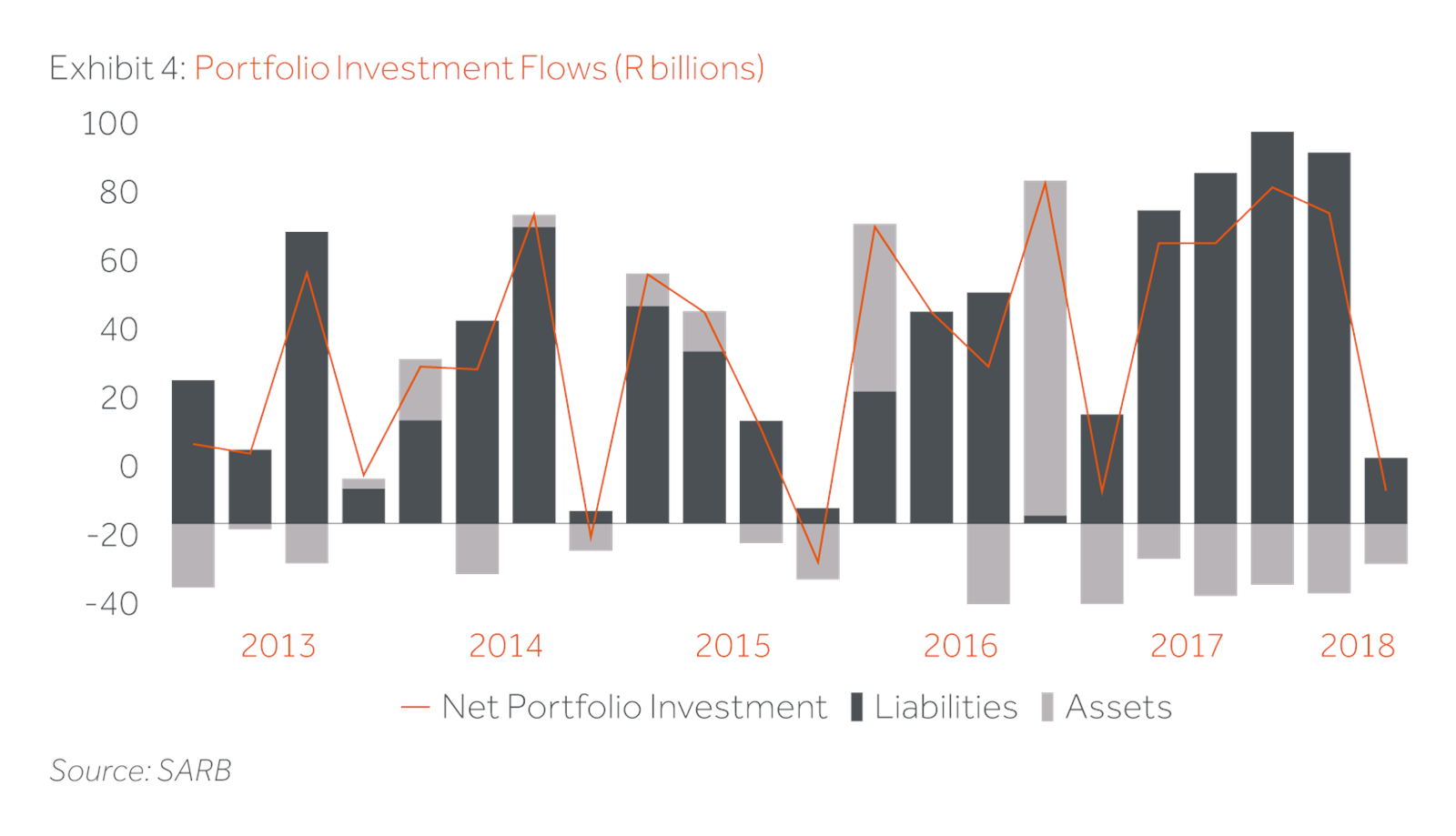

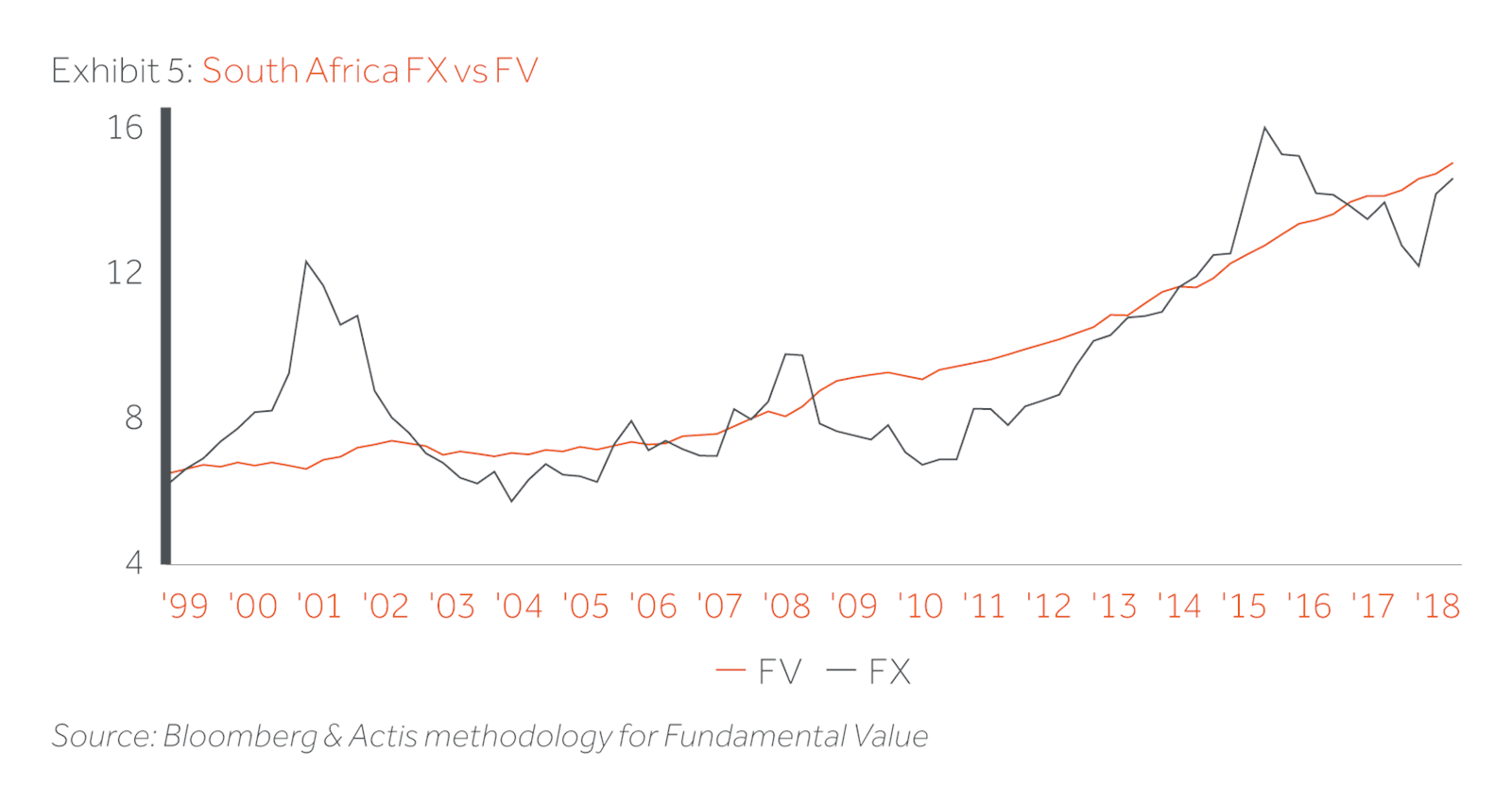

Rand volatility seems to be an ever-present factor impacting borrowing costs, confidence, hard currency returns and inflation. Some of the swing from 11.55 to the US dollar in February to a low of 15.42 in September and back below 14 as year-end approached stems from endogenous sources. In addition a considerable part is also down to the drop in global investor sentiment towards Emerging Markets in general and in particular those reliant on portfolio flow funding. South Africa is vulnerable to reversals in portfolio flows given that 41% of the government bond market is foreign owned and foreign direct investment only represents around 20% of total inflows. That said with an average duration of 12 years in government debt and less than 10% of all debt foreign currency denominated, South Africa is hardly a Turkey or Argentina. Our bottom up experience is that corporates are acutely aware of risks on hedging and timing relating to investments as are we.

Our direct experience is rather better-The key Street View

We place a great deal of emphasis in our views on what we see bottom up-the “Street View”. Our investment teams’ constant conversation with portfolio companies reveal some important differences with headline gloom.

Our Private Equity investors note continued international interest in well invested South African PE portfolios. Despite the consumer being under pressure, we are seeing growth in the furniture and appliances sector and some up-tick in same store sales in our retail business. Market leadership positions are being rewarded, with CSH our credit bureau company seeing earnings growth of over 20% this year. A recent exit from Tracker, Africa’s leading provider of data analytics solutions for the personal auto and fleet telemetrics markets illustrates that genuine value can be created for investors in US dollars despite unpromising macro conditions.

In energy we believe that the close of Round 4 renewables deals and the August issuance of the draft Integrated Resources Plan (‘IRP’) for public comment represent an unpicking of the Zuma log jam. The draft IRP outlines a future based on a least cost basis, cutting proposed nuclear developments, reducing reliance on coal and increasing renewables, gas and possibly storage technologies. While the domestic energy supply sector suffered several years of pause in adopting alternative power sources, we now see moves towards the next round of renewables bidding and an active secondary market with both foreign and domestic interest in operating assets.

Our real estate investment team faces a challenging environment with uncertainties over land reform and ownership rights piled on top of the weak macro environment. We remain cautious but can see some specific opportunities under the overhang of policy uncertainty. In the industrial space we are still seeing positive demand for higher quality developed space albeit in smaller deal sizes, as some logistics providers seem to be streamlining their operations. As would be expected at this juncture prices of serviced land parcels have reduced as well as transactions that deal with sale and leaseback resulting in some tempting buy opportunities.

Last Words-Election Focus

Elsewhere in this issue we focus on elections across Africa in 2019. In South Africa the outcome is central to investor confidence and flows. If the South African electorate looks beyond current difficulties and backs a renewed mandate for Ramaphosa, today’s hard times become tomorrow’s opportunities. Like many other African voters going to the polls over the next year, South Africans will be anxious to turn around the trends of declining per capita incomes and rising levels of poverty inequality and unemployment. Unlike others to the north, the financial system is sound, debt rollover risks low and many of the major problems fixable without widespread social upheavals. 2019 promises to be a pivotal year.