15 years on from inception, Nigeria’s compulsory defined contributions pension scheme modelled after the Chilean scheme has grown to $24bln, a substantial pool of long-term savings at 6.2% of GDP. It’s a major shift from a predominance of unfunded defined benefit schemes that existed pre-2004, mainly for public sector workers, which do not provide inflation protection or an income safety net due to significant back pensions. The 8.5m contributors now covered is laudable at 60% of the 14m employees in the formal sector. Compliance is boosted with incentives: access to certain government contracts/licenses requires full compliance and non-compliant state governments can’t access pension funds for bonds issuance.

Informal sector under penetrated

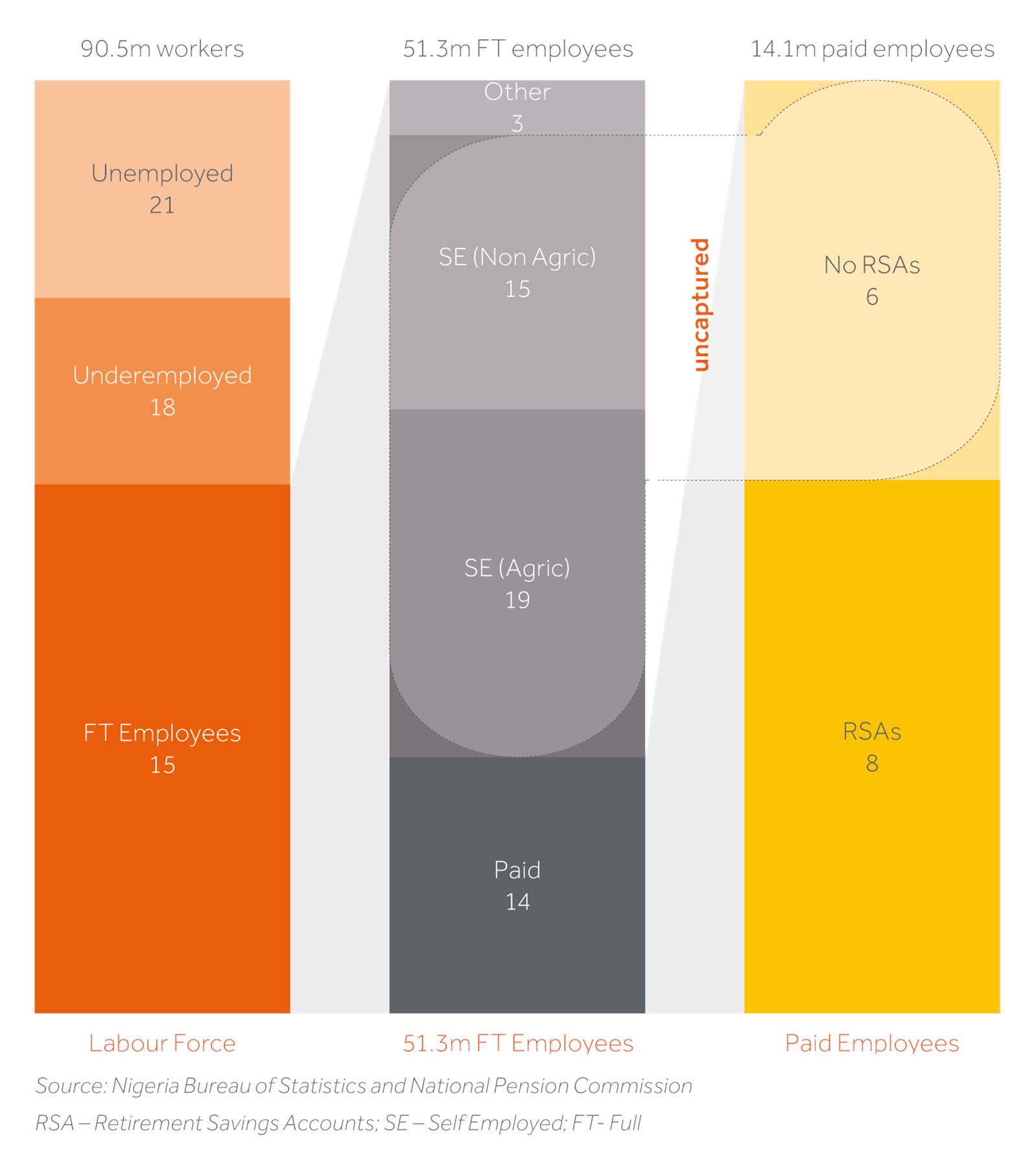

The scheme is still a far cry from its potential, given the 51.3m fully engaged work force and 90.5 million total work force! This is as the scheme is focused only on the formal sector, excluding self-employed and SMEs that account for 85% of the work force. Two new initiatives are set to boost growth. First is the micro-pension scheme targeted at increasing coverage to 30% of the workforce by 2024. This will leverage on mobile technology platforms to address the peculiarities of low-income earners often without regular wages and adopt incentives as the scheme will not be mandatory; ideas include options to use savings as collateral for mortgages and other financial products. Secondly, all contributors will be allowed to switch pension providers. Competition engendered will put pressure on providers to differentiate services, lower costs and boost performance with marketing directed at the wider populace, rather than on employers, that will generate demand for pension services from the unpenetrated market.

The Nigerian Labour Force

-

- The Nigerian labour force is made up of 90.5 million workers

- 51.3 million of these workers work full time (>40 hours)

- Majority of full time workers are self employed, working in Agriculture

- 14.1 million FT workers are in paid employment (pensionable)

- 8.5 out of 14.1 million of these workers have Retirement Savings Accounts (RSAs)

- There is an uncaptured pensionable market of around 40 millions workers

- Of the uncaptured market, only about 6 million are in paid employment, the others are either self employed (SE) or work without contracts.